As the ASX 200 traded flat on the first day of the new financial year, certain sectors like Utilities and IT showed resilience, while others such as Telecommunications lagged behind. In this mixed market environment, identifying stocks that are potentially undervalued can offer opportunities for investors seeking to capitalize on discrepancies between current prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PointsBet Holdings (ASX:PBH) | A$1.185 | A$2.14 | 44.7% |

| Pantoro Gold (ASX:PNR) | A$3.08 | A$5.55 | 44.5% |

| Nanosonics (ASX:NAN) | A$4.05 | A$7.91 | 48.8% |

| Lynas Rare Earths (ASX:LYC) | A$8.39 | A$14.07 | 40.4% |

| Lindsay Australia (ASX:LAU) | A$0.74 | A$1.29 | 42.6% |

| Integral Diagnostics (ASX:IDX) | A$2.53 | A$4.57 | 44.7% |

| Infomedia (ASX:IFM) | A$1.175 | A$2.07 | 43.3% |

| Fenix Resources (ASX:FEX) | A$0.275 | A$0.51 | 45.9% |

| Collins Foods (ASX:CKF) | A$9.28 | A$16.00 | 42% |

| Charter Hall Group (ASX:CHC) | A$19.09 | A$35.43 | 46.1% |

Let's explore several standout options from the results in the screener.

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited, with a market cap of A$1.77 billion, provides a range of banking products and services tailored for small and medium businesses in Australia through its subsidiaries.

Operations: The company's revenue is primarily derived from its banking segment, which generated A$325.50 million.

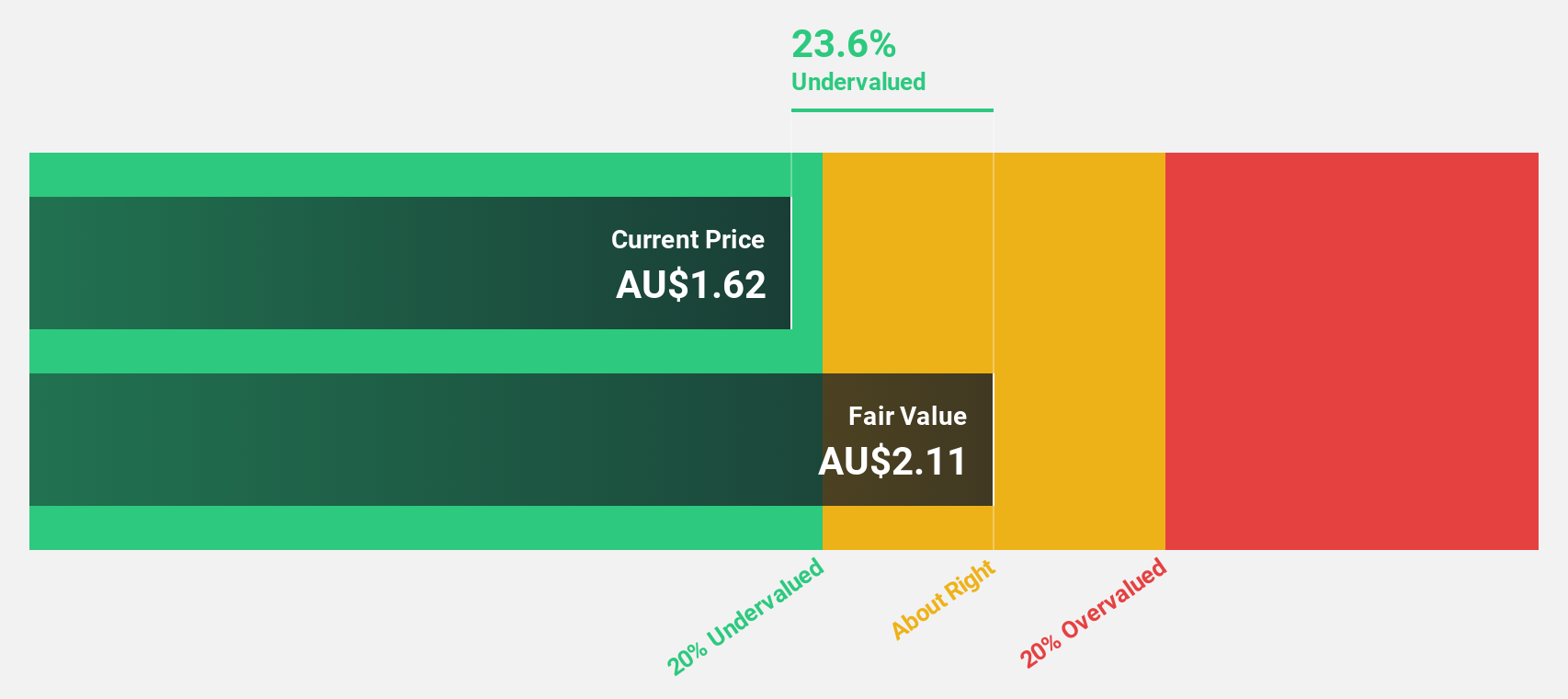

Estimated Discount To Fair Value: 25.3%

Judo Capital Holdings is trading at A$1.59, significantly below its estimated fair value of A$2.12, indicating it may be undervalued based on cash flows. Earnings are forecast to grow 24.8% annually, outpacing the Australian market's 10.9%. However, revenue growth at 17.5% per year is slower than ideal but still surpasses the market average of 5.5%. Despite a low projected return on equity of 9.6%, Judo remains an attractive option for value-focused investors.

- Upon reviewing our latest growth report, Judo Capital Holdings' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Judo Capital Holdings.

Lovisa Holdings (ASX:LOV)

Overview: Lovisa Holdings Limited operates in the retail sector, specializing in the sale of fashion jewelry and accessories, with a market capitalization of A$3.35 billion.

Operations: The company generates revenue of A$731.57 million from its retail operations focused on fashion jewelry and accessories.

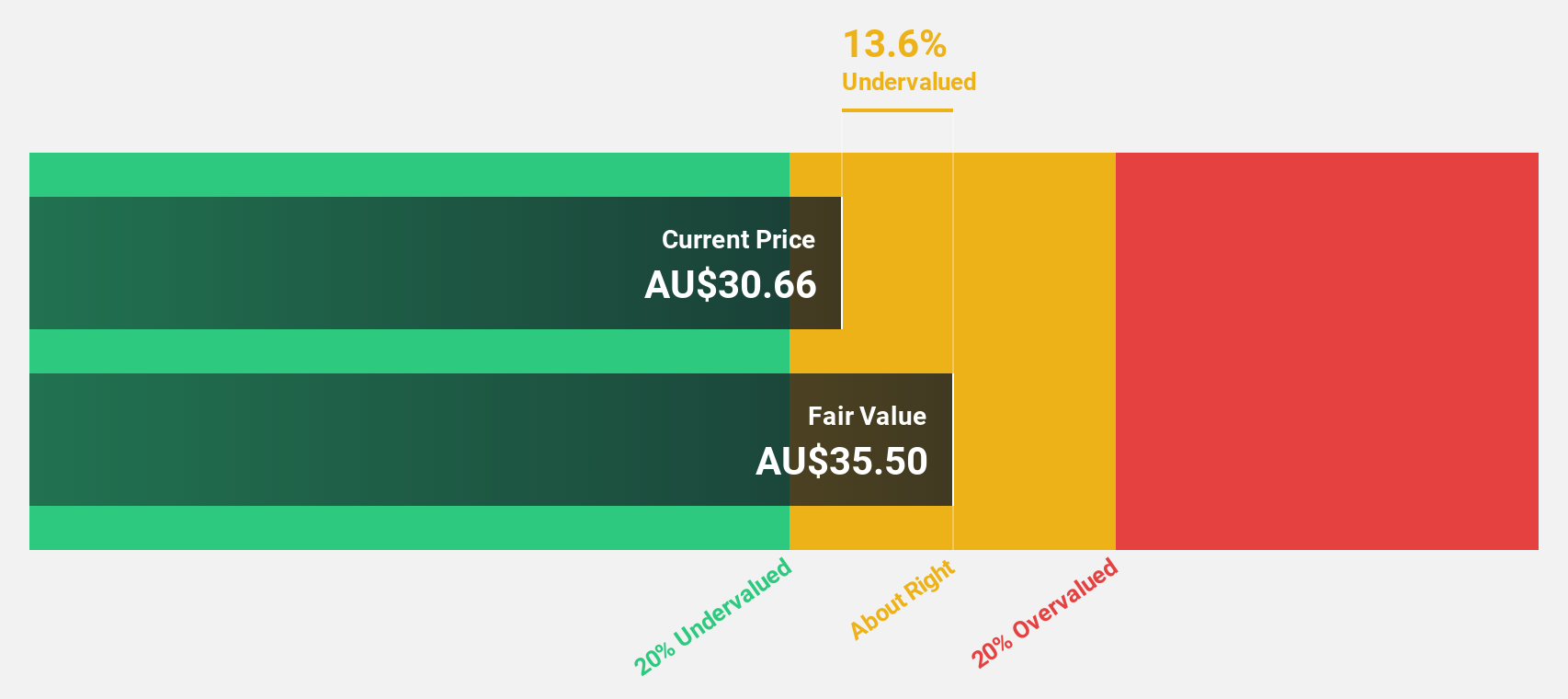

Estimated Discount To Fair Value: 14.6%

Lovisa Holdings is trading at A$30.3, below its estimated fair value of A$35.49, suggesting potential undervaluation based on cash flows. Revenue growth is forecast at 12.3% per year, outpacing the Australian market's 5.5%, while earnings are expected to grow 14.2% annually, exceeding the market average of 10.9%. Despite a high forecasted return on equity in three years and recent executive changes, the dividend yield of 2.87% lacks sufficient earnings coverage.

- According our earnings growth report, there's an indication that Lovisa Holdings might be ready to expand.

- Click to explore a detailed breakdown of our findings in Lovisa Holdings' balance sheet health report.

Technology One (ASX:TNE)

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally, with a market cap of A$13.31 billion.

Operations: The company's revenue segments consist of Software generating A$378.25 million, Corporate contributing A$90.55 million, and Consulting bringing in A$82.87 million.

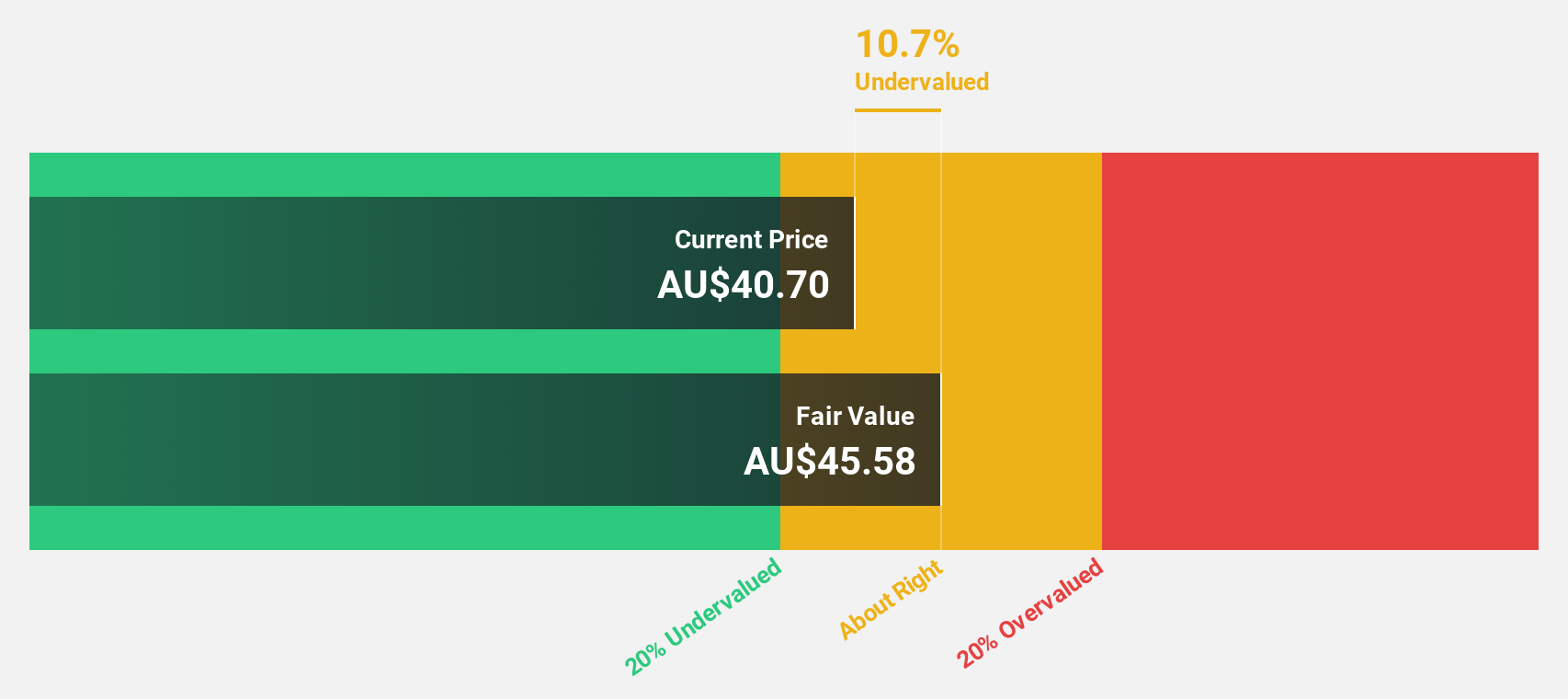

Estimated Discount To Fair Value: 10.7%

Technology One, priced at A$40.68, trades below its estimated fair value of A$45.55, indicating potential undervaluation based on cash flows. Recent earnings growth of 21.3% and a forecasted annual earnings increase of 16.4% surpass the Australian market's average growth rate of 10.9%. Revenue is expected to grow annually by 13.1%, outpacing the market's 5.5%. The company also announced a franked dividend distribution for H1 2025, enhancing shareholder returns amidst robust financial performance.

- Our earnings growth report unveils the potential for significant increases in Technology One's future results.

- Click here to discover the nuances of Technology One with our detailed financial health report.

Where To Now?

- Reveal the 31 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives