- United States

- /

- Banks

- /

- NYSE:BAC

Bank Of America (NYSE:BAC) Plans To Raise Quarterly Dividend To US$0.28 Per Share

Reviewed by Simply Wall St

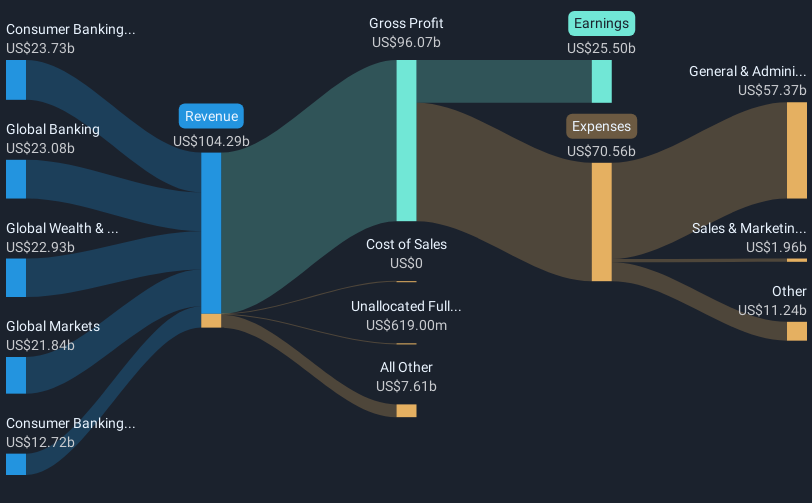

Bank of America (NYSE:BAC) has recently announced plans to increase its quarterly dividend, reflecting an optimistic outlook on its financial health. Over the last quarter, the company's stock price moved up 15%, aligning with the broader market gains. This upward trajectory could have been buoyed by the dividend news, alongside notable earnings improvements, with the company reporting a rise in both net interest and net income. Market trends also reveal a positive atmosphere with indices like the S&P 500 hitting record highs, adding further support to the positive stock momentum. Executive appointments and debt financing actions were noteworthy but may not significantly sway the broader market impact.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bank of America's recent dividend increase reflects a positive stance toward its financial health, signaling potential confidence in continued revenue and earnings growth. Over five years, the company's total shareholder return, including dividends, stands at 136.69%, providing a broader context to the recent quarterly share price increase. This long-term performance has considerably outpaced the 1-year performance, where the company's returns did not match the US Banks industry's 27.4% uptick.

The optimistic outlook is supported by Bank of America's investments in digital engagement and credit diversification, which have been highlighted as factors potentially enhancing revenue and earnings. However, economic volatility and policy uncertainties pose challenges that could impact these growth assumptions, including net margins and earnings through competition and credit quality. In terms of earnings forecasts, the recent dividend announcement may have a positive impact by bolstering investor sentiment, which could, in turn, support higher revenue and earnings projections.

Review our growth performance report to gain insights into Bank of America's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives