- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN) Reports Strong Revenue Growth and IMFINZI Gets Priority Review

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) recently reported robust earnings results, with significant year-over-year increases in sales, revenue, and net income, and also declared a dividend increase. These developments occurred within a generally optimistic market climate, as the S&P 500 has been recording new highs on strong corporate results and economic data. The company’s sBLA acceptance for IMFINZI® and substantial investment plans in the U.S. may have further supported its stock price appreciation of 5% over the month. AstraZeneca's performance resonates well amid these market uptrends, aligning its advancements with broader positive economic sentiment.

Every company has risks, and we've spotted 3 weaknesses for AstraZeneca you should know about.

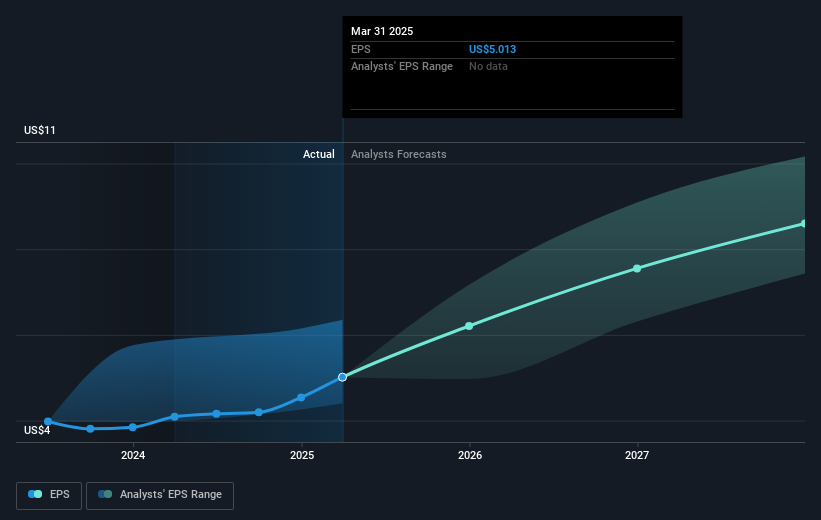

The recent advances by AstraZeneca, including robust earnings results and strategic U.S. investments, may bolster the company's narrative by underpinning its growth momentum. The acceptance of its sBLA for IMFINZI® and dividend improvements could suggest a positive outlook for revenue and earnings, possibly enhancing long-term shareholder value. Analysts anticipate revenue growth driven by strong pipeline momentum and international expansion, including a projected 6% annual growth rate over the next three years. However, price pressures from potential regulatory changes and rising competition might weigh on margins.

AstraZeneca's shares have appreciated 38.17% over the past five years, reflecting consistent growth in total shareholder returns, surpassing the recent one-year underperformance compared to the UK market and the Pharmaceuticals industry. Recent developments may provide a catalyst for closing the gap between its current share price of £107.90 and the analyst consensus price target of £136.14, implying potential upside. A critical examination of external risks, including U.S. tariff implications and competition, remains essential to understanding future revenue and earnings perspectives. These factors are pivotal in assessing the stock's alignment with valuation expectations over the forecast period.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives