- Australia

- /

- Capital Markets

- /

- ASX:MQG

ASX Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

The Australian market has recently experienced a mixed performance, with the ASX 200 dipping due to declines in sectors like Utilities and Financials, while Health Care and Materials showed resilience. In this fluctuating environment, dividend stocks can offer stability and income potential for investors looking to enhance their portfolios amidst these shifting market dynamics.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 7.41% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.12% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.89% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.49% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.29% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.71% | ★★★★★☆ |

| IVE Group (ASX:IGL) | 6.06% | ★★★★☆☆ |

| IPH (ASX:IPH) | 6.40% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.90% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.62% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

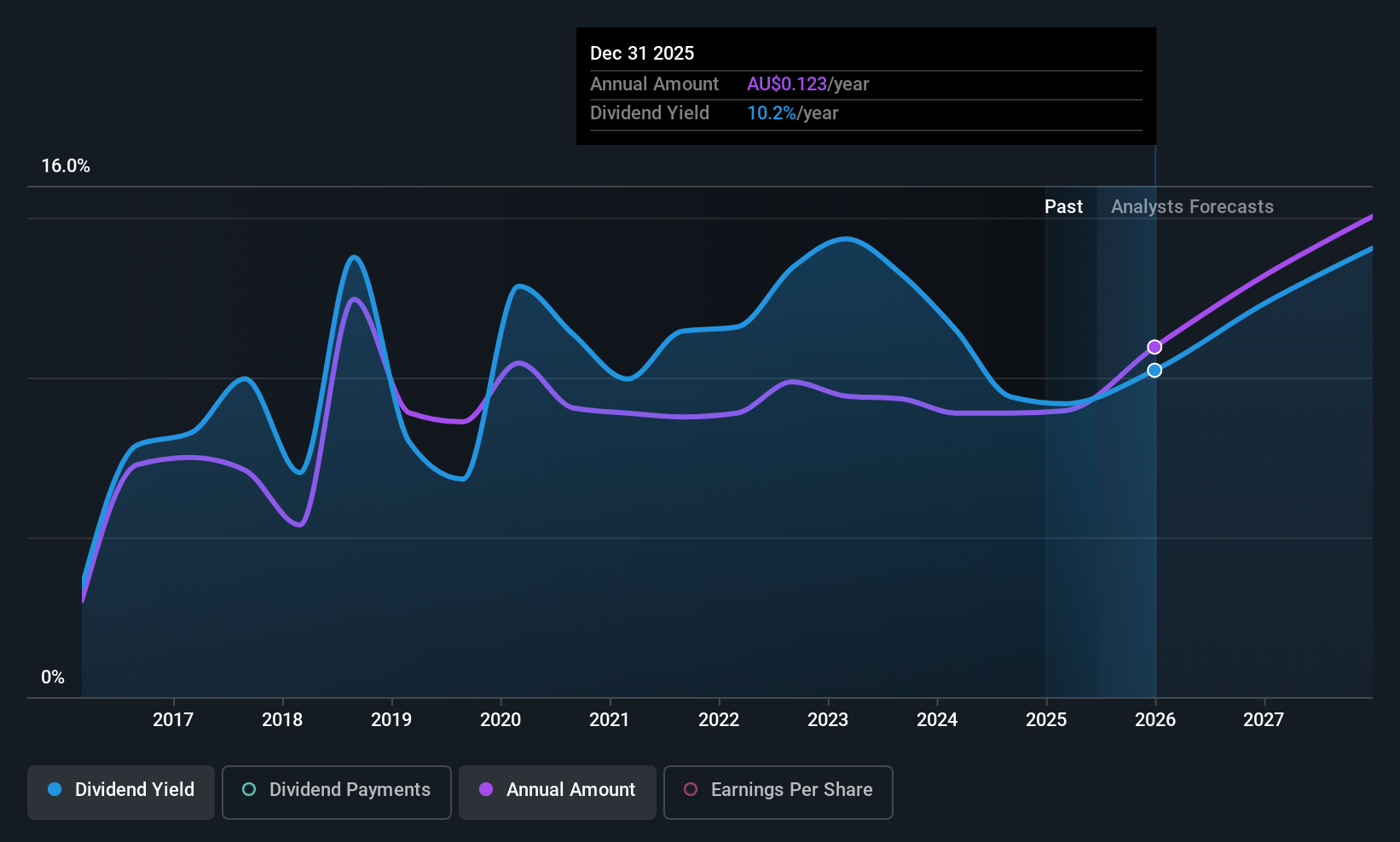

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kina Securities Limited operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage services with a market cap of A$384.10 million.

Operations: Kina Securities Limited generates its revenue through two primary segments: Banking & Finance (Including Corporate) with PGK 421.46 million and Wealth Management contributing PGK 47.36 million.

Dividend Yield: 7.4%

Kina Securities offers a compelling dividend yield of 7.35%, placing it among the top 25% in Australia. Despite this, its dividend history is marked by volatility and an unstable track record over nine years. While dividends are currently covered by earnings with a payout ratio of 74.8%, concerns exist due to high bad loans at 11.1%. The recent resignation of the Group Chief Risk Officer may impact risk management stability during the transition period.

- Dive into the specifics of Kina Securities here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Kina Securities shares in the market.

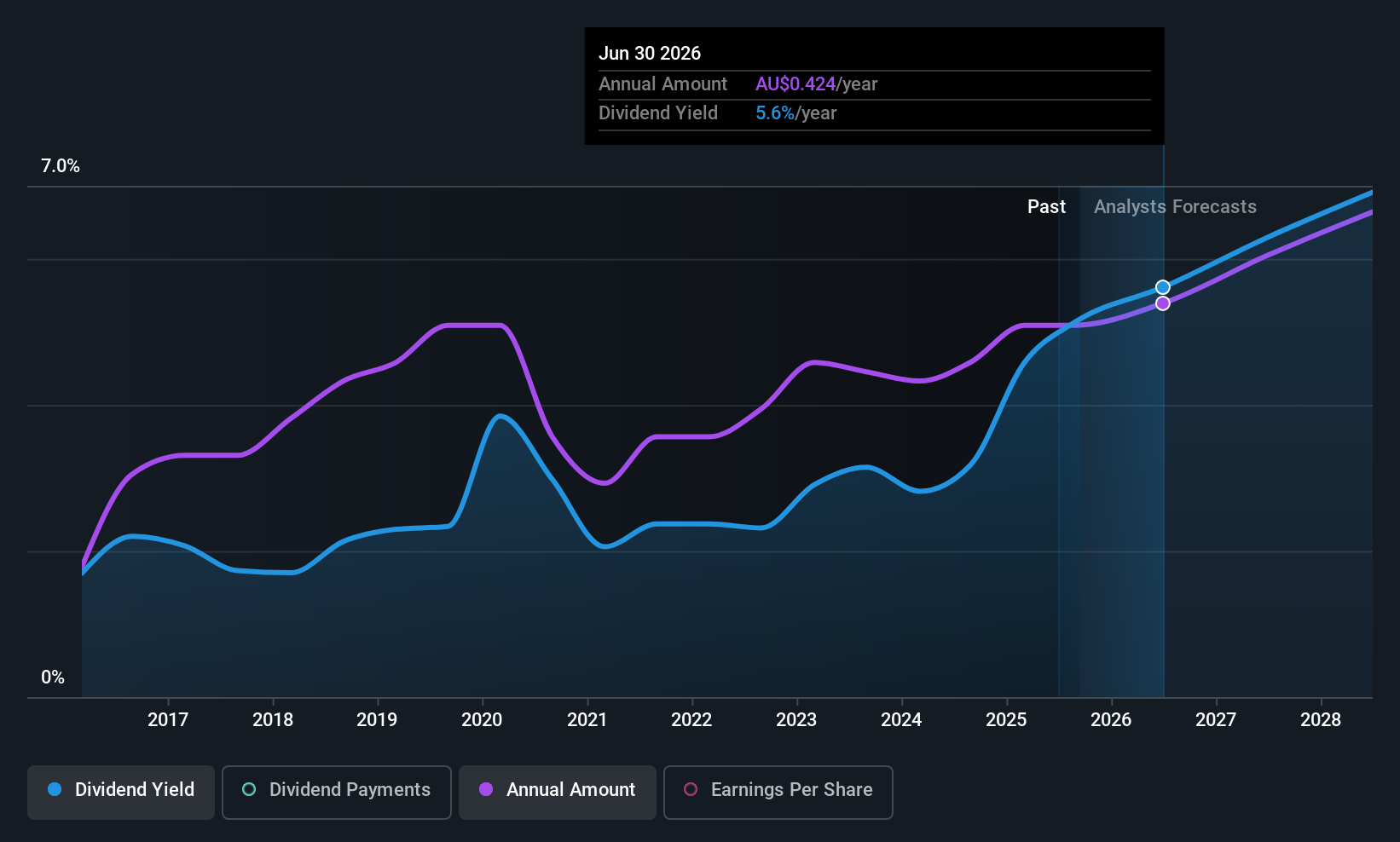

Macquarie Group (ASX:MQG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macquarie Group Limited is a diversified financial services company operating across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market cap of A$77.70 billion.

Operations: Macquarie Group Limited generates revenue through various segments including Corporate (A$1.10 billion), Macquarie Capital (A$2.64 billion), Macquarie Asset Management (A$4.22 billion), Banking and Financial Services (A$3.24 billion), and Commodities and Global Markets (A$6.02 billion).

Dividend Yield: 3.1%

Macquarie Group's dividend payments have been volatile and unreliable over the past decade, with a current payout ratio of 66.4% indicating coverage by earnings. Despite low yield compared to top Australian dividend payers, Macquarie continues to grow earnings at 6.3% annually over five years. Recent M&A discussions, like acquiring a stake in Luz Saúde and potential airport acquisitions, highlight its strategic expansion but also underscore reliance on higher-risk external funding sources for liabilities at 57%.

- Take a closer look at Macquarie Group's potential here in our dividend report.

- The valuation report we've compiled suggests that Macquarie Group's current price could be inflated.

Treasury Wine Estates (ASX:TWE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Treasury Wine Estates Limited is a wine company with operations in Australia, the United States, the United Kingdom, and internationally, holding a market cap of A$6.26 billion.

Operations: Treasury Wine Estates Limited generates its revenue primarily from wine sales across key regions including Australia, the United States, and the United Kingdom.

Dividend Yield: 5.2%

Treasury Wine Estates has shown volatility in its dividend payments over the past decade, yet maintains a low payout ratio of 9.6%, suggesting dividends are well-covered by earnings. Despite this, cash flow coverage is tighter at 83.5%. Recent earnings growth and a share buyback program worth A$200 million indicate strong financial health and capital management focus. However, its dividend yield of 5.18% lags behind top-tier Australian payers, highlighting potential limitations for income-focused investors.

- Click to explore a detailed breakdown of our findings in Treasury Wine Estates' dividend report.

- The valuation report we've compiled suggests that Treasury Wine Estates' current price could be quite moderate.

Taking Advantage

- Discover the full array of 29 Top ASX Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MQG

Macquarie Group

Provides diversified financial services in Australia, New Zealand the Americas, Europe, the Middle East, Africa, and Asia.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives