- United States

- /

- Insurance

- /

- NYSE:BRO

Brown & Brown (BRO) Reports Decline In Q2 2025 Net Income And Earnings Per Share

Reviewed by Simply Wall St

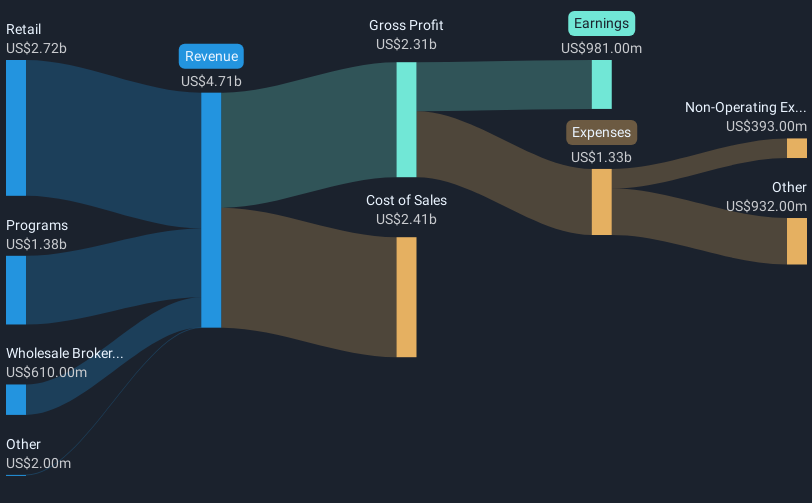

Brown & Brown (BRO) has reported mixed financial results for the second quarter of 2025, enjoying a revenue increase but experiencing a decline in net income and earnings per share. During the same week, the broader stock market faced a 3% drop, largely driven by investor reactions to weak employment data and new tariff policies. These market movements likely added weight to the company's stock price decline of nearly 11% over the past week. While the company's financials provided some stability with positive revenue trends, the overall market volatility and economic concerns dominated investor sentiment, aligning BRO's stock move with broader market declines.

Brown & Brown has 1 warning sign we think you should know about.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

The recent mixed financial results from Brown & Brown, which include a rise in revenue but a fall in net income and earnings per share, could have broad implications on its ongoing narrative. Strategic acquisitions and cost management were expected to drive future growth, yet the short-term pressure from economic volatility might hinder immediate revenue and earnings expansion. While these internal strategies aimed for long-term stability and growth, the external market influences may challenge their effectiveness in the near term.

Despite recent market volatility, Brown & Brown has shown remarkable long-term performance with a total shareholder return, including dividends, of 106.78% over five years. However, in comparison to the last year's performance, the company's return was less favorable than the US Insurance industry, which saw a return of 3.7%. This context highlights the company's resilience over time but also underscores its struggle in recent times amidst broader market pressures.

The current share price of US$92.24 offers insight when contrasted against the analyst consensus price target of US$114.27, suggesting potential upside if market conditions stabilize and internal growth initiatives materialize. Nevertheless, any lingering economic uncertainties or reduced market confidence could impact revenue and earnings forecasts negatively. While analysts project substantial growth to US$9.1 billion in revenues by 2028, these targets could be tested against prevailing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives