- United States

- /

- Capital Markets

- /

- NYSE:BLK

BlackRock (NYSE:BLK) Removed From Russell 1000 Dynamic Index

Reviewed by Simply Wall St

BlackRock (NYSE:BLK) experienced a 10.99% increase in its share price over the last quarter despite its removal from the Russell 1000 Dynamic Index, which might have impacted its visibility among investors. This removal occurred in a period where the broader market was experiencing notable gains, with major indices like the S&P 500 and Nasdaq reaching new highs. BlackRock’s quarterly cash dividend announcement and active share repurchase program likely provided additional support to its stock performance. Meanwhile, the company continued to strengthen its portfolio with new product launches and strategic client collaborations.

Be aware that BlackRock is showing 1 warning sign in our investment analysis.

BlackRock's recent 10.99% share price increase over the last quarter, despite its removal from the Russell 1000 Dynamic Index, showcases resilience amidst wider market gains and internal maneuvers like dividend announcements and share repurchases. Over the past five years, BlackRock's total shareholder return, combining share price appreciation and dividends, reached 112.19%, demonstrating considerable long-term value generation. However, the company's performance in the last year matched the US Capital Markets industry's 33.9% return, indicating solid alignment with sector trends amid diverse market conditions.

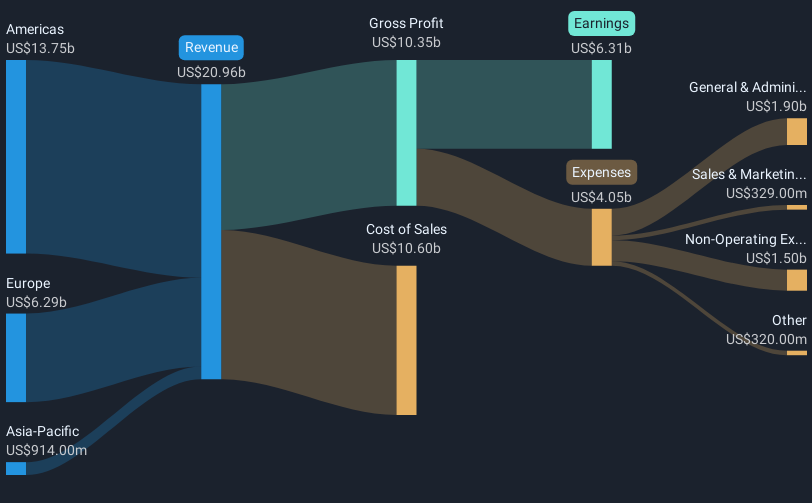

While the news of index removal might temporarily affect investor visibility, BlackRock's ongoing expansion into private markets and alternative investments could offset this impact by driving future growth and improving margins. The introduction of new products and strategic client collaborations aligns with these initiatives, likely bolstering revenue and profitability forecasts. Analysts currently anticipate revenue growth of 9.9% annually, with earnings projected to rise to US$9.1 billion by May 2028, contingent on market conditions and client demand holding steady.

The recent share price movement, in the context of an analyst consensus price target of US$1,023.32, suggests a 10.6% upside potential. Continued execution on strategic initiatives could influence whether BlackRock meets these expectations, given the risks associated with market volatility and geopolitical tensions. Investors should weigh these factors when assessing BlackRock's future trajectory and potential for further returns.

Review our growth performance report to gain insights into BlackRock's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives