- Australia

- /

- Metals and Mining

- /

- ASX:AVL

ASX Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The Australian market has seen a day of mixed signals, with optimism sparked by a surprise unemployment rate of 4.3% and hopes for an interest rate cut, while broader economic uncertainties persist. Amid these conditions, investors often seek opportunities in less conventional areas like penny stocks—smaller or newer companies that can offer significant growth potential when backed by solid financials. This article will explore three such penny stocks on the ASX that may present hidden value and long-term potential for investors willing to navigate this niche segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.35 | A$110.86M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.59 | A$112.49M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.03 | A$467.17M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.22 | A$2.53B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.775 | A$469.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.57 | A$864.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.73 | A$847.84M | ✅ 5 ⚠️ 3 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.895 | A$152.63M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 458 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Australian Vanadium (ASX:AVL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Australian Vanadium Limited, with a market cap of A$86.35 million, is involved in mineral exploration activities in Australia through its subsidiary.

Operations: Australian Vanadium Limited has not reported any revenue segments.

Market Cap: A$86.35M

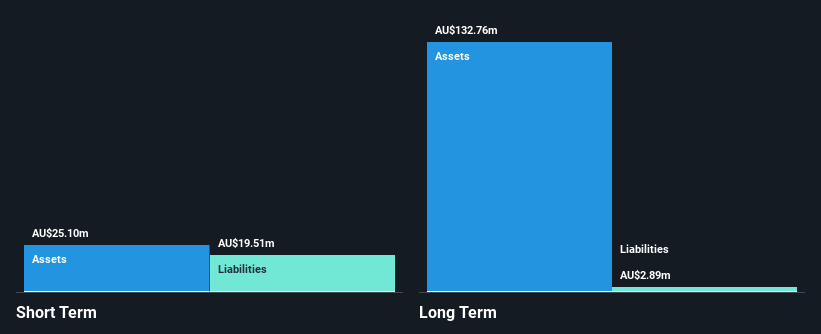

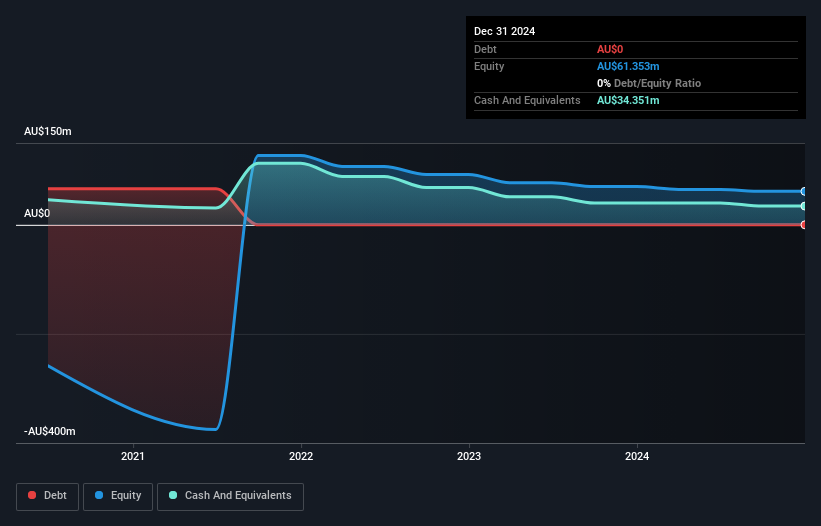

Australian Vanadium Limited, with a market cap of A$86.35 million, is pre-revenue and currently unprofitable. The company maintains a strong financial position with short-term assets of A$25.1 million exceeding both its short and long-term liabilities. It has no debt, but its cash runway is limited to just over a year if current cash flow trends continue. The management team is experienced, yet the board lacks tenure stability. Despite stable weekly volatility compared to last year, the share price remains highly volatile over recent months, reflecting typical characteristics of penny stocks in terms of risk and uncertainty.

- Navigate through the intricacies of Australian Vanadium with our comprehensive balance sheet health report here.

- Examine Australian Vanadium's earnings growth report to understand how analysts expect it to perform.

Boss Energy (ASX:BOE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boss Energy Limited is engaged in the exploration and production of uranium deposits in Australia and the United States, with a market cap of A$1.58 billion.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$1.58B

Boss Energy Limited, with a market cap of A$1.58 billion, is pre-revenue but strategically positioned in the uranium sector. The company benefits from a debt-free balance sheet and robust short-term assets of A$222.7 million that comfortably cover its liabilities. Despite being unprofitable, Boss has reduced losses significantly over the past five years and is forecasted to grow earnings by 47.15% annually. Recent board appointments aim to enhance governance and strategic direction as Boss continues its production growth trajectory. The stock trades at a substantial discount to estimated fair value, highlighting potential investment appeal amidst inherent risks typical of penny stocks.

- Click here to discover the nuances of Boss Energy with our detailed analytical financial health report.

- Understand Boss Energy's earnings outlook by examining our growth report.

SiteMinder (ASX:SDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SiteMinder Limited develops, markets, and sells an online guest acquisition platform and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.26 billion.

Operations: The company's revenue is derived entirely from its Software & Programming segment, totaling A$203.65 million.

Market Cap: A$1.26B

SiteMinder Limited, with a market cap of A$1.26 billion, offers an intriguing profile within the penny stock landscape. Despite being unprofitable and having negative return on equity, the company has shown consistent revenue growth of 28.2% annually over five years and is forecasted to grow earnings by 55.55% per year. SiteMinder's debt-free status and sufficient cash runway for more than three years enhance its financial resilience, though short-term assets slightly trail liabilities at A$53.1 million against A$54.3 million in short-term obligations. Recent management changes may impact strategic direction as investors weigh potential value against inherent risks.

- Take a closer look at SiteMinder's potential here in our financial health report.

- Assess SiteMinder's future earnings estimates with our detailed growth reports.

Next Steps

- Access the full spectrum of 458 ASX Penny Stocks by clicking on this link.

- Curious About Other Options? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AVL

Australian Vanadium

Together with its subsidiary, engages in the mineral exploration activities in Australia.

Excellent balance sheet moderate.

Market Insights

Community Narratives