Can You Imagine How Ecstatic argenx's (EBR:ARGX) Shareholders Feel About Its 1527% Share Price Increase?

Long term investing can be life changing when you buy and hold the truly great businesses. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held argenx SE (EBR:ARGX) shares for the last five years, while they gained 1527%. If that doesn't get you thinking about long term investing, we don't know what will. And in the last month, the share price has gained 0.9%. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for argenx

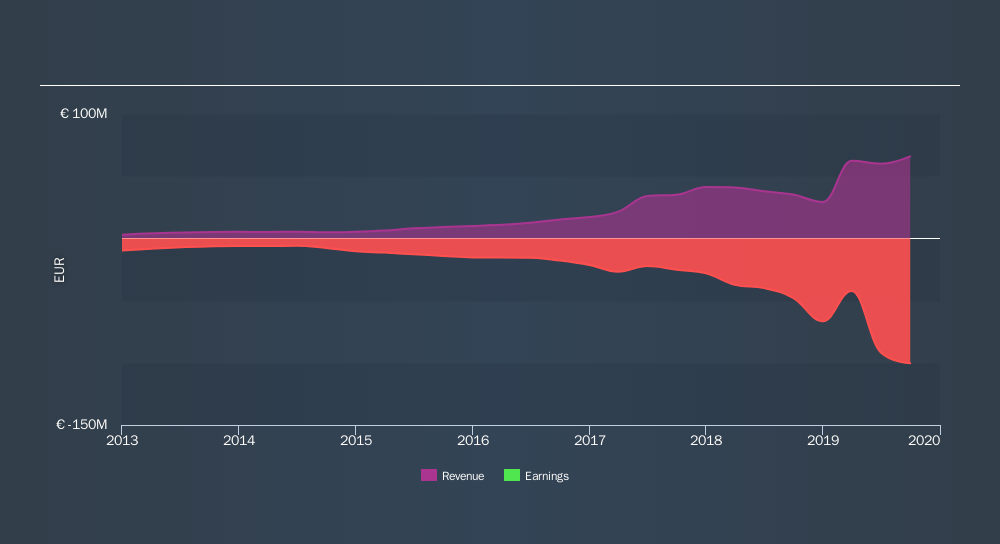

Given that argenx didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, argenx can boast revenue growth at a rate of 44% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 75% per year in that time. It's never too late to start following a top notch stock like argenx, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

The image below shows how revenue has tracked over time.

argenx is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's nice to see that argenx shareholders have received a total shareholder return of 33% over the last year. Having said that, the five-year TSR of 75% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTBR:ARGX

argenx

A commercial-stage biopharma company, develops various therapies for the treatment of autoimmune diseases in the United States, Japan, China, the Netherlands, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives