- Canada

- /

- Commercial Services

- /

- TSXV:KUT

Can You Imagine How Elated RediShred Capital's (CVE:KUT) Shareholders Feel About Its 576% Share Price Gain?

RediShred Capital Corp. (CVE:KUT) shareholders might be concerned after seeing the share price drop 13% in the last quarter. But over five years returns have been remarkably great. In fact, during that period, the share price climbed 576%. Impressive! So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for RediShred Capital

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

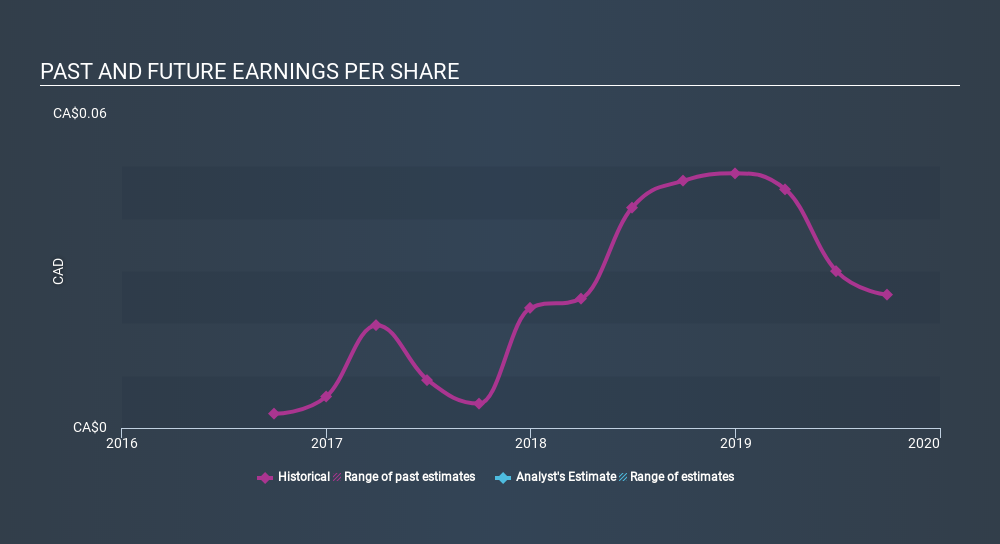

During five years of share price growth, RediShred Capital achieved compound earnings per share (EPS) growth of 4.3% per year. This EPS growth is slower than the share price growth of 47% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on RediShred Capital's earnings, revenue and cash flow.

A Different Perspective

We regret to report that RediShred Capital shareholders are down 7.8% for the year. Unfortunately, that's worse than the broader market decline of 2.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 47%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for RediShred Capital that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:KUT

RediShred Capital

Operates the Proshred franchise and license business in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives