Asian Market Value Picks Trading Below Estimated Worth In August 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of inflation data and interest rate speculations, Asian indices have shown resilience, with Japan's stock markets reaching record highs and Chinese stocks advancing amid renewed trade negotiations. In such an environment, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential growth despite broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥160.67 | CN¥312.31 | 48.6% |

| Sunjin Beauty ScienceLtd (KOSDAQ:A086710) | ₩10720.00 | ₩21037.18 | 49% |

| SRE Holdings (TSE:2980) | ¥3115.00 | ¥6106.05 | 49% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩97200.00 | ₩189933.83 | 48.8% |

| Matsuya R&DLtd (TSE:7317) | ¥717.00 | ¥1428.98 | 49.8% |

| Lotes (TWSE:3533) | NT$1350.00 | NT$2686.73 | 49.8% |

| Kolmar Korea (KOSE:A161890) | ₩79600.00 | ₩155807.48 | 48.9% |

| Jiangxi Rimag Group (SEHK:2522) | HK$19.16 | HK$37.57 | 49% |

| Fositek (TWSE:6805) | NT$1060.00 | NT$2092.67 | 49.3% |

| EROAD (NZSE:ERD) | NZ$2.35 | NZ$4.63 | 49.2% |

Underneath we present a selection of stocks filtered out by our screen.

Dekon Food and Agriculture Group (SEHK:2419)

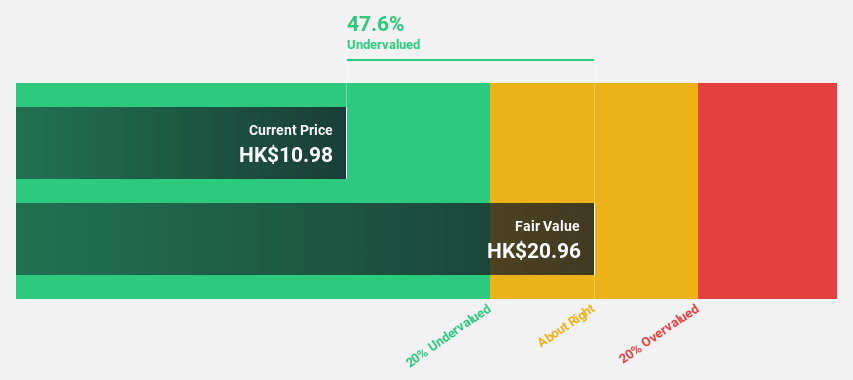

Overview: Dekon Food and Agriculture Group operates in the livestock and poultry breeding and farming sectors, with a market cap of HK$34.42 billion.

Operations: The company's revenue is primarily derived from the sales of pigs (CN¥21.32 billion), poultry (CN¥3.07 billion), and ancillary products (CN¥6.12 billion).

Estimated Discount To Fair Value: 44.3%

Dekon Food and Agriculture Group is trading at HK$88.5, significantly below its estimated fair value of HK$159.01, suggesting it may be undervalued based on cash flows. Despite recent volatility in share price and a decline in net income for the first half of 2025, the company expects substantial profit growth due to improved management efficiency and reduced pig costs. Revenue growth is projected to outpace the Hong Kong market, reinforcing its value proposition.

- The growth report we've compiled suggests that Dekon Food and Agriculture Group's future prospects could be on the up.

- Get an in-depth perspective on Dekon Food and Agriculture Group's balance sheet by reading our health report here.

InnoCare Pharma (SEHK:9969)

Overview: InnoCare Pharma Limited is a biopharmaceutical company focused on discovering, developing, and commercializing drugs for cancer and autoimmune diseases in China, with a market cap of HK$37.30 billion.

Operations: InnoCare Pharma Limited generates revenue by discovering, developing, and commercializing therapeutic drugs targeting cancer and autoimmune diseases within the Chinese market.

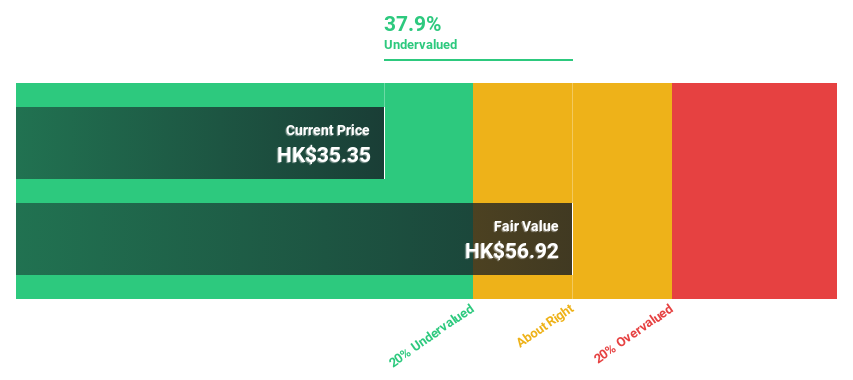

Estimated Discount To Fair Value: 22.2%

InnoCare Pharma, trading at HK$19.05, is undervalued with a fair value estimate of HK$24.49, reflecting over 20% potential upside based on cash flows. The company's revenue grew significantly to CNY 731.43 million for H1 2025 from CNY 419.74 million a year ago, while net losses narrowed considerably to CNY 30.09 million from CNY 261.84 million, driven by robust oncology pipelines and innovative drug development efforts in solid tumors and hematologic malignancies.

- In light of our recent growth report, it seems possible that InnoCare Pharma's financial performance will exceed current levels.

- Click here to discover the nuances of InnoCare Pharma with our detailed financial health report.

Kinik (TWSE:1560)

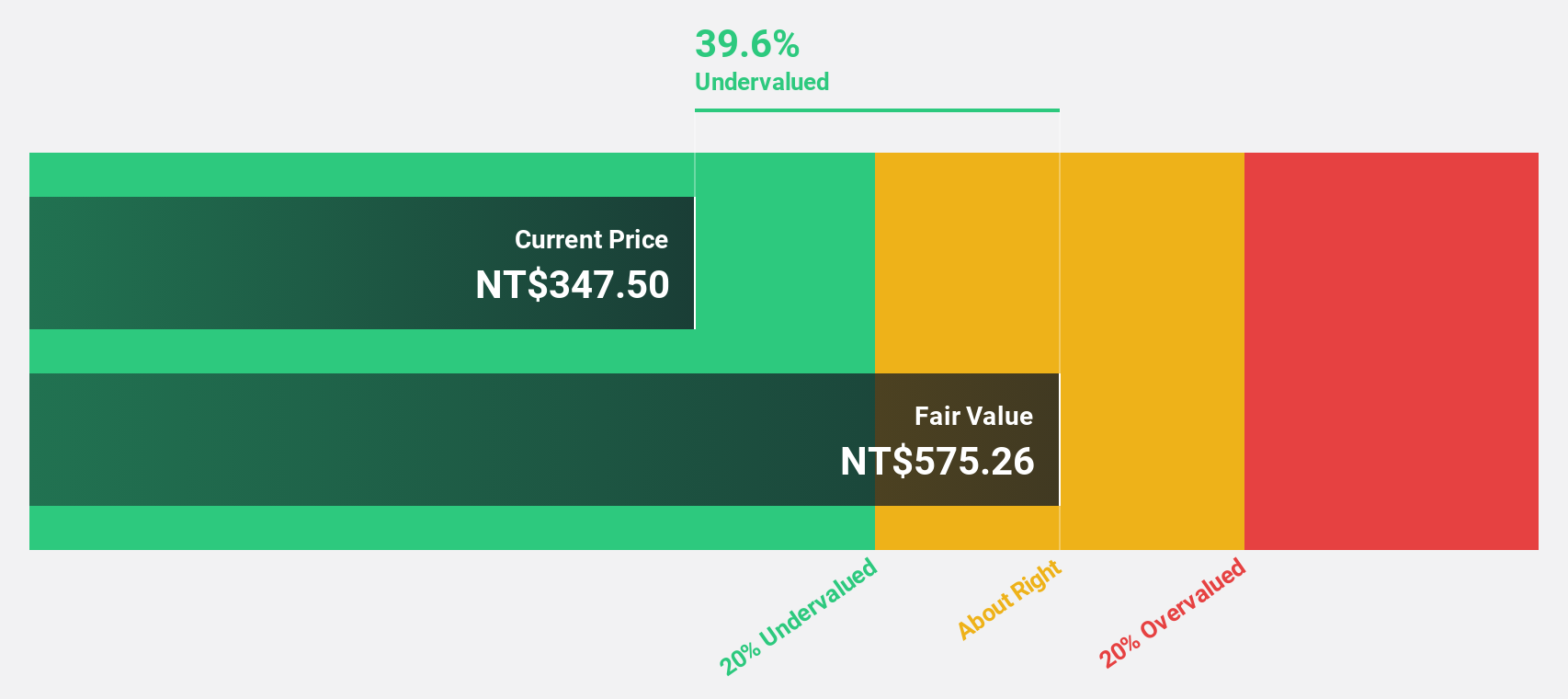

Overview: Kinik Company produces and sells abrasives, cutting tools, and reclaimed wafers both in Taiwan and internationally, with a market cap of approximately NT$47.92 billion.

Operations: The company's revenue is divided into two main segments: The Electronics Sector, generating NT$3.73 billion, and The Traditional Sectors, contributing NT$3.85 billion.

Estimated Discount To Fair Value: 43.6%

Kinik, trading at NT$327, is undervalued with a fair value estimate of NT$579.61. The company's earnings are projected to grow significantly at 32.7% annually, outpacing the TW market's 15.4%. Recent results show sales increased to TWD 2.11 billion in Q2 2025 from TWD 1.73 billion a year ago, with net income rising modestly to TWD 266.37 million from TWD 253.67 million, reflecting strong operational performance amidst favorable cash flow valuations.

- According our earnings growth report, there's an indication that Kinik might be ready to expand.

- Take a closer look at Kinik's balance sheet health here in our report.

Next Steps

- Delve into our full catalog of 269 Undervalued Asian Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinik might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1560

Kinik

Produces and sells various abrasives, cutting tools, and reclaimed wafers in Taiwan and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026