- China

- /

- Gas Utilities

- /

- SHSE:603080

Asian Dividend Stocks To Consider Now

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate and trade talks between the U.S. and China show signs of progress, Asian markets are navigating a complex landscape with mixed economic signals. Amid these developments, dividend stocks in Asia can offer investors a potential source of steady income, especially when selecting companies with strong fundamentals and resilience to market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.63% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.38% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.14% | ★★★★★★ |

| NCD (TSE:4783) | 4.23% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.30% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.19% | ★★★★★★ |

| Daicel (TSE:4202) | 5.00% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

Click here to see the full list of 1240 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

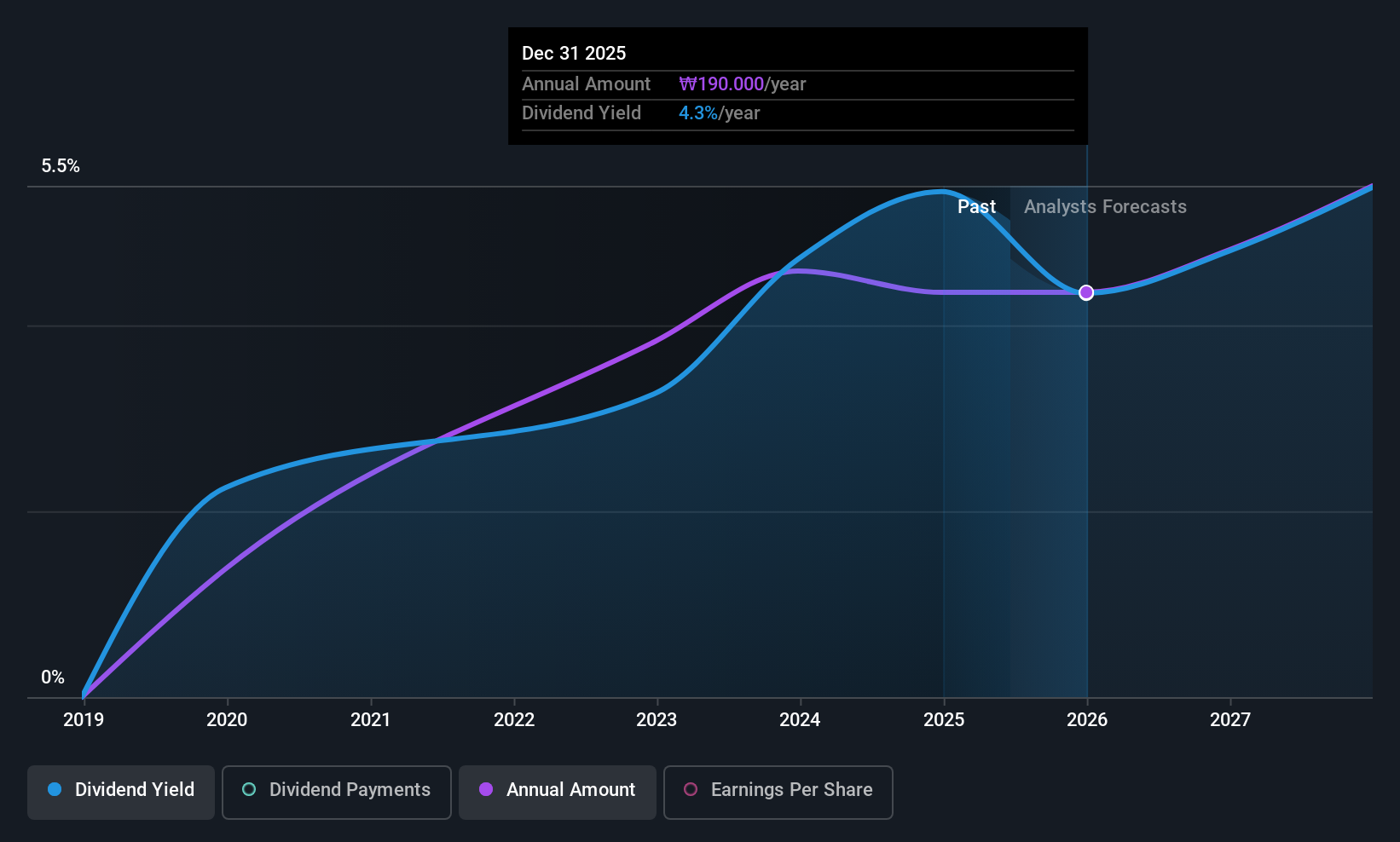

KX Innovation (KOSDAQ:A122450)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KX Innovation Co., Ltd. offers broadcasting transmission and channel services, with a market cap of ₩191.53 billion.

Operations: KX Innovation Co., Ltd. generates its revenue primarily from broadcasting transmission and channel services.

Dividend Yield: 4.3%

KX Innovation's dividend profile presents a mixed picture. While the company trades at a significant discount to its estimated fair value and offers a competitive dividend yield of 4.3%, its dividends have been unstable over the past six years, with volatility in payments. Despite this, dividends are well-covered by both earnings and cash flows, boasting low payout ratios of 9.8% and 10.1%, respectively. Recent share buybacks may signal efforts to enhance shareholder value amidst these challenges.

- Dive into the specifics of KX Innovation here with our thorough dividend report.

- The valuation report we've compiled suggests that KX Innovation's current price could be quite moderate.

Xinjiang Torch Gas (SHSE:603080)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang Torch Gas Co., Ltd is a gas service company operating in China with a market cap of CN¥2.55 billion.

Operations: Xinjiang Torch Gas Co., Ltd generates revenue through its operations as a gas service provider in China.

Dividend Yield: 3.1%

Xinjiang Torch Gas's dividend profile is characterized by a competitive yield of 3.1%, placing it in the top 25% of the CN market, though its payments have been volatile over seven years. Despite this instability, dividends are well-covered by earnings and cash flows with payout ratios of 47.9% and 54.1%, respectively. Recent financial performance shows growth, with Q1 revenue at CNY 467.24 million and net income rising to CNY 45.48 million, supporting its dividend strategy.

- Click here and access our complete dividend analysis report to understand the dynamics of Xinjiang Torch Gas.

- Our comprehensive valuation report raises the possibility that Xinjiang Torch Gas is priced higher than what may be justified by its financials.

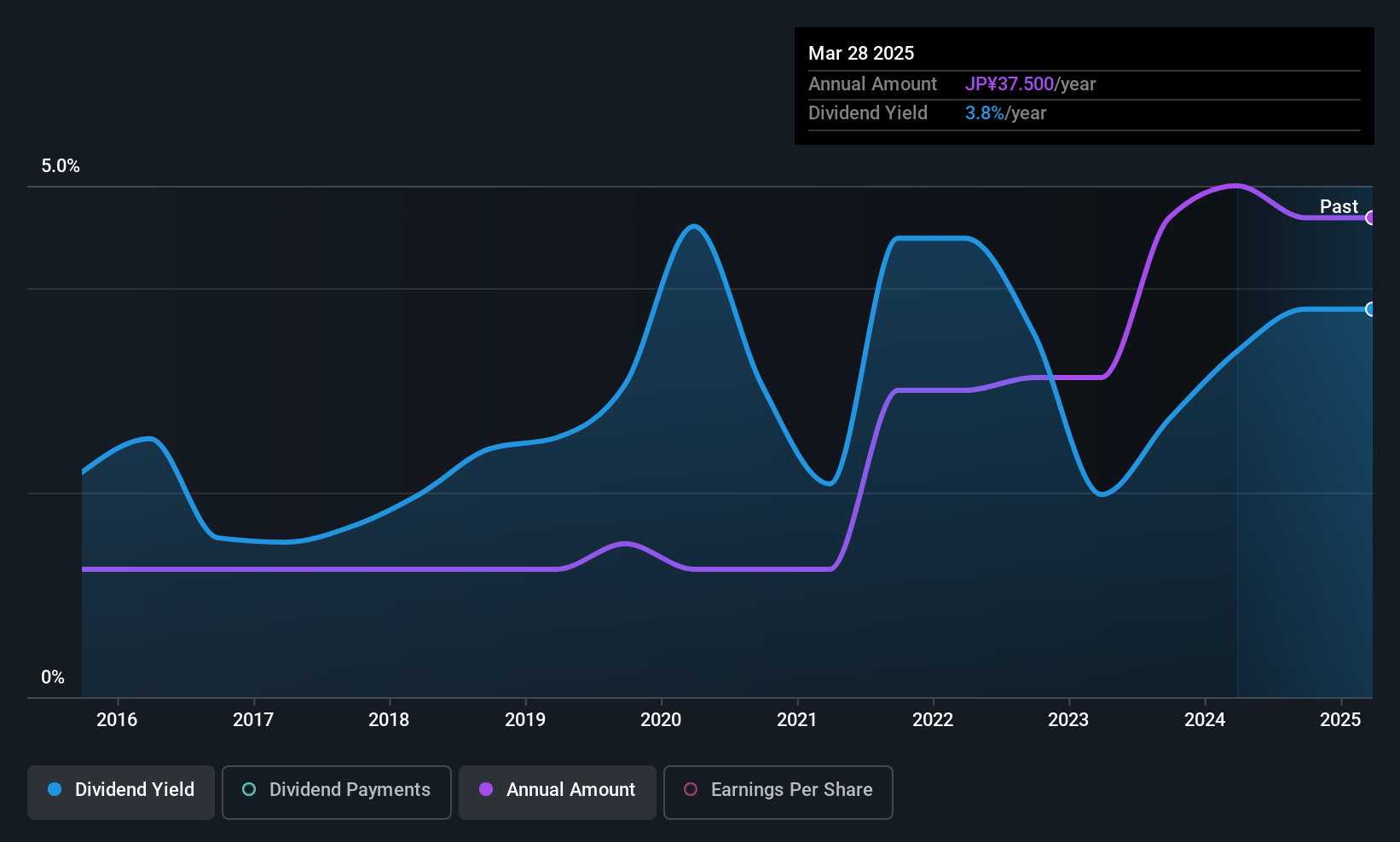

Y.A.C. Holdings (TSE:6298)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Y.A.C. Holdings Co., Ltd. operates in the mechatronics, display, industrial machinery, and electronics sectors both in Japan and internationally, with a market cap of ¥15.05 billion.

Operations: Y.A.C. Holdings Co., Ltd.'s revenue is primarily derived from the Semiconductor and Mechatronics segment at ¥11.39 billion, followed by Environment and Infrastructure at ¥6.87 billion, and Medical Care at ¥5.02 billion.

Dividend Yield: 4.9%

Y.A.C. Holdings' dividend yield of 4.9% ranks in the top 25% within Japan, yet its payments have been volatile, with recent reductions highlighting sustainability concerns due to a high payout ratio of 123.5%. Despite a low cash payout ratio of 30.9%, dividends are not well-covered by earnings, and financial restructuring aims to enhance synergy across business segments amid lowered earnings guidance due to market shifts and delays in strategic ventures with Linus Bio.

- Click here to discover the nuances of Y.A.C. Holdings with our detailed analytical dividend report.

- Our valuation report unveils the possibility Y.A.C. Holdings' shares may be trading at a premium.

Next Steps

- Discover the full array of 1240 Top Asian Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603080

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives