- United States

- /

- Biotech

- /

- NasdaqGS:BIIB

Biogen (NasdaqGS:BIIB) Partners With City Therapeutics in US$1 Billion RNAi Therapy Deal

Reviewed by Simply Wall St

Biogen (NasdaqGS:BIIB) recently announced a collaboration with City Therapeutics, Inc. to develop RNAi therapies for central nervous system diseases, contributing to a 6% share price increase over the past month. While this move aligns with an uptick in the broader tech sector due to policy shifts, other market responses could have influenced this rise. The announcement coincided with positive market momentum, as evident from major indexes inching upwards during this period, reflecting investor optimism. The collaboration highlights Biogen's focus on innovative therapies, potentially enhancing its market position amidst sector-wide gains.

Every company has risks, and we've spotted 2 risks for Biogen you should know about.

The collaboration between Biogen and City Therapeutics, Inc. could bolster Biogen's focus on RNAi therapies, aligning with its strategic pivot towards innovative treatments. This enhances the narrative surrounding Biogen's expansion into central nervous system diseases, as seen with its significant efforts in Alzheimer's treatments, such as LEQEMBI. The collaboration may positively affect revenue and earnings forecasts by expanding Biogen's pipeline and improving long-term growth prospects. These developments could counterbalance the company's challenges, including the shrinking multiple sclerosis portfolio and competition from generics and biosimilars.

Over the past three years, Biogen's total shareholder return, inclusive of share price and dividends, showed a decrease of 37.09%. This performance contrasts with its shorter-term gains, reflecting broader market dynamics and company-specific challenges impacting its long-term trajectory. Despite recent share price gains, Biogen underperformed the US Biotechs industry, which saw a return of 12.9% over the past year, highlighting the company's struggle to keep pace with industry benchmarks.

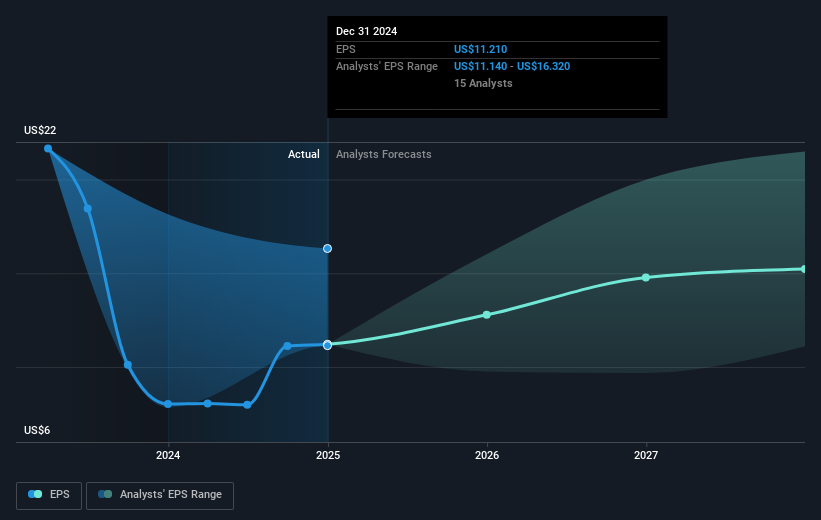

In terms of price movement expectations, the recent share price increase still lags behind the analyst consensus price target of US$171.95. The current market valuation, with a price discount of approximately 36.67% to the target, suggests investor skepticism or uncertainties around future earnings growth and revenue projections. The updates concerning Biogen's pipeline and collaborations may influence these factors and potentially shift market perceptions over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIIB

Biogen

Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives