- Australia

- /

- Medical Equipment

- /

- ASX:SOM

ASX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

The Australian market is experiencing a gradual decline, with recent profit-taking activities contributing to a downturn as traders react to broader global tensions and local developments. Despite these challenges, opportunities still exist for investors willing to look beyond the mainstream stocks. Penny stocks, though often associated with smaller or newer companies, can offer surprising value and potential growth when backed by solid financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.525 | A$71.94M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.24M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.54 | A$391.62M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.715 | A$453.46M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.06 | A$716.16M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.27 | A$763.09M | ✅ 4 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.875 | A$1.13B | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.715 | A$226.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.49 | A$165.6M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.845 | A$148.6M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,002 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Barton Gold Holdings (ASX:BGD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Barton Gold Holdings Limited focuses on the exploration and development of mineral projects in South Australia, with a market cap of A$178.57 million.

Operations: Barton Gold Holdings Limited has not reported any revenue segments.

Market Cap: A$178.57M

Barton Gold Holdings Limited, with a market cap of A$178.57 million, is pre-revenue and currently unprofitable, facing challenges in achieving profitability over the next three years. Despite this, it remains debt-free and possesses a sufficient cash runway for over a year. Recent activities include follow-on equity offerings amounting to A$3 million and promising high-grade assays from its Tolmer prospect at the Tarcoola Gold Project, indicating potential for new mineralisation styles. The management team is experienced with an average tenure of 3.4 years but faces volatility in share price movements compared to other Australian stocks.

- Get an in-depth perspective on Barton Gold Holdings' performance by reading our balance sheet health report here.

- Gain insights into Barton Gold Holdings' outlook and expected performance with our report on the company's earnings estimates.

Investigator Resources (ASX:IVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Investigator Resources Limited, along with its subsidiaries, is involved in the exploration of mineral properties in Australia and has a market cap of A$44.50 million.

Operations: Investigator Resources Limited does not report any revenue segments.

Market Cap: A$44.5M

Investigator Resources Limited, with a market cap of A$44.50 million, is pre-revenue and debt-free but has less than a year of cash runway. Recent developments include an Earn-In Agreement with Alliance Resources over the Black Hill tenement adjacent to its Paris Silver Project, which is in the final stages of a Definitive Feasibility Study. The company continues exploration at the Perseus and Manto Prospects, showing promising silver-lead-zinc mineralisation potential. Management and board teams are experienced with average tenures of 2.6 and 4.9 years respectively, while shareholders have not faced significant dilution recently.

- Jump into the full analysis health report here for a deeper understanding of Investigator Resources.

- Explore historical data to track Investigator Resources' performance over time in our past results report.

SomnoMed (ASX:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SomnoMed Limited, with a market cap of A$133.99 million, produces and sells devices for the oral treatment of sleep-related disorders across the Asia Pacific region, North America, and Europe.

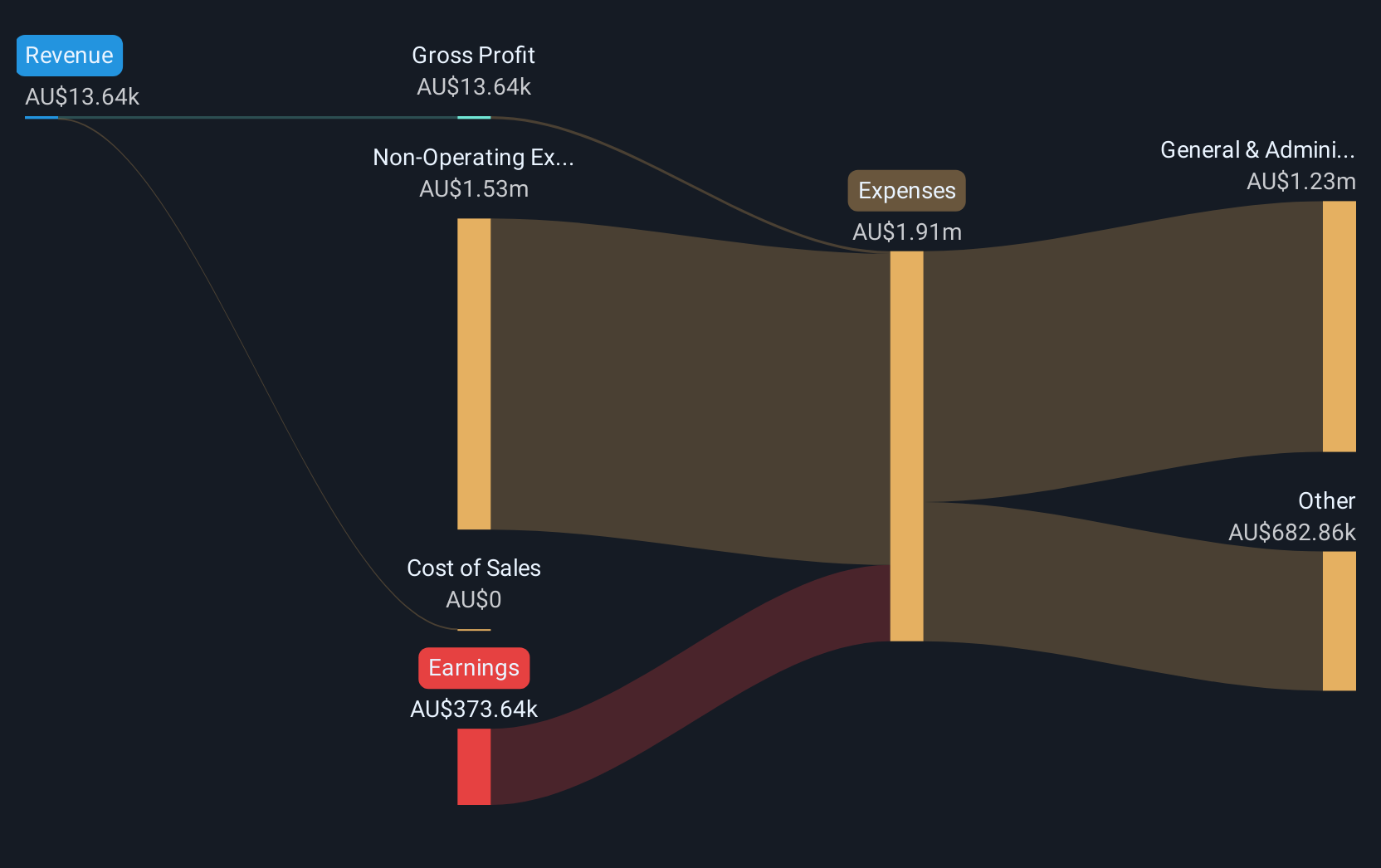

Operations: The company generates revenue of A$100.25 million from the production and sale of products designed to treat sleep disordered breathing.

Market Cap: A$133.99M

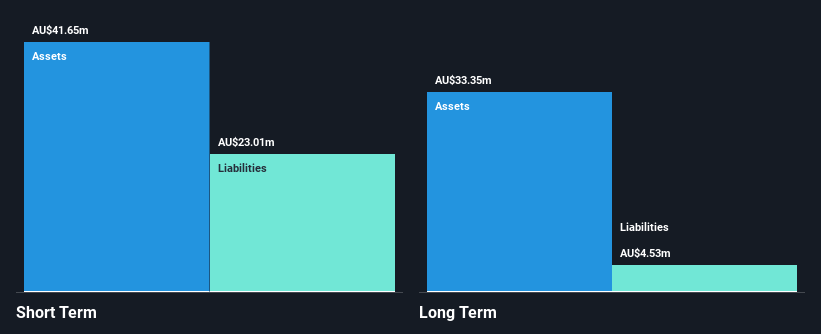

SomnoMed Limited, with a market cap of A$133.99 million, operates in the medical equipment sector and has shown resilience despite being currently unprofitable. The company has a robust cash position, with short-term assets exceeding liabilities and more cash than debt. Revenue for FY2025 is projected at approximately A$105 million, indicating steady growth prospects. While its share price has been volatile recently, SomnoMed's management and board are seasoned, contributing to strategic stability. The company's debt-to-equity ratio has significantly improved over five years, enhancing financial health amidst industry challenges.

- Unlock comprehensive insights into our analysis of SomnoMed stock in this financial health report.

- Examine SomnoMed's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 999 more companies for you to explore.Click here to unveil our expertly curated list of 1,002 ASX Penny Stocks.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SOM

SomnoMed

SomnoMed Limited, together with its subsidiaries, produce and sells devices for the oral treatment of sleep related disorders in the Asia Pacific region, North America, and Europe.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives