- Australia

- /

- Oil and Gas

- /

- ASX:BOE

Boss Energy (ASX:BOE) Announces Key Executive Board Changes

Reviewed by Simply Wall St

Boss Energy (ASX:BOE) saw significant executive board changes with the appointment of Joanne Palmer and Caroline Keats, alongside the retirement of Bryn Jones. These leadership adjustments aim to strengthen the company's governance as it eyes increased production and cash flow. This internal restructuring coincides with a market environment where major indexes, like the S&P 500, have experienced sharp movements due to geopolitical tensions affecting oil prices and broader market sentiment. While these market conditions mirror Boss Energy's 80% price increase over the last quarter, the board changes potentially added weight to these upward trends by boosting investor confidence in strategic growth.

Buy, Hold or Sell Boss Energy? View our complete analysis and fair value estimate and you decide.

Over the past five years, Boss Energy's shares have experienced a very large total return of 921.23%, showcasing impressive long-term growth. In the last year, the company performed in line with the Australian market, which had a 9% return, and it outperformed the Australian Oil and Gas industry, which saw a 23.9% decline.

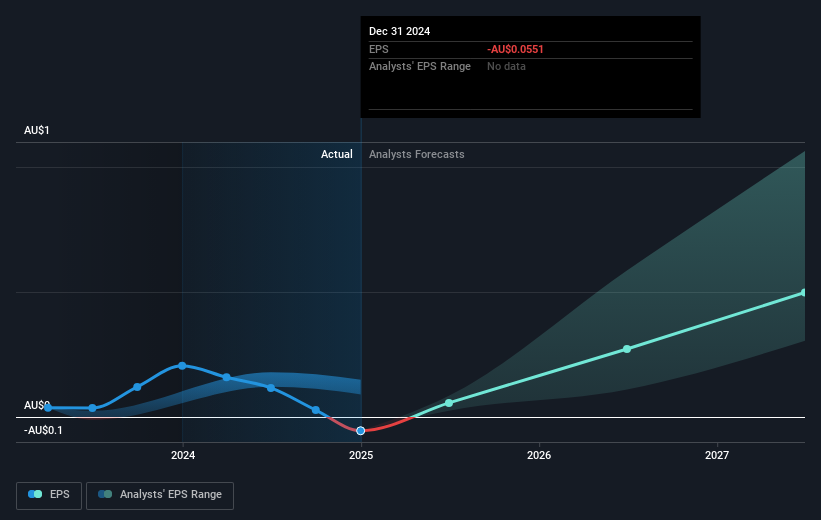

The recent changes in the executive board mentioned in the introduction might support Boss Energy's revenue expansion and earnings potential, as the new directors bring substantial industry experience. However, the company's current valuation appears high, with a Price-To-Sales Ratio significantly exceeding the peer average. Additionally, the A$4.33 share price trades just below the consensus analyst price target of A$4.13, indicating limited upside based on current market sentiment.

Review our historical performance report to gain insights into Boss Energy's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives