- Canada

- /

- Medical Equipment

- /

- TSXV:ZEN

August 2025's TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market has been experiencing positive developments, with labour productivity improving and corporate earnings growth rising, providing a supportive backdrop for investors. Amid these conditions, penny stocks—often smaller or newer companies—continue to hold potential when backed by strong financials. These stocks can offer a mix of affordability and growth potential, making them intriguing options for those looking to explore under-the-radar opportunities in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$62.71M | ✅ 3 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.315 | CA$48.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.84 | CA$525.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.95 | CA$17.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.06 | CA$334.29M | ✅ 2 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.15 | CA$209.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.92 | CA$184.26M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.70 | CA$9.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 432 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoldMining Inc. is a mineral exploration company focused on acquiring, exploring, and developing gold and copper assets in the Americas, with a market cap of CA$220.95 million.

Operations: GoldMining Inc. currently does not report any specific revenue segments.

Market Cap: CA$220.95M

GoldMining Inc. is currently a pre-revenue company, with its focus on exploration and development across several promising projects. Recent developments include the permit application for the West Susitna Access Project in Alaska, which could enhance infrastructure access to its Whistler Gold-Copper Project. The company also reported strong historic drill intercepts at its Crucero Project in Peru, indicating potential for multi-metal value creation. Despite having no debt and sufficient short-term assets to cover liabilities, GoldMining faces challenges with a limited cash runway and ongoing unprofitability, as evidenced by recent financial results showing continued losses.

- Jump into the full analysis health report here for a deeper understanding of GoldMining.

- Evaluate GoldMining's prospects by accessing our earnings growth report.

Scottie Resources (TSXV:SCOT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scottie Resources Corp. is involved in the identification, acquisition, exploration, and development of mineral properties in British Columbia, Canada with a market cap of CA$51.97 million.

Operations: Scottie Resources Corp. currently does not report any revenue segments.

Market Cap: CA$51.97M

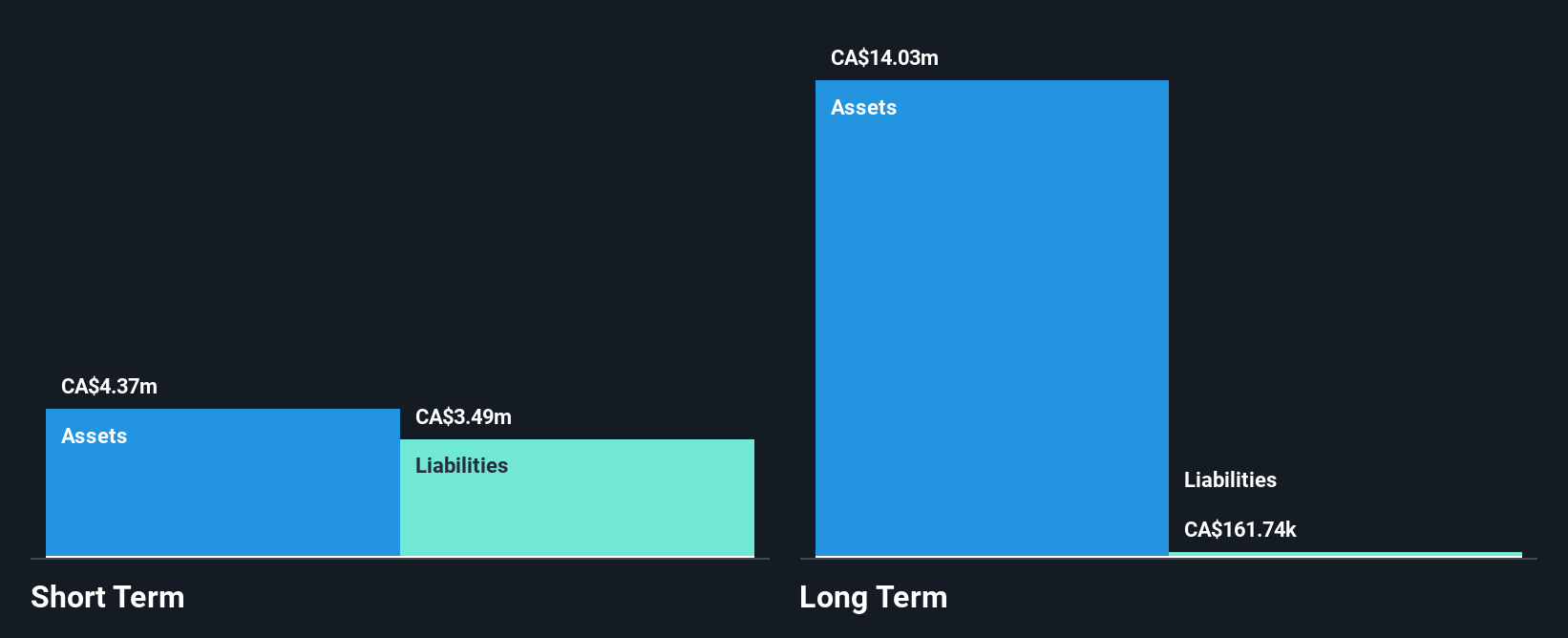

Scottie Resources Corp., a pre-revenue company, is actively advancing its Scottie Gold Mine Project in British Columbia. Recent updates highlight the commencement of bulk sampling and diamond drilling, aimed at gathering essential technical data for future development decisions. The company has secured permits for a 10,000-tonne surface bulk sample to explore mineralized rock potential. Despite no defined mineral reserves or completed feasibility studies, Scottie's strategic focus includes converting inferred resources to indicated through ongoing drilling campaigns. Financially stable with no debt and adequate short-term assets over liabilities, Scottie recently raised CA$6 million to support its exploration activities.

- Unlock comprehensive insights into our analysis of Scottie Resources stock in this financial health report.

- Gain insights into Scottie Resources' past trends and performance with our report on the company's historical track record.

Zentek (TSXV:ZEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zentek Ltd. is a Canadian company focused on the research and development of graphene and related nanomaterials, with a market cap of CA$121.46 million.

Operations: Zentek generates revenue from its Biotech segment, which accounts for CA$0.79 million, and Intellectual Property Development segment, contributing CA$0.08 million.

Market Cap: CA$121.46M

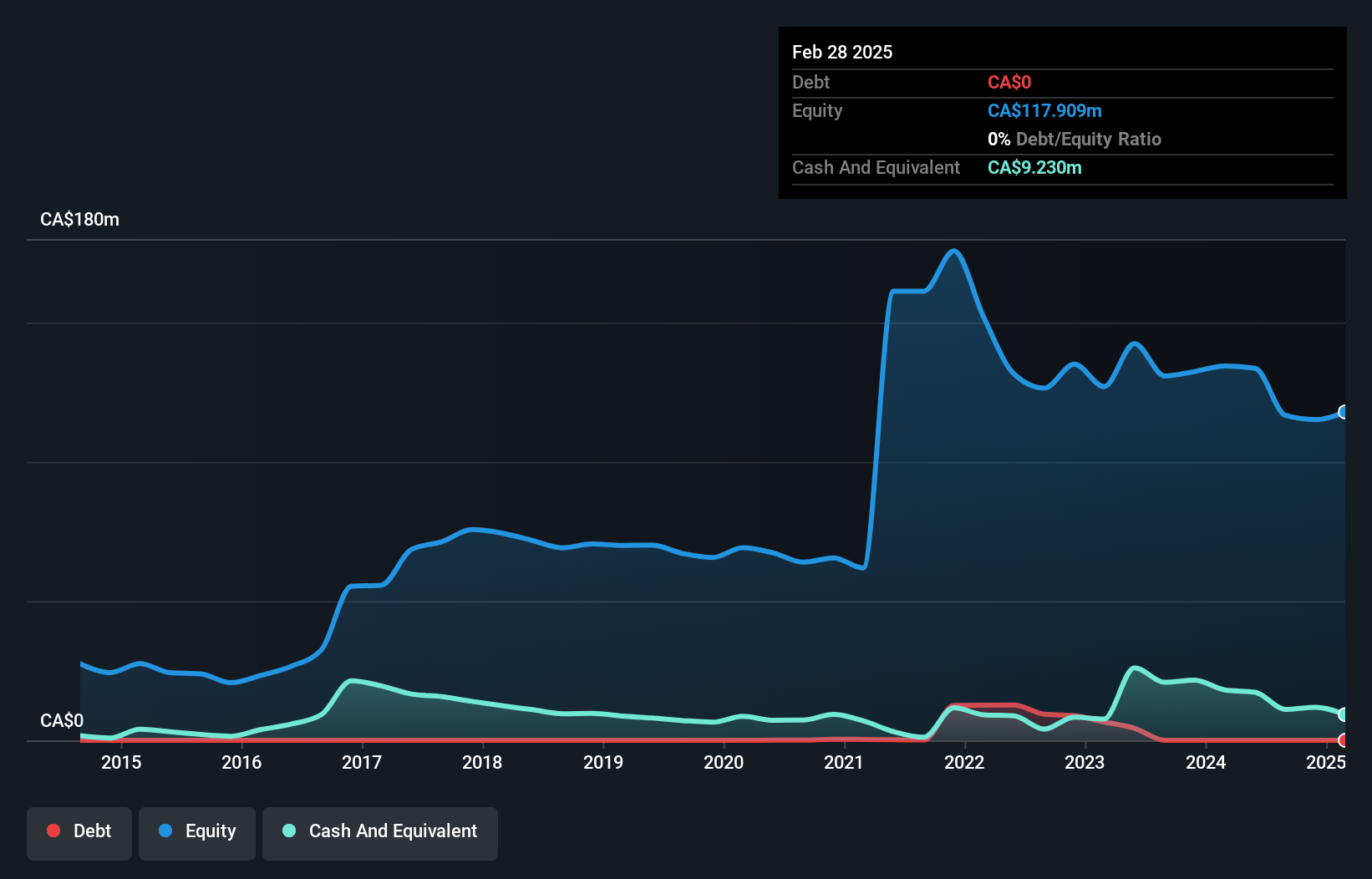

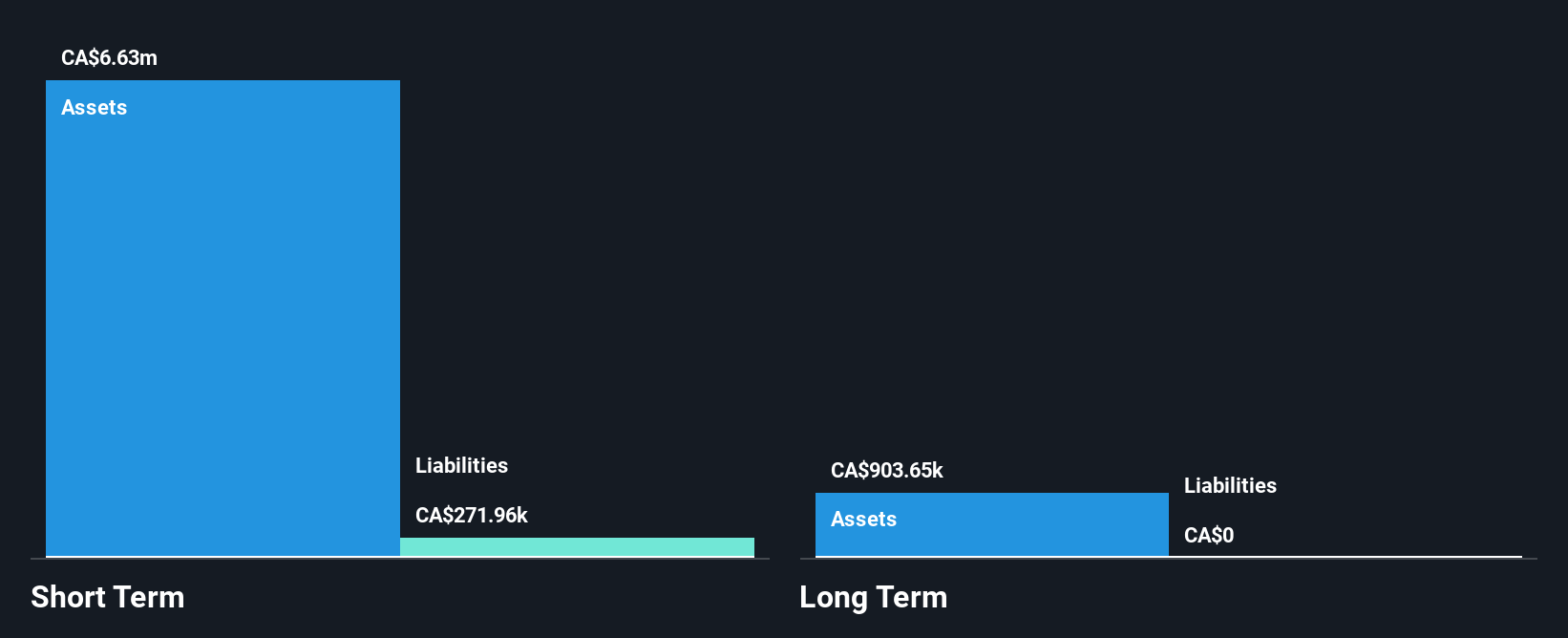

Zentek Ltd., a pre-revenue company, is navigating challenges in its commercialization efforts, particularly with its ZenGUARD™ Enhanced Air Filters. Despite promising test results demonstrating high effectiveness against infectious aerosols, regulatory hurdles remain as Health Canada reviews the classification of these filters. Financially, Zentek's short-term assets exceed liabilities, and it maintains a satisfactory net debt to equity ratio of 1.5%. However, the company's auditor has expressed doubts about its ability to continue as a going concern. Leadership changes are underway as the board seeks a new CEO to succeed Greg Fenton by March 2026.

- Dive into the specifics of Zentek here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Zentek's track record.

Key Takeaways

- Get an in-depth perspective on all 432 TSX Penny Stocks by using our screener here.

- Ready To Venture Into Other Investment Styles? These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zentek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZEN

Zentek

Engages in the research and development of graphene and related nanomaterials in Canada.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives