- Hong Kong

- /

- Electrical

- /

- SEHK:1072

Asian Dividend Stocks To Watch In 2023

Reviewed by Simply Wall St

As global markets navigate a complex landscape of trade tensions and economic shifts, Asian indices have shown resilience, with Chinese stocks gaining momentum amid expectations of government stimulus. In this environment, dividend stocks in Asia present an intriguing opportunity for investors seeking steady income streams, particularly as companies with strong fundamentals and reliable payout histories can offer stability amidst market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.44% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.07% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.20% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.50% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.18% | ★★★★★★ |

| Daicel (TSE:4202) | 5.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.37% | ★★★★★★ |

Click here to see the full list of 1240 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

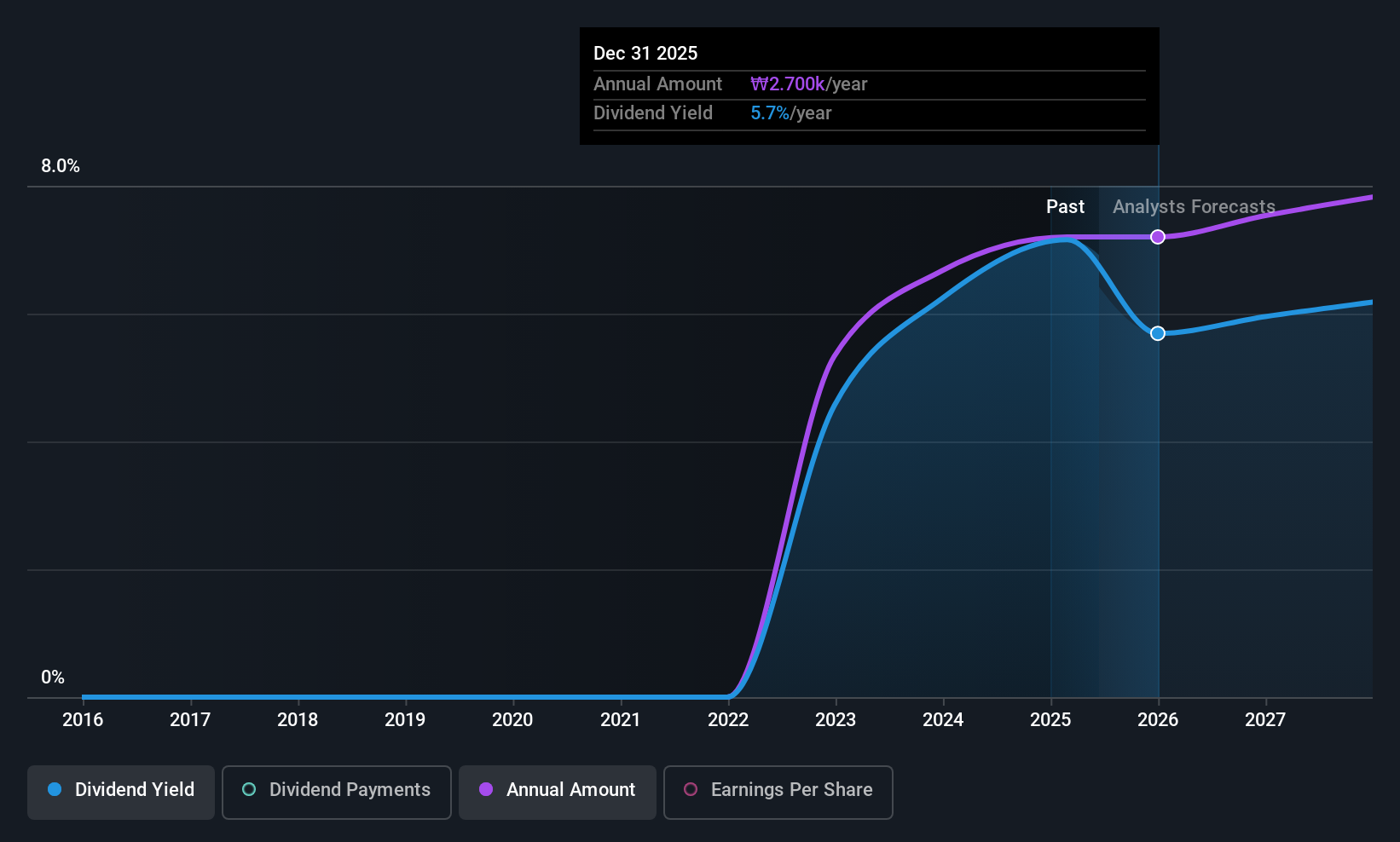

GS Holdings (KOSE:A078930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GS Holdings Corp., along with its subsidiaries, operates in the energy, power generation, retail, service, construction, and infrastructure sectors with a market cap of ₩4.49 trillion.

Operations: GS Holdings Corp.'s revenue primarily comes from its Distribution segment at ₩11.39 trillion, followed by the Gas and Electric Business at ₩7.43 trillion, Trade at ₩3.91 trillion, with an adjustment for Cross-Sector Revenue of -₩0.21 trillion.

Dividend Yield: 5.7%

GS Holdings offers a compelling dividend profile with its payouts well-covered by earnings (63.7% payout ratio) and cash flows (47.4% cash payout ratio). The dividend yield of 5.68% ranks in the top 25% of South Korean market payers, though the company has only a three-year history of dividends, indicating limited track record stability. Despite recent profit margin declines, GS Holdings trades at a significant discount to fair value estimates and peers, enhancing its attractiveness as a value investment.

- Take a closer look at GS Holdings' potential here in our dividend report.

- Our valuation report here indicates GS Holdings may be undervalued.

Shandong Weigao Group Medical Polymer (SEHK:1066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shandong Weigao Group Medical Polymer Company Limited is involved in the R&D, production, wholesale, and sale of medical devices both in China and internationally, with a market cap of HK$26.97 billion.

Operations: Shandong Weigao Group Medical Polymer's revenue is primarily derived from its Medical Device Products segment at CN¥6.60 billion, followed by Interventional Products at CN¥1.98 billion, Pharma Packaging Products at CN¥2.28 billion, Orthopaedic Products at CN¥1.44 billion, and Blood Management Products at CN¥876.78 million.

Dividend Yield: 4%

Shandong Weigao Group Medical Polymer provides a mixed dividend profile, with payouts covered by earnings (47.3% payout ratio) and cash flows (45.9% cash payout ratio), yet its dividend history has been volatile over the past decade. Recent shareholder-approved buybacks aim to enhance net asset value and earnings per share, potentially bolstering future dividends. The company trades at a considerable discount to fair value estimates, though its current yield of 3.98% lags behind top-tier payers in Hong Kong.

- Click here and access our complete dividend analysis report to understand the dynamics of Shandong Weigao Group Medical Polymer.

- Our valuation report unveils the possibility Shandong Weigao Group Medical Polymer's shares may be trading at a discount.

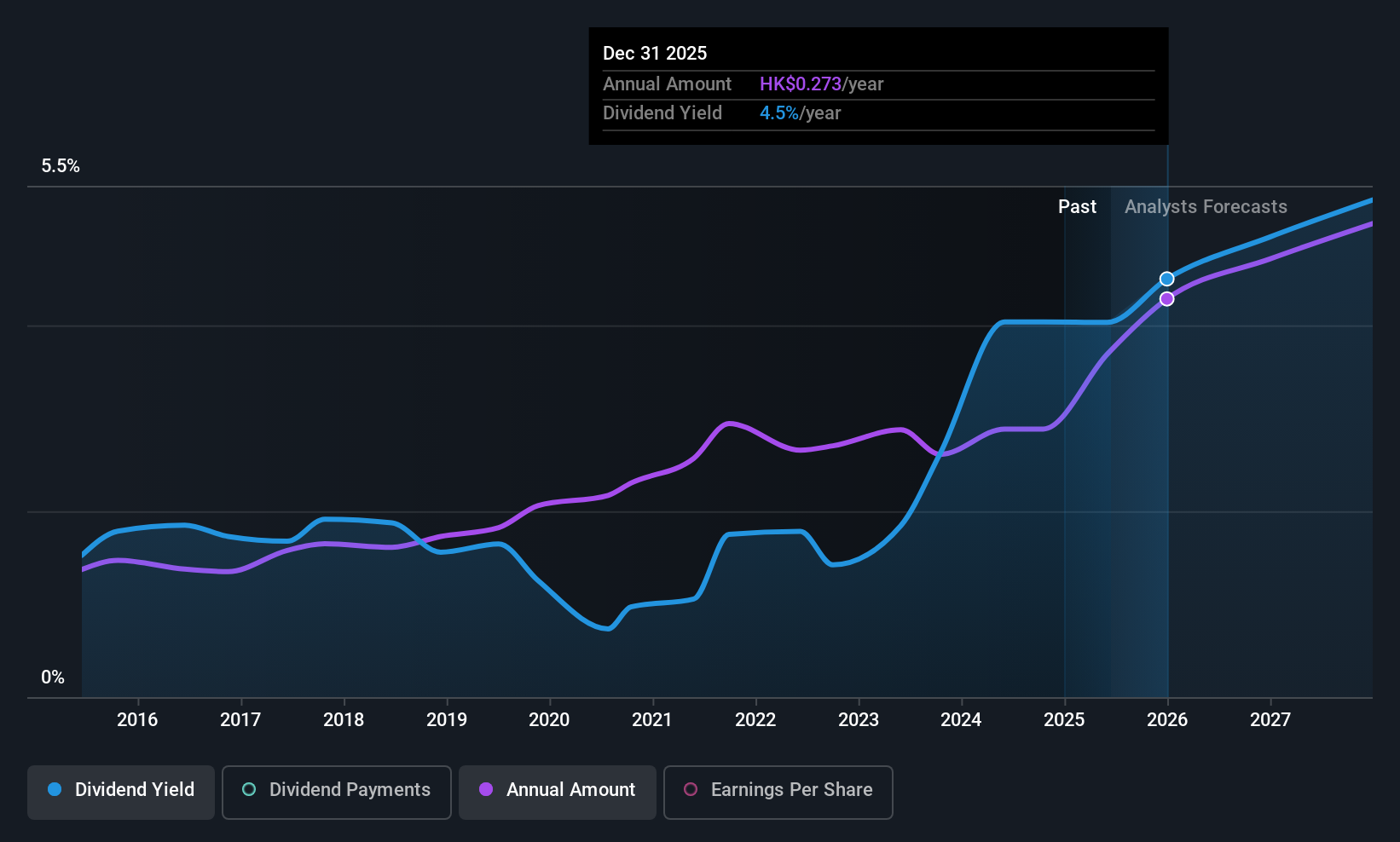

Dongfang Electric (SEHK:1072)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dongfang Electric Corporation Limited designs, develops, manufactures, and sells power generation equipment in China and internationally with a market cap of HK$60.10 billion.

Operations: Dongfang Electric Corporation Limited's revenue segments include CN¥45.23 billion from thermal power equipment, CN¥12.78 billion from hydropower equipment, CN¥5.67 billion from wind power equipment, and CN¥3.45 billion from nuclear power equipment.

Dividend Yield: 3.6%

Dongfang Electric's dividends are supported by earnings (43.1% payout ratio) and cash flows (59.2% cash payout ratio), though its dividend history has been unstable over the last decade. Recent earnings reports show improved financial performance, with Q1 2025 net income rising to CNY 1.15 billion from CNY 905.75 million a year earlier, yet the proposed final dividend for 2024 decreased, reflecting ongoing volatility in payouts despite potential growth prospects.

- Get an in-depth perspective on Dongfang Electric's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Dongfang Electric's current price could be inflated.

Seize The Opportunity

- Take a closer look at our Top Asian Dividend Stocks list of 1240 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1072

Dongfang Electric

Engages in the design, develop, manufacture, and sale of power generation equipment in China and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives