Asian Market Gems: Digital China Holdings And 2 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets experience shifts driven by interest rate expectations and technological advancements, the Asian market remains a focal point for investors seeking growth opportunities. While the term "penny stocks" might seem outdated, it continues to signify potential in smaller or newer companies that offer affordability coupled with growth prospects. This article explores three such stocks, focusing on their financial robustness and potential to deliver significant returns amidst evolving market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.00 | THB3.95B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.05 | HK$2.48B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.61 | HK$995.82M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.97 | SGD393.13M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.96 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.18 | SGD12.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.98 | THB1.44B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.43 | SGD161.09M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 976 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Digital China Holdings (SEHK:861)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise customers in Mainland China, with a market cap of HK$5.37 billion.

Operations: The company's revenue is primarily derived from its Software and Operating Services segment, which generated CN¥5.82 billion, followed by Traditional and Localization Services at CN¥8.37 billion, and Big Data Products and Solutions contributing CN¥3.40 billion.

Market Cap: HK$5.37B

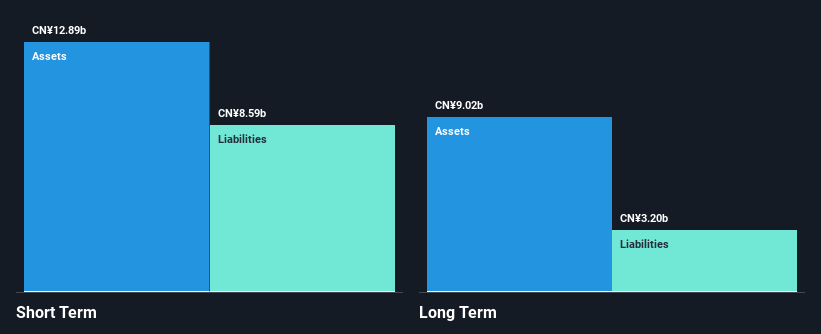

Digital China Holdings has shown growth in revenue, reporting CN¥7.87 billion for the first half of 2025, up from CN¥7.01 billion a year earlier, though it remains unprofitable with a net income of CN¥15.21 million. The company opted not to declare an interim dividend for this period, signaling cautious cash management despite having short-term assets exceeding both its short and long-term liabilities significantly. While trading below its estimated fair value and offering good relative value compared to peers, the company's debt-to-equity ratio has increased over five years, indicating rising leverage concerns amidst stable weekly volatility and seasoned management oversight.

- Take a closer look at Digital China Holdings' potential here in our financial health report.

- Learn about Digital China Holdings' future growth trajectory here.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Start Group Co.Ltd specializes in providing anti-intrusion detection systems in China and has a market capitalization of CN¥8.71 billion.

Operations: Revenue Segments: No specific revenue segments have been reported.

Market Cap: CN¥8.71B

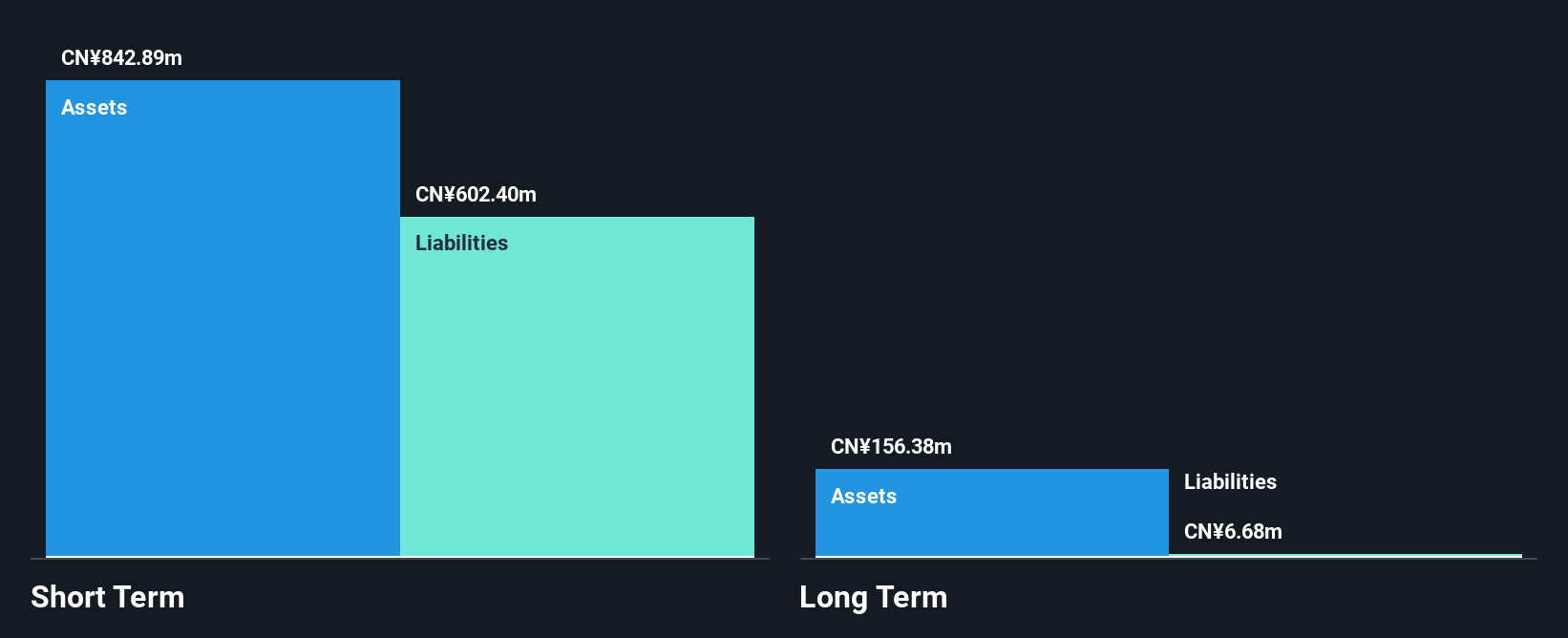

Fujian Start Group Co. Ltd has reported significant revenue growth for the first half of 2025, with sales increasing to CN¥105.94 million from CN¥33.33 million a year prior, though it remains unprofitable with a net loss of CN¥55.51 million. The company benefits from strong liquidity, as its short-term assets exceed both short and long-term liabilities, and it holds more cash than total debt, which is favorable for financial stability despite ongoing losses. Shareholders have not faced meaningful dilution recently; however, the management team is relatively new with an average tenure of 1.6 years.

- Click to explore a detailed breakdown of our findings in Fujian Start GroupLtd's financial health report.

- Gain insights into Fujian Start GroupLtd's historical outcomes by reviewing our past performance report.

Shandong Yabo Technology (SZSE:002323)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Yabo Technology Co., Ltd focuses on the design, research, and development of new materials for metal roof and wall enclosure systems, with a market cap of CN¥3.10 billion.

Operations: The company's revenue is primarily derived from its Metal Roofing segment, generating CN¥121.29 million, followed by the Photovoltaic Business at CN¥170.49 million and Software and Design contributing CN¥2.85 million.

Market Cap: CN¥3.1B

Shandong Yabo Technology's recent earnings report highlights a challenging landscape, with revenue slightly declining to CN¥116.34 million for the first half of 2025 and a net loss narrowing to CN¥41.24 million. Despite being unprofitable, the company has reduced its debt significantly over five years, with a satisfactory net debt to equity ratio of 38.7%. Short-term assets comfortably cover both short and long-term liabilities, suggesting solid liquidity management. However, cash runway concerns persist as it holds less than one year based on current free cash flow trends. The board is experienced, but management tenure data remains insufficient for evaluation.

- Dive into the specifics of Shandong Yabo Technology here with our thorough balance sheet health report.

- Learn about Shandong Yabo Technology's historical performance here.

Next Steps

- Investigate our full lineup of 976 Asian Penny Stocks right here.

- Contemplating Other Strategies? Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:861

Digital China Holdings

An investment holding company, provides big data products and solutions for government and enterprise customers in Mainland China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives