- China

- /

- Tech Hardware

- /

- SZSE:001339

Asian Stocks That May Be Undervalued In June 2025

Reviewed by Simply Wall St

As global markets experience a surge in optimism due to easing trade tensions and positive economic indicators, Asian stock markets are also witnessing a period of renewed investor interest. In this environment, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential value amidst the broader market rally.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.53 | CN¥75.96 | 49.3% |

| T'Way Air (KOSE:A091810) | ₩2040.00 | ₩3980.07 | 48.7% |

| Strike CompanyLimited (TSE:6196) | ¥3660.00 | ¥7291.10 | 49.8% |

| Polaris Holdings (TSE:3010) | ¥210.00 | ¥415.69 | 49.5% |

| Peijia Medical (SEHK:9996) | HK$6.39 | HK$12.66 | 49.5% |

| Livero (TSE:9245) | ¥1705.00 | ¥3379.75 | 49.6% |

| Kanto Denka Kogyo (TSE:4047) | ¥842.00 | ¥1680.16 | 49.9% |

| GCH Technology (SHSE:688625) | CN¥30.38 | CN¥60.22 | 49.6% |

| Forum Engineering (TSE:7088) | ¥1218.00 | ¥2377.47 | 48.8% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥31.51 | CN¥62.42 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

JWIPC Technology (SZSE:001339)

Overview: JWIPC Technology Co., Ltd. focuses on researching, developing, and manufacturing IoT hardware solutions, with a market cap of CN¥11.39 billion.

Operations: JWIPC Technology Co., Ltd.'s revenue segments are not provided in the given text.

Estimated Discount To Fair Value: 34.3%

JWIPC Technology is trading 34.3% below its estimated fair value of CNY 73, indicating potential undervaluation based on cash flows. The company reported a significant increase in net income to CNY 124.92 million for 2024 from CNY 32.81 million the previous year, with earnings expected to grow faster than the Chinese market at an annual rate of 34.2%. Recent dividend affirmations further bolster investor confidence amidst strong financial performance and growth prospects.

- The analysis detailed in our JWIPC Technology growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in JWIPC Technology's balance sheet health report.

Easy Click Worldwide Network Technology (SZSE:301171)

Overview: Easy Click Worldwide Network Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥12.37 billion.

Operations: The company's revenue is primarily derived from its Advertising and Promotion Services segment, which generated CN¥2.99 billion.

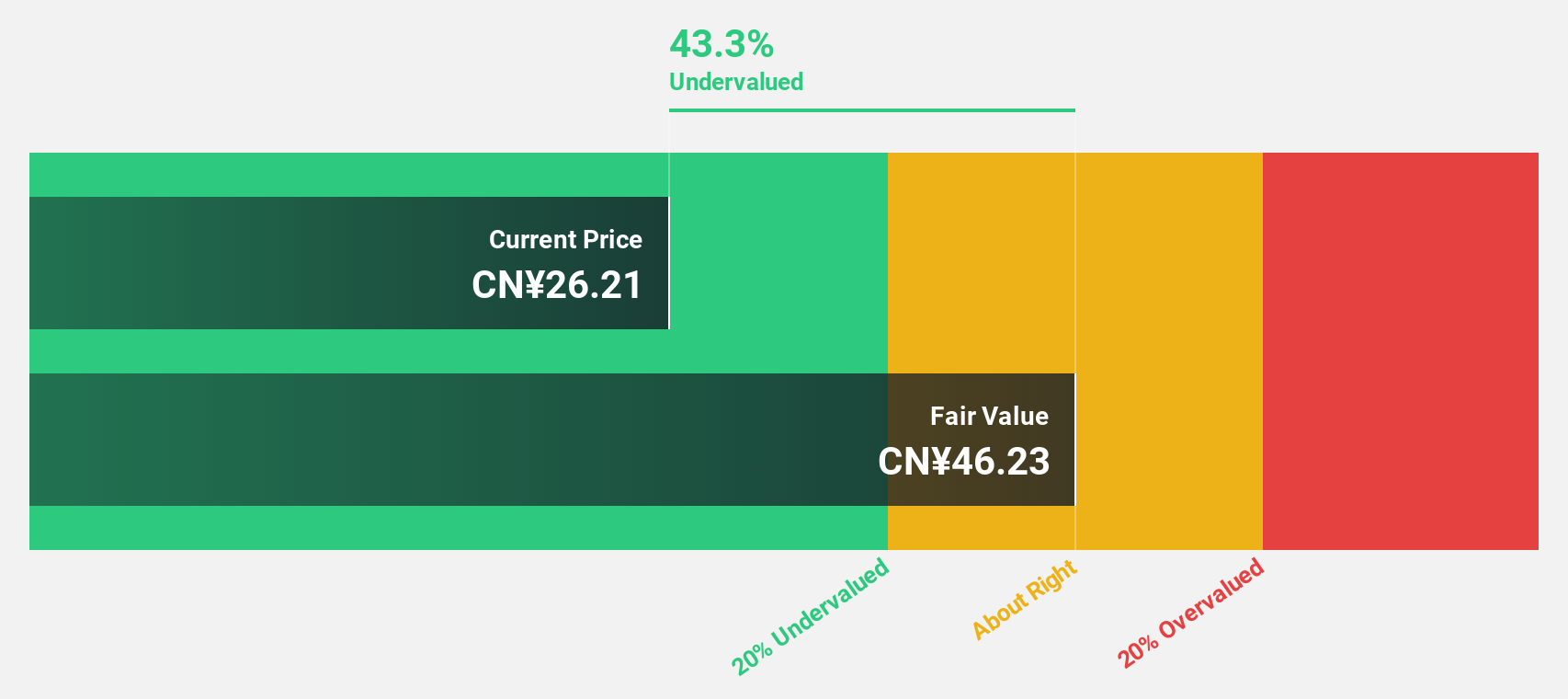

Estimated Discount To Fair Value: 43.5%

Easy Click Worldwide Network Technology is trading at CNY 26.25, significantly below its estimated fair value of CNY 46.49, indicating potential undervaluation based on cash flows. The company reported Q1 2025 sales of CNY 929.12 million, nearly doubling from the previous year, with earnings expected to grow annually by over 31%, outpacing the Chinese market's growth rate. However, recent share price volatility may concern some investors despite these strong financial indicators.

- Our earnings growth report unveils the potential for significant increases in Easy Click Worldwide Network Technology's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Easy Click Worldwide Network Technology.

Sumitomo Mitsui Financial Group (TSE:8316)

Overview: Sumitomo Mitsui Financial Group, Inc. operates as a comprehensive financial services company offering banking, leasing, securities, and consumer finance across multiple regions including Japan and internationally, with a market cap of ¥14.03 trillion.

Operations: The company's revenue segments include banking, leasing, securities, and consumer finance services across Japan, the Americas, Europe, the Middle East, Asia, and Oceania.

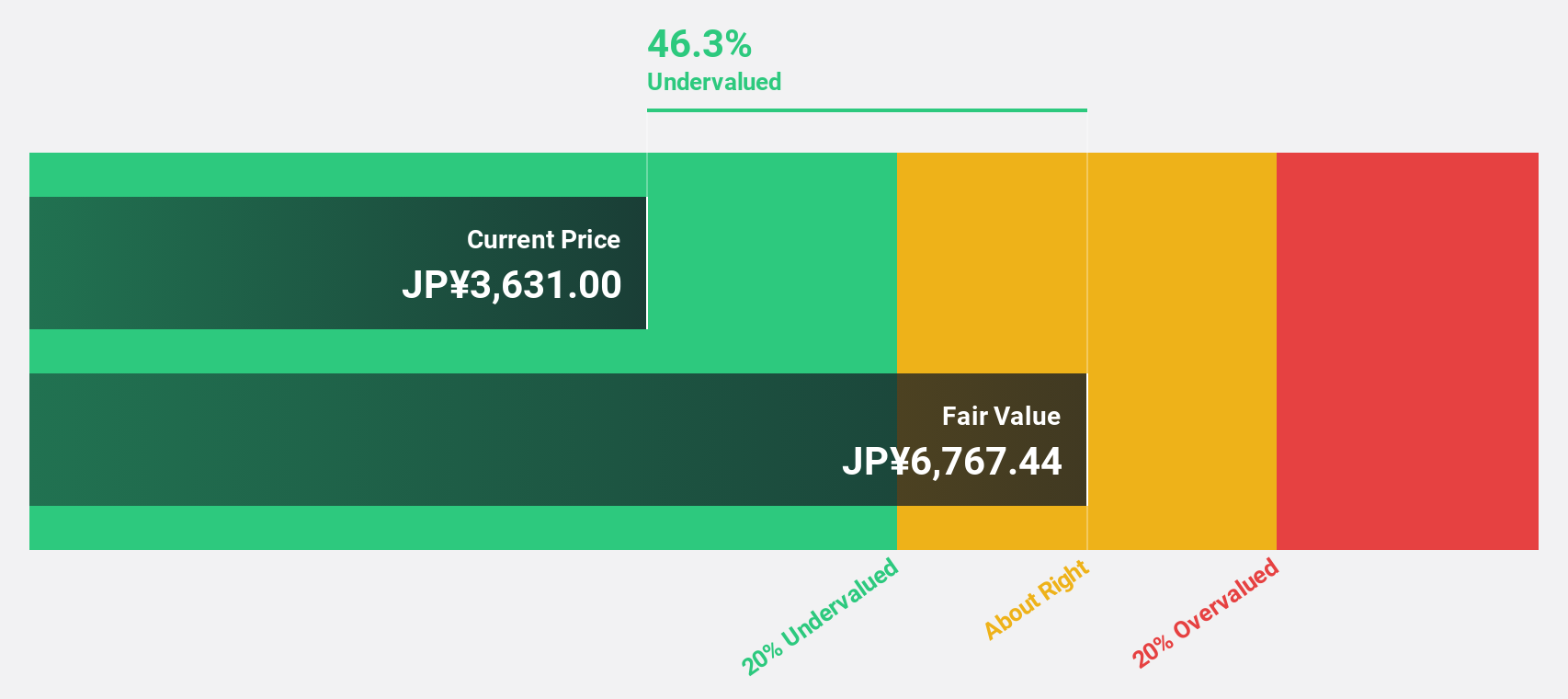

Estimated Discount To Fair Value: 46.5%

Sumitomo Mitsui Financial Group is trading at ¥3,625, significantly below its estimated fair value of ¥6,769.69, suggesting potential undervaluation based on cash flows. The company forecasts a significant annual earnings growth of 20.4%, surpassing the Japanese market's average. However, its dividend yield of 3.75% might not be well covered by earnings in the future. Recent strategic alliances and fixed-income offerings strengthen its financial positioning amidst executive changes and corporate governance updates.

- According our earnings growth report, there's an indication that Sumitomo Mitsui Financial Group might be ready to expand.

- Dive into the specifics of Sumitomo Mitsui Financial Group here with our thorough financial health report.

Key Takeaways

- Click here to access our complete index of 284 Undervalued Asian Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001339

JWIPC Technology

Researches, develops, and manufactures IoT hardware solutions.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives