As global markets celebrate positive developments, such as the U.S. and China signing a new trade deal, Asian indices have also shown resilience and potential for growth. Penny stocks may be an older term, but they continue to represent intriguing opportunities in the investment landscape, particularly within smaller or newer companies. By identifying those with strong financial health and clear growth prospects, investors can uncover potential gems that offer both stability and upside in today's market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.04 | HK$3.53B | ✅ 5 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.27 | HK$1.89B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.05 | HK$1.75B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.25 | SGD8.86B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.182 | SGD36.26M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.12 | SGD855.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.64 | HK$53.16B | ✅ 4 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.52 | HK$13.44B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,001 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

HuBei NengTer TechnologyLtd (SZSE:002102)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HuBei NengTer Technology Co., Ltd operates an ecommerce platform focused on the supply chain of plastic raw materials in China, with a market cap of CN¥8.82 billion.

Operations: Currently, there are no reported revenue segments available for this company.

Market Cap: CN¥8.82B

HuBei NengTer Technology Ltd., with a market cap of CN¥8.82 billion, recently reported first-quarter sales of CN¥2,877.27 million and net income of CN¥215.9 million, reflecting an improvement from the previous year's figures despite a decline in sales compared to last year. The company has completed a share buyback worth CN¥329.98 million, enhancing shareholder value without significant dilution over the past year. While unprofitable with increasing losses over five years, it maintains sufficient cash runway for more than three years and holds more cash than its total debt, indicating financial stability amidst volatility concerns.

- Unlock comprehensive insights into our analysis of HuBei NengTer TechnologyLtd stock in this financial health report.

- Examine HuBei NengTer TechnologyLtd's past performance report to understand how it has performed in prior years.

Tianjin Chase Sun PharmaceuticalLtd (SZSE:300026)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tianjin Chase Sun Pharmaceutical Co., Ltd is involved in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥11.99 billion.

Operations: No specific revenue segments are reported for Tianjin Chase Sun Pharmaceutical Co., Ltd.

Market Cap: CN¥11.99B

Tianjin Chase Sun Pharmaceutical Co., Ltd, with a market cap of CN¥11.99 billion, reported first-quarter sales of CN¥1.39 billion and net income of CN¥60.33 million, showing slight growth from the previous year despite declining sales figures. The company's short-term assets significantly exceed its liabilities, and it holds more cash than debt, indicating a strong liquidity position. However, profit margins have decreased to 0.4% from 6.6% last year, raising concerns about profitability sustainability amid negative earnings growth over the past year and low return on equity at 0.3%. Recent board changes may influence strategic direction moving forward.

- Dive into the specifics of Tianjin Chase Sun PharmaceuticalLtd here with our thorough balance sheet health report.

- Assess Tianjin Chase Sun PharmaceuticalLtd's future earnings estimates with our detailed growth reports.

Hunan Er-Kang Pharmaceutical (SZSE:300267)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hunan Er-Kang Pharmaceutical Co., Ltd is engaged in the manufacturing and sale of APIs, finished drug products, and pharmaceutical excipients both in China and internationally, with a market cap of CN¥6.91 billion.

Operations: Hunan Er-Kang Pharmaceutical Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥6.91B

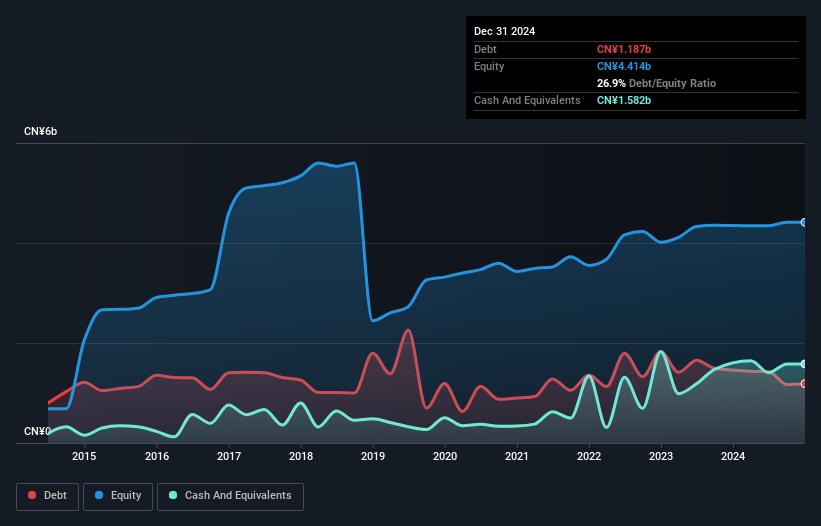

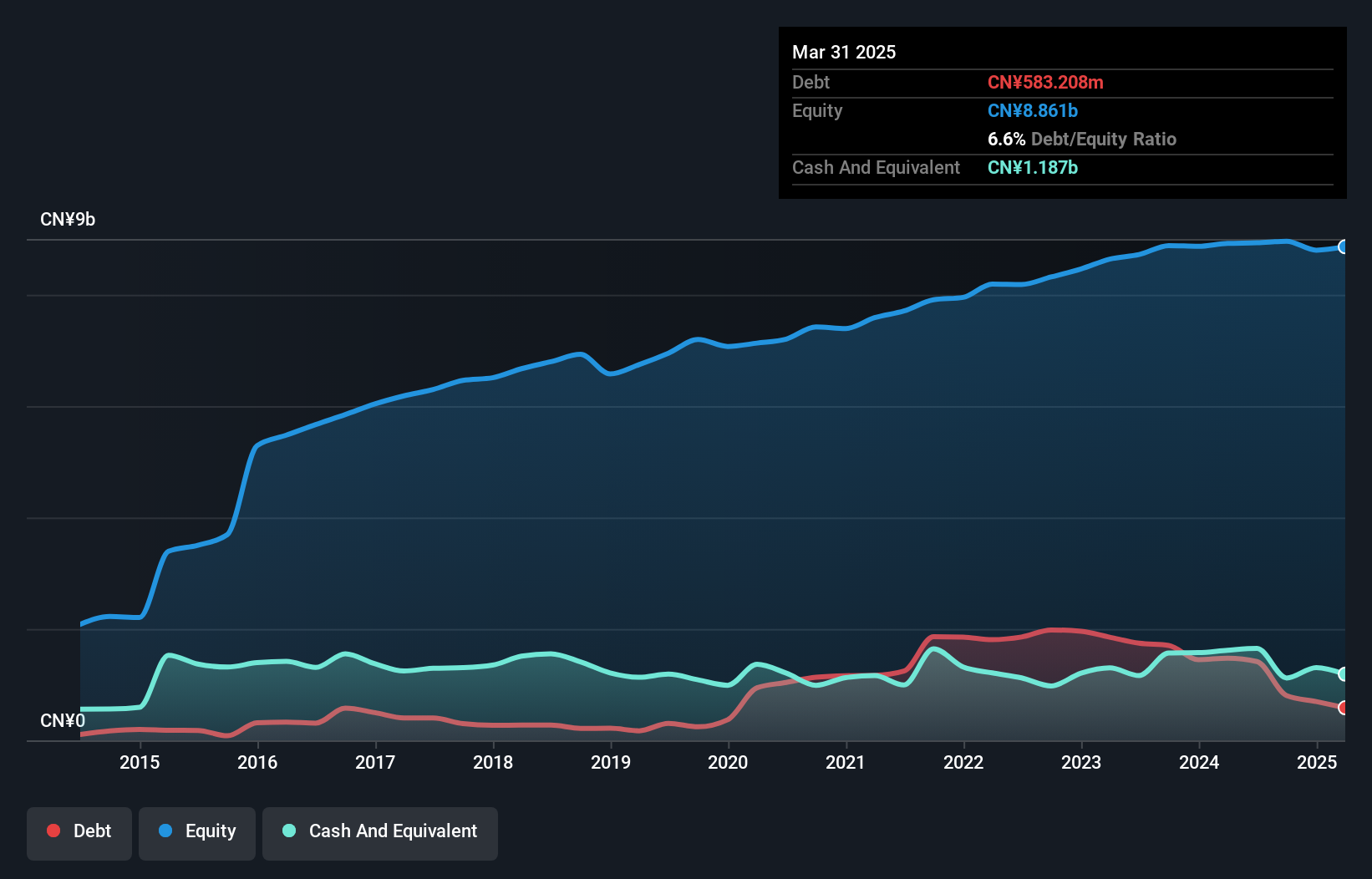

Hunan Er-Kang Pharmaceutical, with a market cap of CN¥6.91 billion, has shown mixed financial performance. Despite a decline in annual revenue from CN¥1.78 billion to CN¥1.14 billion and an increased net loss of CN¥373.37 million for 2024, the company reported improved first-quarter sales of CN¥353.55 million and net income of CN¥28.11 million in 2025 compared to the previous year. The company's short-term assets exceed both its long-term and short-term liabilities, indicating strong liquidity, yet its negative return on equity and high share price volatility highlight ongoing profitability challenges amid increased debt levels over time.

- Navigate through the intricacies of Hunan Er-Kang Pharmaceutical with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Hunan Er-Kang Pharmaceutical's track record.

Make It Happen

- Navigate through the entire inventory of 1,001 Asian Penny Stocks here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Er-Kang Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300267

Hunan Er-Kang Pharmaceutical

Manufactures and sells APIs, finished drug products, and pharmaceutical excipients in China and internationally.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives