- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:ALNEO

Can You Imagine How Ecstatic Alpha MOS' (EPA:ALM) Shareholders Feel About Its 1775% Share Price Increase?

While Alpha MOS SA (EPA:ALM) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 13% in the last quarter. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In fact, it is up 1775% in that time. So it is not that surprising to see the stock retrace a little. While winners often keep winning, it can pay to be cautious after a strong rise.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Alpha MOS

Given that Alpha MOS didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Alpha MOS's revenue grew by 11%. That's not a very high growth rate considering it doesn't make profits. So the 1775% gain in just twelve months is completely unexpected. It's great to see that some have made big profits, but we aren't so sure that the increase is justified. This is an example of the huge profits some lucky shareholders occasionally make on growth stocks.

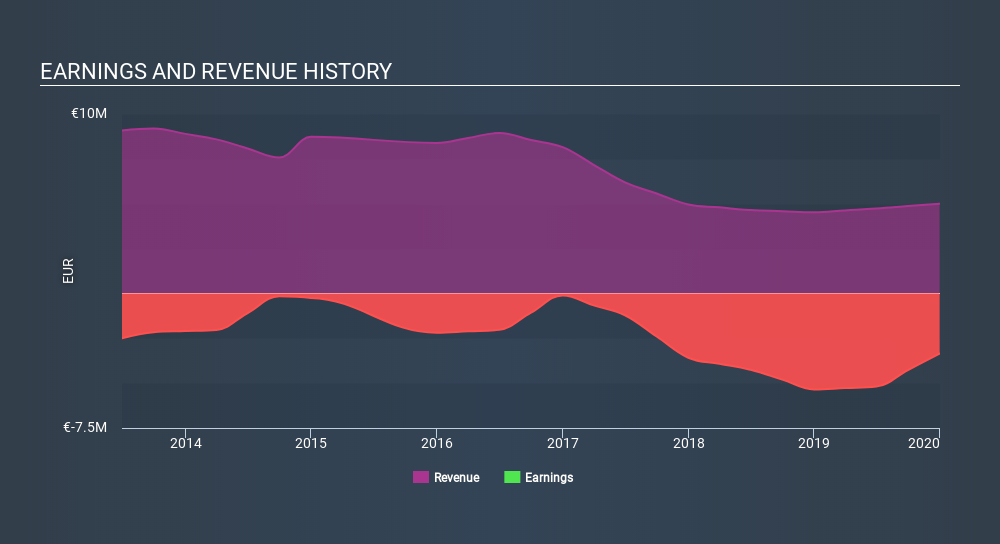

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Alpha MOS's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Alpha MOS hasn't been paying dividends, but its TSR of 1775% exceeds its share price return of 1775%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Alpha MOS has rewarded shareholders with a total shareholder return of 1775% in the last twelve months. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Alpha MOS better, we need to consider many other factors. For instance, we've identified 4 warning signs for Alpha MOS (2 are a bit concerning) that you should be aware of.

Of course Alpha MOS may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTPA:ALNEO

Alpha MOS

Develops, manufactures, and sells sensory analysis solutions worldwide.

Moderate with acceptable track record.

Market Insights

Community Narratives