- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Can You Imagine How Ecstatic Advanced Micro Devices's (NASDAQ:AMD) Shareholders Feel About Its 1915% Share Price Increase?

Long term investing can be life changing when you buy and hold the truly great businesses. While the best companies are hard to find, but they can generate massive returns over long periods. Don't believe it? Then look at the Advanced Micro Devices, Inc. (NASDAQ:AMD) share price. It's 1915% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 62% over the last quarter.

It really delights us to see such great share price performance for investors.

View our latest analysis for Advanced Micro Devices

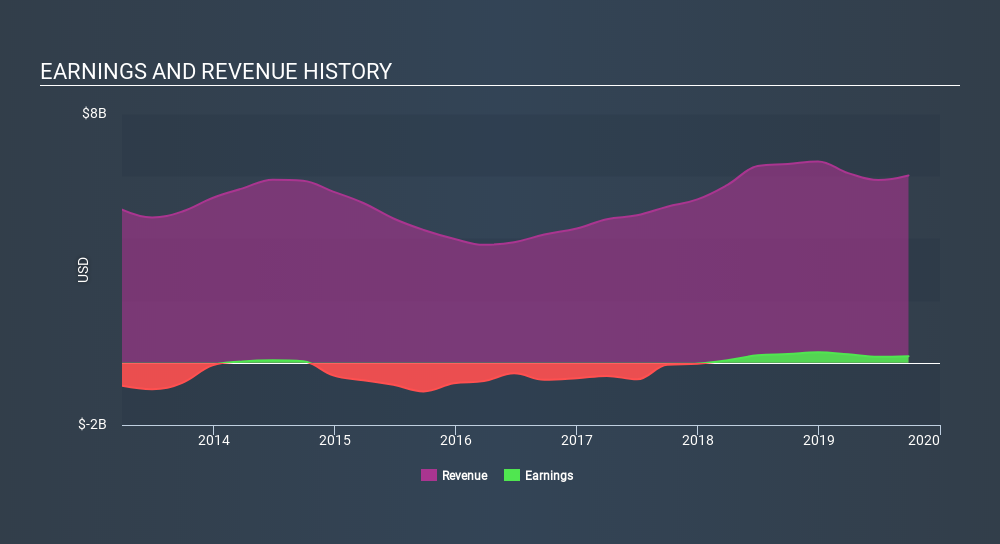

We don't think that Advanced Micro Devices's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Advanced Micro Devices saw its revenue grow at 6.5% per year. That's a fairly respectable growth rate. However, the share price gain of 82% during the period is considerably stronger. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Fundamentally, investors are buying a company's future earnings, but the stability of the business can influence the price they're willing to pay. For example, we've discovered 4 warning signs for Advanced Micro Devices (of which 1 is major) which any shareholder or potential investor should be aware of.

A Different Perspective

We're pleased to report that Advanced Micro Devices shareholders have received a total shareholder return of 138% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 82% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Advanced Micro Devices may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives