As global markets navigate the complexities of new U.S. tariffs, Asian economies are showing resilience, with some regions even experiencing a modest uptick in their stock indices. Investors are increasingly looking beyond established giants to explore opportunities in smaller or newer companies, where penny stocks continue to capture attention despite their somewhat outdated moniker. These stocks can offer unique value propositions and growth potential, often underpinned by robust financials that make them intriguing options for those seeking to uncover hidden gems in the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.40 | HK$883.33M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.27 | HK$1.89B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.18 | HK$1.97B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.58 | THB2.75B | ✅ 3 ⚠️ 3 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.605 | SGD576.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.36 | SGD9.29B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.92 | THB1.35B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.23 | SGD46.51M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.47 | SGD951.99M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 984 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Frontage Holdings (SEHK:1521)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Frontage Holdings Corporation is a contract research organization offering laboratory and related services to pharmaceutical, biotechnology, and agrochemical companies, with a market cap of HK$2.41 billion.

Operations: The company generates revenue from two key regions: North America and Europe, contributing $198.21 million, and the People's Republic of China (PRC), adding $56.70 million.

Market Cap: HK$2.41B

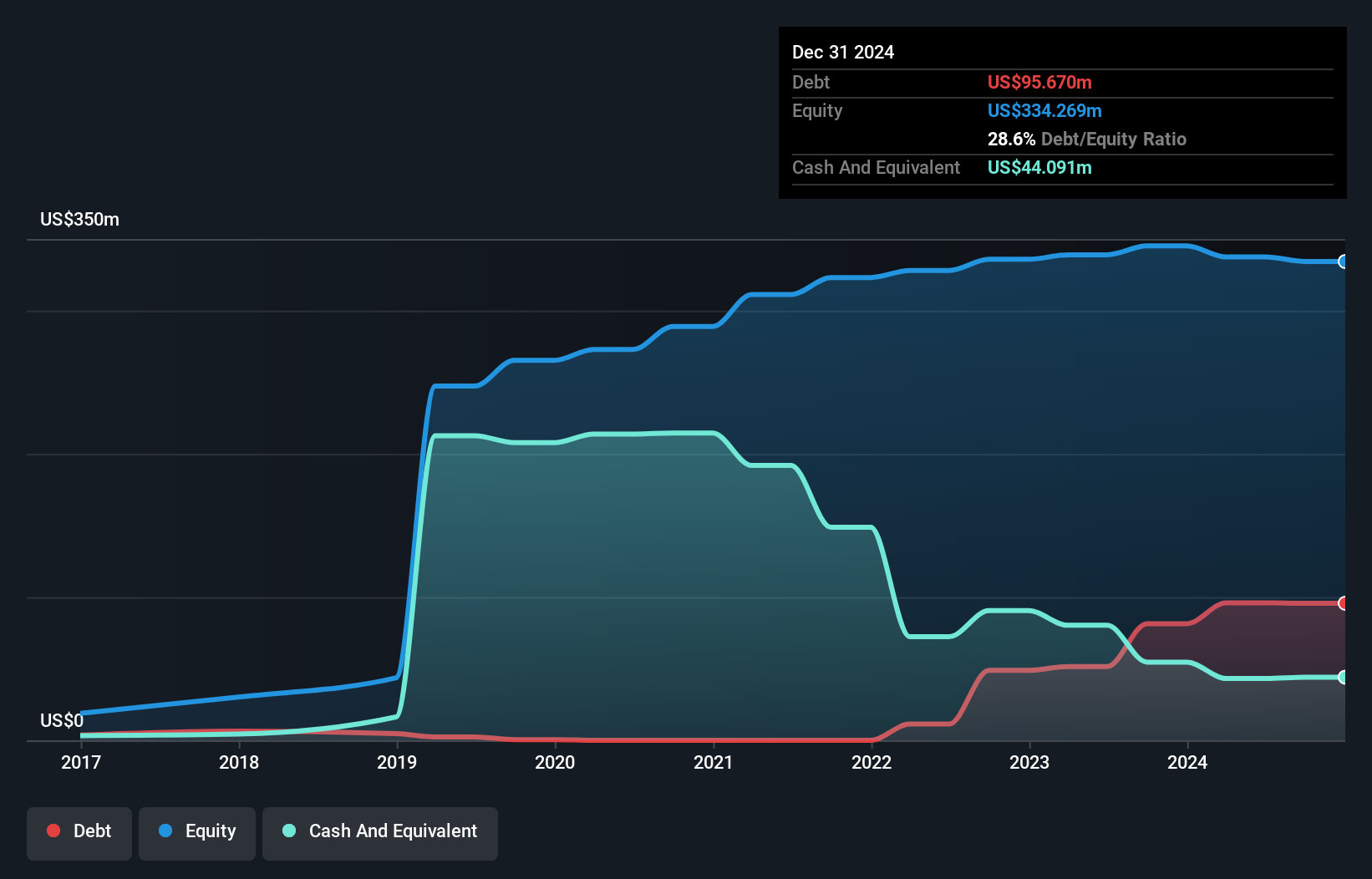

Frontage Holdings demonstrates a mixed financial profile with revenues of US$198.21 million from North America and Europe, and US$56.70 million from the PRC, reflecting its established market presence. However, challenges include declining earnings over the past five years at an annual rate of 14.8% and a significant one-off loss impacting recent results. Despite these setbacks, the company maintains satisfactory debt levels with operating cash flow covering 42.5% of its debt and has stable weekly volatility at 8%. Recent strategic appointments aim to bolster growth in Canada, aligning with Frontage's global expansion strategy in the biotech sector.

- Unlock comprehensive insights into our analysis of Frontage Holdings stock in this financial health report.

- Learn about Frontage Holdings' future growth trajectory here.

Eastern Polymer Group (SET:EPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eastern Polymer Group Public Company Limited, with a market cap of THB7.90 billion, operates through its subsidiaries to manufacture and distribute rubber insulation, automotive components, and plastic packing products both in Thailand and internationally.

Operations: The company's revenue is derived from three main segments: Rubber Insulation (THB4.59 billion), Automotive Plastics (THB6.97 billion), and Packaging Plastics (THB2.32 billion).

Market Cap: THB7.9B

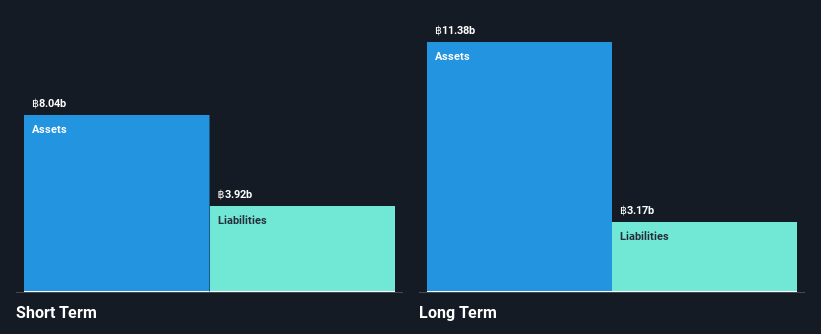

Eastern Polymer Group's financial landscape reveals both strengths and challenges. With a market cap of THB7.90 billion, the company operates across rubber insulation, automotive plastics, and packaging plastics segments. Despite a decline in net income to THB795.99 million for the year ending March 2025, its short-term assets (THB8.3 billion) comfortably exceed liabilities, indicating solid liquidity management. The company's debt is well-covered by operating cash flow at 28%, though its earnings growth has been negative recently with profit margins dropping from 9% to 5.7%. Additionally, Eastern Polymer trades at significant value compared to peers and industry standards while maintaining a seasoned management team and board of directors.

- Get an in-depth perspective on Eastern Polymer Group's performance by reading our balance sheet health report here.

- Understand Eastern Polymer Group's earnings outlook by examining our growth report.

Delfi (SGX:P34)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Delfi Limited is an investment holding company that manufactures, markets, distributes, and sells chocolate and consumer products across Indonesia, the Philippines, Malaysia, Singapore, and internationally with a market cap of SGD498.09 million.

Operations: Delfi's revenue is primarily derived from its operations in Indonesia, which generated $336.95 million, and its Regional Markets segment, contributing $188.39 million.

Market Cap: SGD498.09M

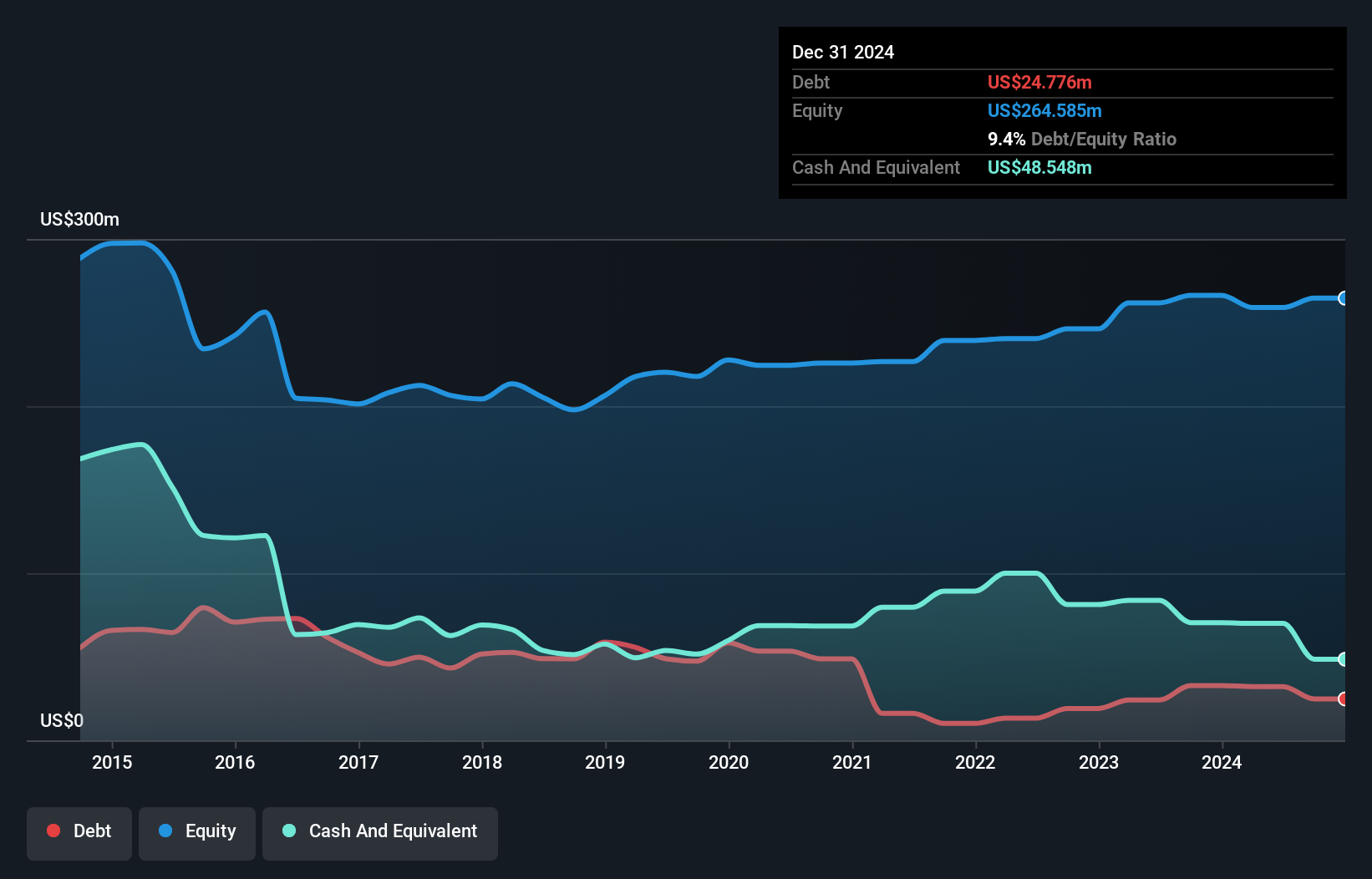

Delfi Limited's financial profile demonstrates a blend of positive elements and areas for caution. With a market cap of SGD498.09 million, the company benefits from strong liquidity as short-term assets exceed both long-term and short-term liabilities. Delfi's debt management is robust, with cash surpassing total debt and operating cash flow well covering its obligations. However, earnings growth has been negative recently, contrasting with its five-year average growth rate of 15.7%. The company's Price-To-Earnings ratio suggests it is valued favorably against the SG market, yet dividend stability remains uncertain following recent decreases.

- Click here and access our complete financial health analysis report to understand the dynamics of Delfi.

- Review our growth performance report to gain insights into Delfi's future.

Seize The Opportunity

- Dive into all 984 of the Asian Penny Stocks we have identified here.

- Ready For A Different Approach? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Polymer Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:EPG

Eastern Polymer Group

Through its subsidiaries, engages in the manufacture and distribution of rubber insulation, automotive, and plastic packing products in Thailand and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives