- Hong Kong

- /

- Real Estate

- /

- SEHK:1209

Asian Market Value Stock Picks Featuring Three Companies Estimably Trading Below Fair Value

Reviewed by Simply Wall St

Amidst the backdrop of renewed U.S.-China trade tensions and mixed performance in global markets, Asian equities present intriguing opportunities for value investors. In this environment of uncertainty, identifying stocks that are potentially trading below their fair value can offer a strategic advantage, as they may provide resilience against broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.15 | CN¥38.16 | 49.8% |

| TaewoongLtd (KOSDAQ:A044490) | ₩35600.00 | ₩69644.59 | 48.9% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥44.65 | CN¥89.14 | 49.9% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.28 | 49.8% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥959.00 | ¥1910.64 | 49.8% |

| Insource (TSE:6200) | ¥927.00 | ¥1803.64 | 48.6% |

| Genesem (KOSDAQ:A217190) | ₩9730.00 | ₩19382.18 | 49.8% |

| Essex Bio-Technology (SEHK:1061) | HK$4.77 | HK$9.46 | 49.6% |

| DuChemBIOLtd (KOSDAQ:A176750) | ₩9180.00 | ₩17999.49 | 49% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.29 | CN¥59.73 | 49.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

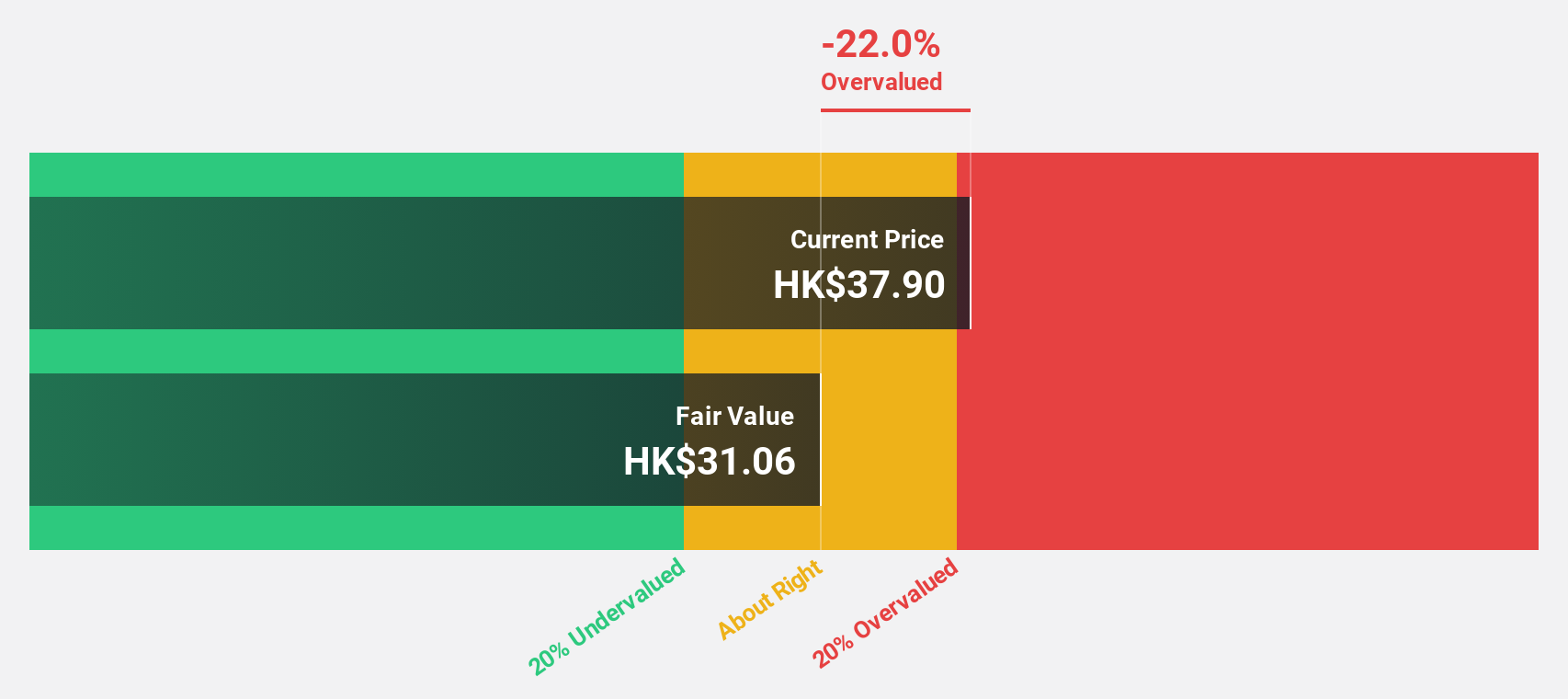

China Resources Mixc Lifestyle Services (SEHK:1209)

Overview: China Resources Mixc Lifestyle Services Limited is an investment holding company providing property management and commercial operational services in the People’s Republic of China, with a market cap of HK$92.08 billion.

Operations: The company's revenue segments include the ecosystem business generating CN¥104.49 million, property management business contributing CN¥10.77 billion, and commercial management business bringing in CN¥6.69 billion.

Estimated Discount To Fair Value: 14.2%

China Resources Mixc Lifestyle Services appears undervalued, trading at HK$40.34, below its fair value estimate of HK$47.01. Despite a dividend yield of 4.12% not fully covered by free cash flows, earnings and revenue growth are expected to outpace the Hong Kong market at 12.7% and 10.1% annually, respectively. Recent leadership changes include Mr. Zhao Wei's appointment as a non-executive director amidst stable financial performance with increased interim dividends declared for 2025.

- In light of our recent growth report, it seems possible that China Resources Mixc Lifestyle Services' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of China Resources Mixc Lifestyle Services.

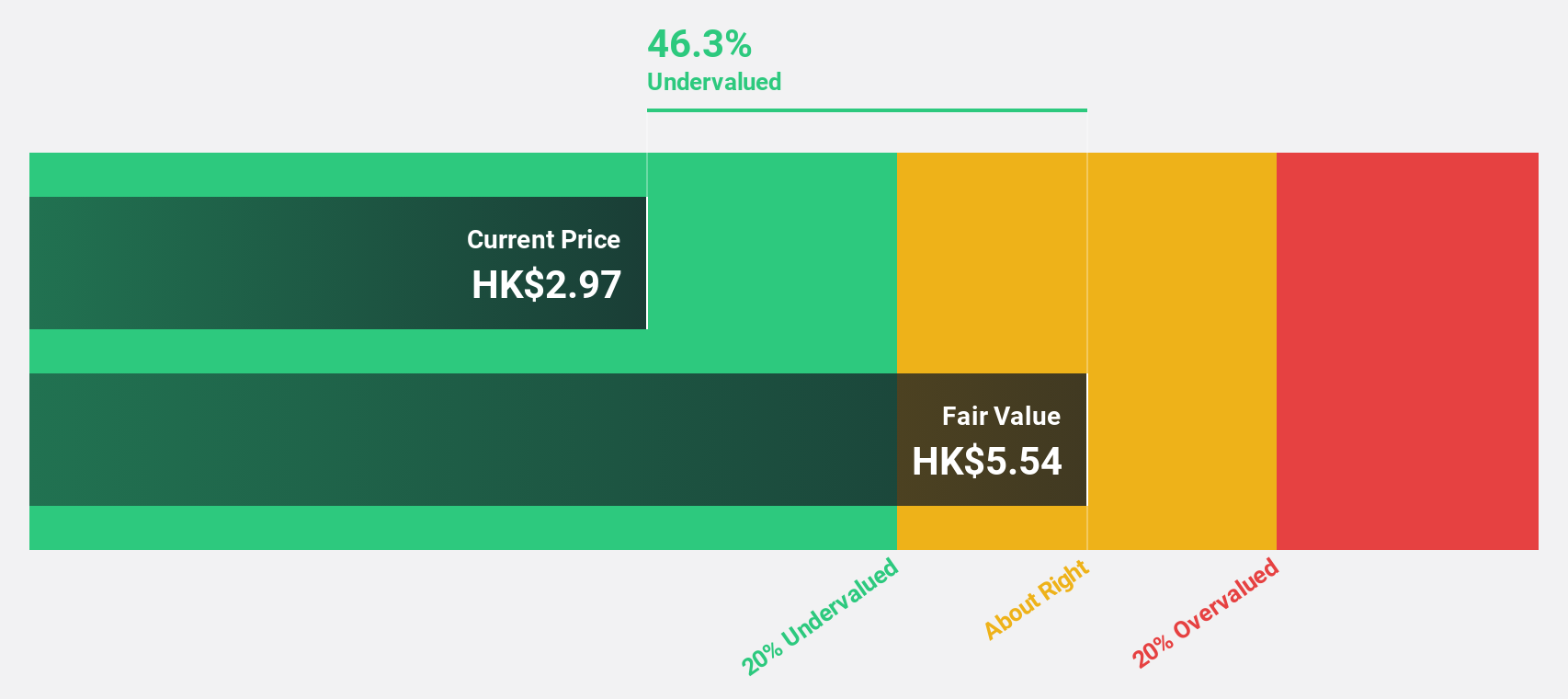

Tongguan Gold Group (SEHK:340)

Overview: Tongguan Gold Group Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and related products in China with a market cap of HK$14.12 billion.

Operations: The company's revenue primarily comes from its gold mining operations, which generated HK$1.69 billion.

Estimated Discount To Fair Value: 41.4%

Tongguan Gold Group is trading at HK$3.21, significantly below its estimated fair value of HK$5.48, indicating potential undervaluation based on cash flows. The company reported strong financial performance for the first half of 2025, with net income rising to HK$342.64 million from HK$91.96 million a year earlier, driven by increased gold production and sales volumes. Recent inclusion in the S&P Global BMI Index and leadership changes with Mr. Wang Dequan as CEO may influence future prospects positively.

- The analysis detailed in our Tongguan Gold Group growth report hints at robust future financial performance.

- Dive into the specifics of Tongguan Gold Group here with our thorough financial health report.

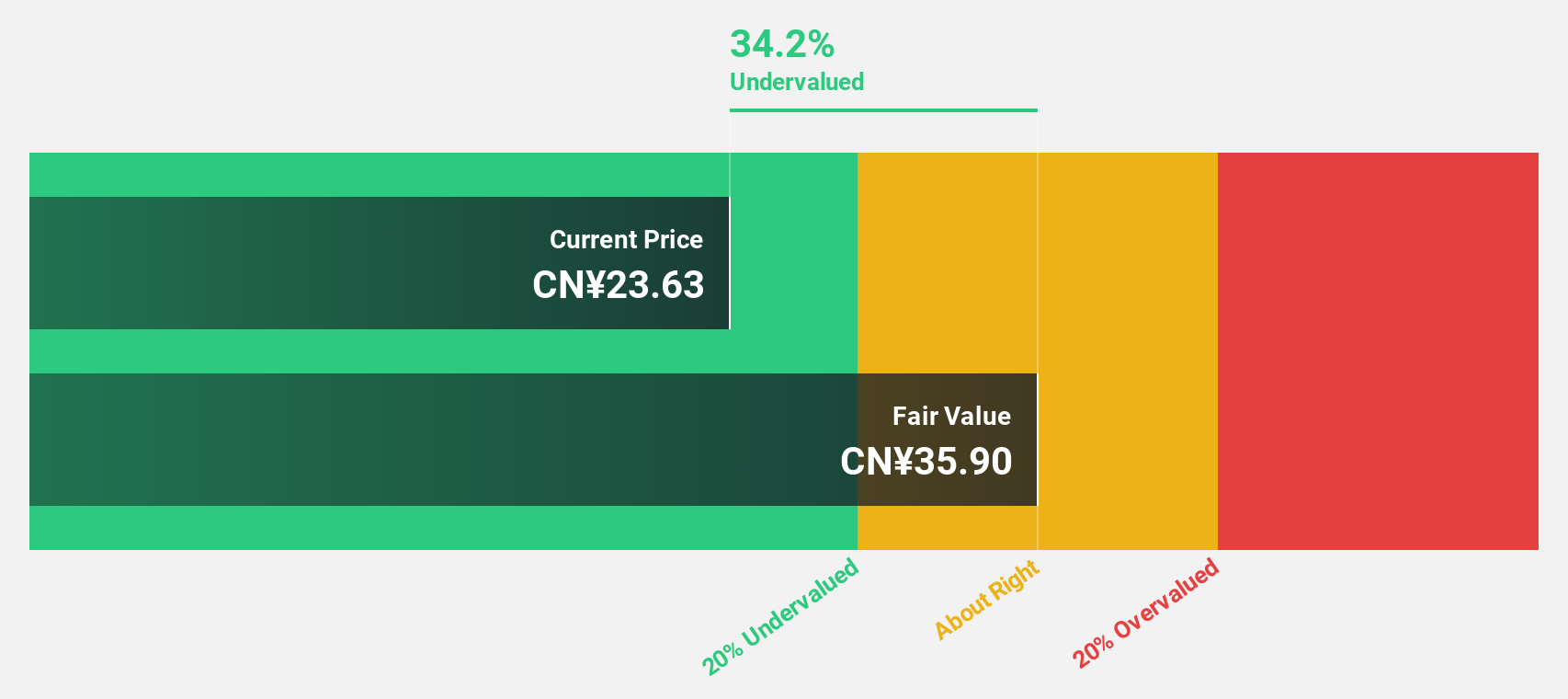

Anhui Jinhe IndustrialLtd (SZSE:002597)

Overview: Anhui Jinhe Industrial Co., Ltd. is involved in the R&D, production, and sales of food additives, daily chemical flavors, bulk chemicals, and intermediates with a market cap of CN¥11.58 billion.

Operations: The company's revenue is derived from Trade (CN¥11.80 billion), Food Manufacturing (CN¥2.59 billion), and the Basic Chemical Industry (CN¥2.16 billion).

Estimated Discount To Fair Value: 35.4%

Anhui Jinhe Industrial Ltd. is trading at CN¥21.17, well below its estimated fair value of CN¥32.79, highlighting potential undervaluation based on cash flows. Despite a slight decline in revenue to CN¥2.44 billion for the first half of 2025, net income increased to CN¥334.24 million from the previous year due to improved earnings per share and operational efficiencies. Recent amendments to its articles of association may impact governance and strategic direction moving forward.

- Our growth report here indicates Anhui Jinhe IndustrialLtd may be poised for an improving outlook.

- Take a closer look at Anhui Jinhe IndustrialLtd's balance sheet health here in our report.

Summing It All Up

- Embark on your investment journey to our 275 Undervalued Asian Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1209

China Resources Mixc Lifestyle Services

An investment holding company, engages in the provision of property management and commercial operational services in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026