- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (NasdaqGS:BKR) Secures Major P&A Contract with Equinor in North Sea

Reviewed by Simply Wall St

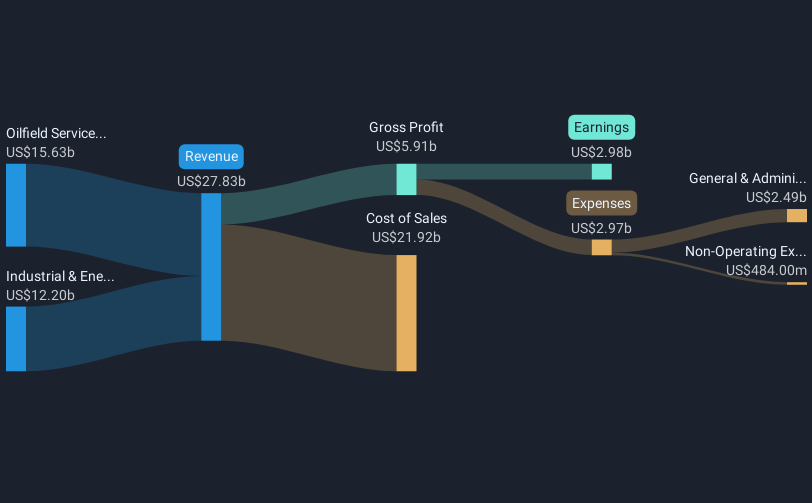

Baker Hughes (NasdaqGS:BKR) recently secured a contract with Equinor for plug and abandonment services in the Oseberg East field, signifying strong ongoing partnerships and showcasing technological advancements. Over the past month, Baker Hughes's stock rose 7.1%, a move consistent with broader market trends, as the S&P 500 and Nasdaq recorded gains amid eased trade tensions and benign inflation data. Additional collaborations, such as the joint venture with Cactus and extension of agreements with C3.ai, underlined the company's concerted growth efforts, aligning with positive sentiment in the market, recently buoyed by global trade advancements and favorable economic indicators.

Buy, Hold or Sell Baker Hughes? View our complete analysis and fair value estimate and you decide.

The recent contract with Equinor and other collaborations highlight Baker Hughes's focus on expanding its offerings and solidifying partnerships, potentially enhancing revenue streams in areas like plug and abandonment services. These efforts align with the company’s emphasis on increasing demand in the natural gas sector and expanding into data centers to stabilize and grow future revenues. However, risks such as geopolitical tensions and price volatility could challenge these growth drivers and affect the company's earnings forecasts.

Over the past five years, Baker Hughes’s total shareholder return was 166.96%, providing solid gains for investors. In comparison, over the past year, the company's returns exceeded the US market, which saw a return of 12.4%. This outperformance suggests strong relative performance in the recent period.

The recent share price increase of 7.1% reflects positive market sentiment amid favorable economic indicators. With a current share price of US$36.4 and a consensus price target of US$47.13, there is an implied potential upside of 22.8%. This price target suggests that analysts are optimistic about Baker Hughes's future earnings growth and revenue expansion. However, achieving this target could require the company to meet or exceed the projected earnings growth of reaching US$3 billion by May 2028 and improving operational efficiencies despite market and geopolitical headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives