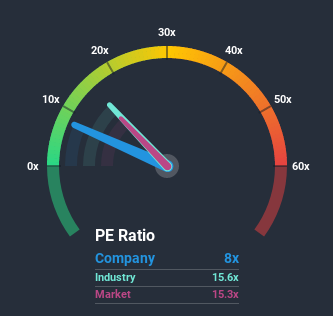

Care Service Co.,Ltd.'s (TYO:2425) price-to-earnings (or "P/E") ratio of 8x might make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 16x and even P/E's above 27x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been quite advantageous for Care ServiceLtd as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Care ServiceLtd

How Does Care ServiceLtd's P/E Ratio Compare To Its Industry Peers?

It's plausible that Care ServiceLtd's low P/E ratio could be a result of tendencies within its own industry. The image below shows that the Healthcare industry as a whole has a P/E ratio similar to the market. So it appears the company's ratio isn't really influenced by these industry numbers currently. Ordinarily, the majority of companies' P/E's would be supported by the general conditions within the Healthcare industry. Nonetheless, the greatest force on the company's P/E will be its own earnings growth expectations.

Is There Any Growth For Care ServiceLtd?

There's an inherent assumption that a company should underperform the market for P/E ratios like Care ServiceLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 157% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 57% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to shrink 6.2% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's quite peculiar that Care ServiceLtd's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader market.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Care ServiceLtd revealed its growing earnings over the medium-term aren't contributing to its P/E anywhere near as much as we would have predicted, given the market is set to shrink. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. At least the risk of a price drop looks to be subdued, but investors think future earnings could see a lot of volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Care ServiceLtd.

You might be able to find a better investment than Care ServiceLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

When trading Care ServiceLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:2425

Care ServiceLtd

Provides in-home care support and day services in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives