- Hong Kong

- /

- Specialty Stores

- /

- SEHK:590

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amid escalating geopolitical tensions and trade-related concerns, the Asian markets have shown mixed performance, with some indices experiencing declines while others remain buoyed by optimistic economic data. In this environment, dividend stocks can offer a degree of stability and income potential for investors seeking to enhance their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.58% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.32% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.21% | ★★★★★★ |

| NCD (TSE:4783) | 4.19% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.47% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.35% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.94% | ★★★★★★ |

Click here to see the full list of 1246 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

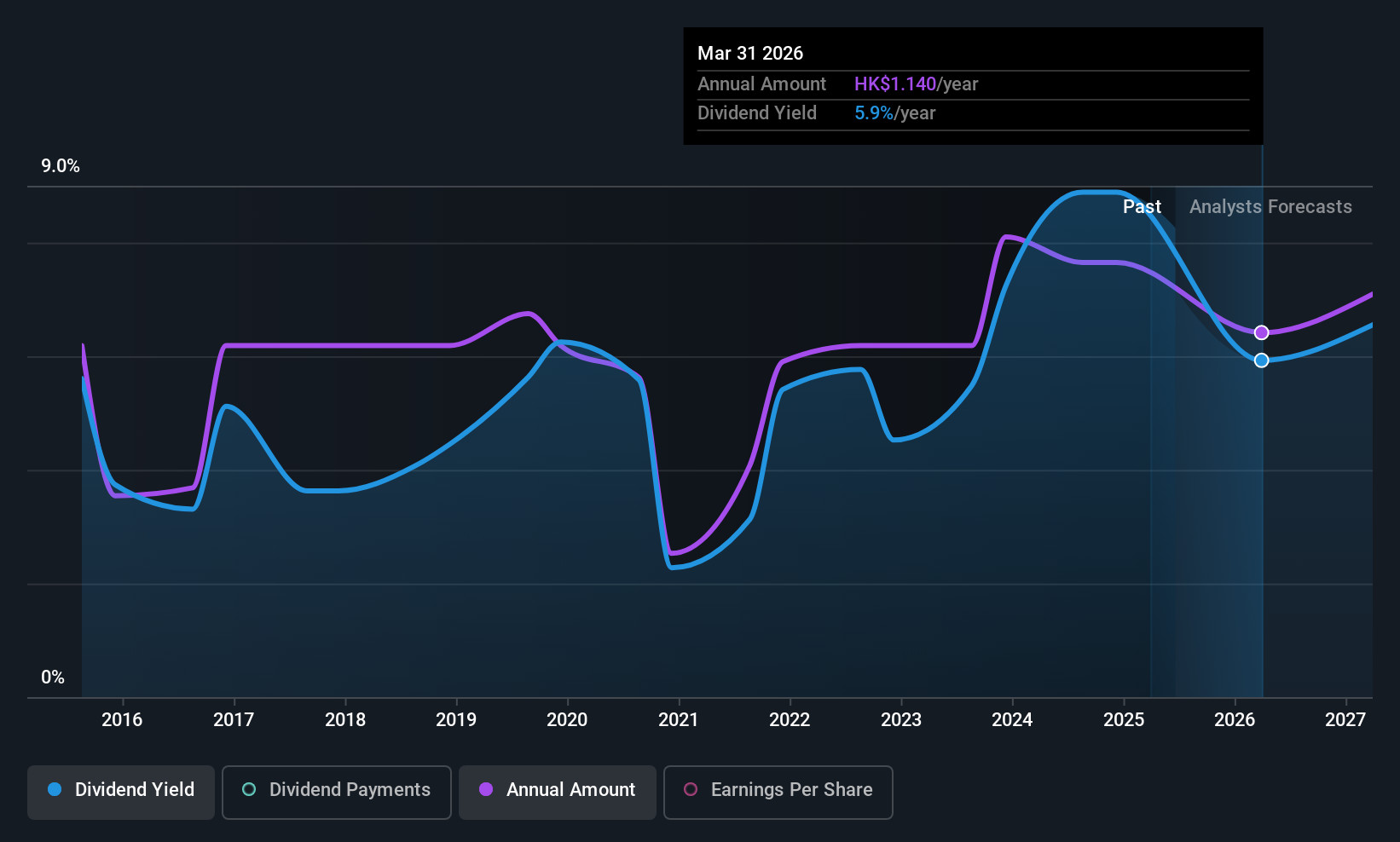

Luk Fook Holdings (International) (SEHK:590)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Luk Fook Holdings (International) Limited is an investment holding company involved in sourcing, designing, wholesaling, trademark licensing, and retailing gold and platinum jewelry as well as gem-set jewelry products, with a market cap of HK$12.53 billion.

Operations: Luk Fook Holdings (International) Limited generates revenue from several segments, including Licensing (HK$892.75 million), Retailing - Mainland (HK$2.81 billion), Wholesaling - Hong Kong (HK$2.06 billion), Wholesaling - Mainland (HK$1.08 billion), and Retailing - Hong Kong, Macau and Overseas (HK$8.66 billion).

Dividend Yield: 6.4%

Luk Fook Holdings (International) offers a mixed dividend profile. While its dividends are covered by earnings and cash flows, with payout ratios of 55.5% and 42% respectively, the company's dividend history has been volatile with significant annual drops. Trading at a significant discount to estimated fair value, it presents potential value despite its lower-than-top-tier yield of 6.37%. Recent sales results show flat revenue growth, indicating challenges in retail performance.

- Click here to discover the nuances of Luk Fook Holdings (International) with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Luk Fook Holdings (International) shares in the market.

PTT Exploration and Production (SET:PTTEP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PTT Exploration and Production Public Company Limited, along with its subsidiaries, is involved in the exploration and production of petroleum both in Thailand and internationally, with a market cap of THB448.61 billion.

Operations: PTT Exploration and Production's revenue segments include $5.40 billion from Southeast Asia - Thailand, $2.26 billion from Other Southeast Asia, $1.09 billion from the Middle East, and $309 million from Africa.

Dividend Yield: 7.9%

PTT Exploration and Production's dividends are supported by earnings with a payout ratio of 50.8% and cash flows at 76%, though they have been volatile over the past decade. The dividend yield of 7.91% is below Thailand's top-tier payers, and recent earnings showed a slight decline in revenue to US$2.19 billion for Q1 2025. Despite trading below estimated fair value, its unstable dividend history may concern some investors seeking reliability.

- Get an in-depth perspective on PTT Exploration and Production's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that PTT Exploration and Production is trading behind its estimated value.

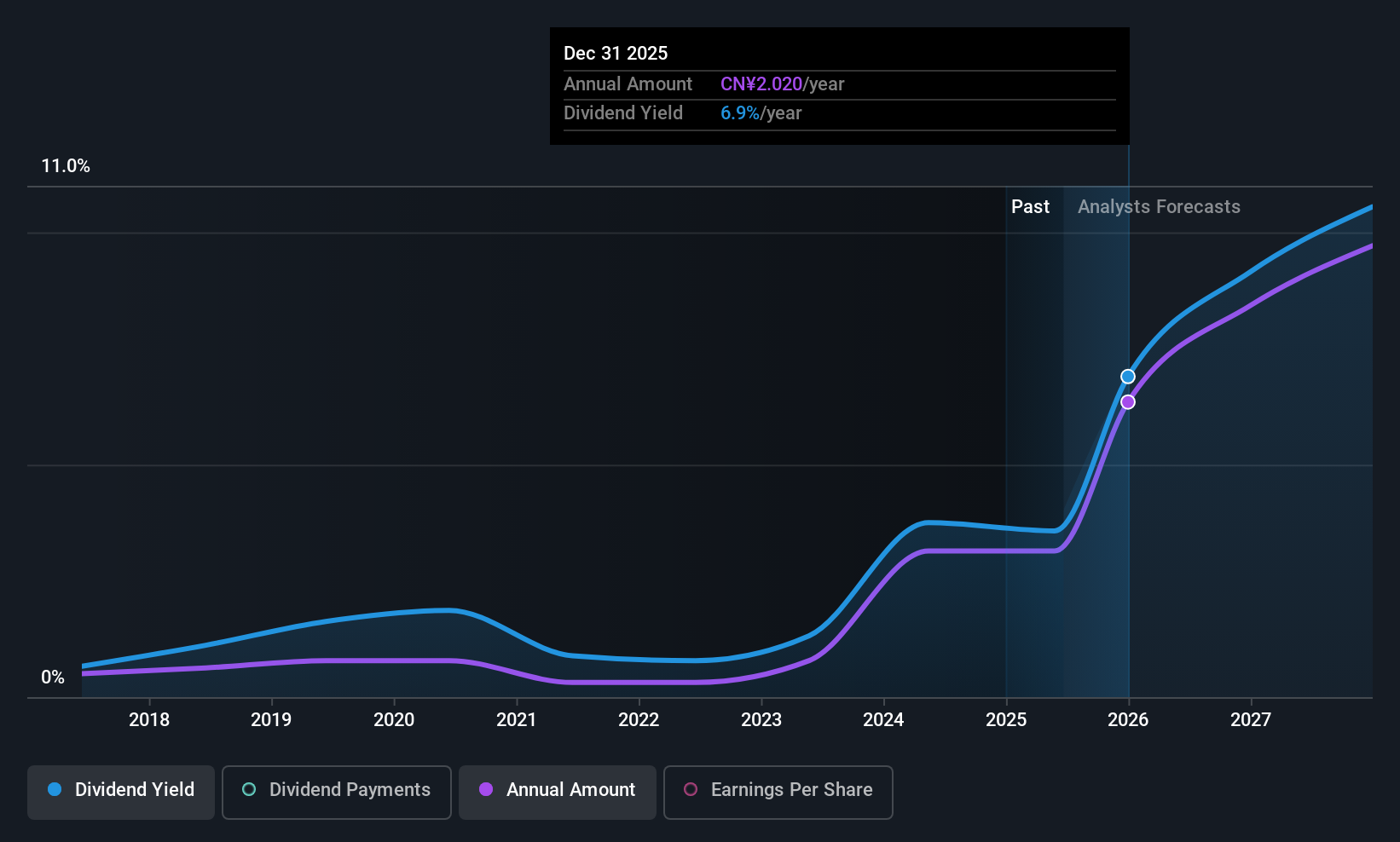

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: L&K Engineering (Suzhou) Co., Ltd. offers specialized engineering technical services in China and has a market cap of CN¥6.38 billion.

Operations: L&K Engineering (Suzhou) Co., Ltd. generates its revenue primarily from providing specialized engineering technical services within China.

Dividend Yield: 3.3%

L&K Engineering (Suzhou) Ltd. offers a dividend yield of 3.34%, placing it among the top 25% of payers in China, though its eight-year history shows volatility with significant annual drops. Recent earnings reveal a decline, with Q1 2025 net income at CNY 81.99 million from CNY 116.84 million the previous year, following subsidiary closures to optimize costs. Despite these challenges, dividends are well covered by earnings and cash flows with payout ratios at 35.5% and 11.6%, respectively.

- Dive into the specifics of L&K Engineering (Suzhou)Ltd here with our thorough dividend report.

- The valuation report we've compiled suggests that L&K Engineering (Suzhou)Ltd's current price could be quite moderate.

Make It Happen

- Unlock our comprehensive list of 1246 Top Asian Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:590

Luk Fook Holdings (International)

An investment holding company, engages in sourcing, designing, wholesaling, trademark licensing, and retailing various gold and platinum jewelry, and gem-set jewelry products.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives