Cautious Investors Not Rewarding Brødrene Hartmann A/S' (CPH:HART) Performance Completely

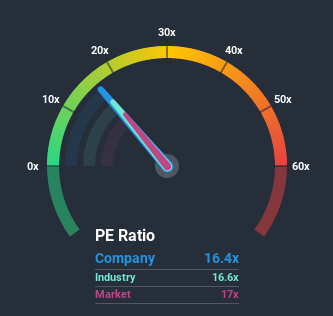

It's not a stretch to say that Brødrene Hartmann A/S' (CPH:HART) price-to-earnings (or "P/E") ratio of 16.4x right now seems quite "middle-of-the-road" compared to the market in Denmark, where the median P/E ratio is around 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's exceedingly strong of late, Brødrene Hartmann has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Brødrene Hartmann

Is There Some Growth For Brødrene Hartmann?

The only time you'd be comfortable seeing a P/E like Brødrene Hartmann's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 149%. EPS has also lifted 14% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 3.8% shows it's a great look while it lasts.

In light of this, it's peculiar that Brødrene Hartmann's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Brødrene Hartmann's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Brødrene Hartmann currently trades on a lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. When we see its superior earnings with some actual growth, we assume potential risks are what might be placing pressure on the P/E ratio. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. It appears some are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for Brødrene Hartmann (1 is significant!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you decide to trade Brødrene Hartmann, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Brødrene Hartmann might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About CPSE:HART

Brødrene Hartmann

Brødrene Hartmann A/S produces and sells moulded-fibre packaging for eggs and fruits in Denmark, rest of Europe, North and South America, India, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives