Bank of Nova Scotia (TSX:BNS) Announces Dividend Increase and Considers Share Repurchase

Reviewed by Simply Wall St

Bank of Nova Scotia (TSX:BNS) announced a 4-cent increase in its quarterly dividend, bringing it to $1.10 per share, alongside considerations for a potential share buyback. Over the past month, the company's share price moved up by 6%, a performance potentially supported by these corporate developments. Although the broader market experienced swings due to shifts in U.S. trade policy, Scotiabank's dividend increase and buyback consideration could have provided positive momentum relative to the market's overall trend. While the market saw some fluctuation, these events likely provided a stabilizing effect on the company's share price.

Be aware that Bank of Nova Scotia is showing 1 risk in our investment analysis.

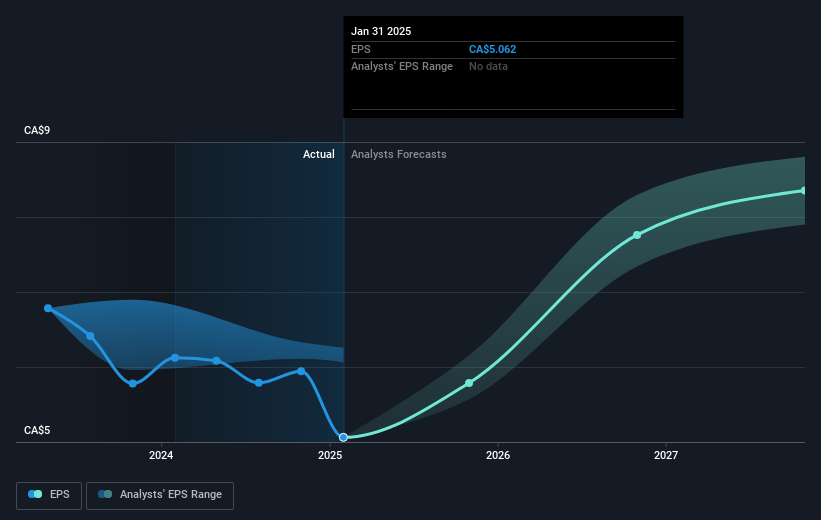

The recent dividend increase and share buyback consideration by Bank of Nova Scotia may have bolstered investor confidence, aligning with their ongoing strategic objectives. Over a five-year span, the company's total shareholder return, which includes both share price and dividends, was 70.37%. This long-term performance provides valuable context, particularly when juxtaposed against its one-year underperformance, where it lagged behind both the Canadian market and the Banks industry. The recent price target of CA$76.73 surpasses the current share price by roughly 10.7%, indicating potential room for growth if the forecasted revenue and earnings are realized.

The company's initiatives, such as Mortgage+ and Scene+, and its redeployment of capital into higher-growth markets, are likely to influence future revenue and earnings positively. While analysts project a revenue growth of 7.8% per year, this does not fully meet the higher growth thresholds but outpaces the Canadian market's average revenue growth. The bank's quarterly earnings have the potential to rise significantly, contributing to the justification for the current price target. Notably, any macroeconomic headwinds, like geopolitical instability or credit provisions, could affect these optimistic forecasts and, by extension, the price trajectory. However, the recent corporate actions may provide some stability and growth impetus.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion