- Japan

- /

- Professional Services

- /

- TSE:2153

Asian Dividend Stocks Spotlight: 3 Top Picks

Reviewed by Simply Wall St

Amid recent global market developments, Asia has been a focal point, with China's stock markets seeing gains driven by hopes for more stimulus in response to persistent deflationary pressures. As investors navigate these complex economic landscapes, dividend stocks in Asia stand out as attractive options for those seeking stable income streams and potential resilience against market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.06% | ★★★★★★ |

| NCD (TSE:4783) | 4.36% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.26% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.36% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.86% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.11% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.00% | ★★★★★★ |

Click here to see the full list of 1203 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

E J Holdings (TSE:2153)

Simply Wall St Dividend Rating: ★★★★★★

Overview: E J Holdings Inc., with a market cap of ¥25.84 billion, operates through its subsidiaries in the civil engineering consultancy sector both in Japan and internationally.

Operations: E J Holdings Inc. generates revenue primarily through its subsidiaries' civil engineering consultancy services offered both domestically and internationally.

Dividend Yield: 4.9%

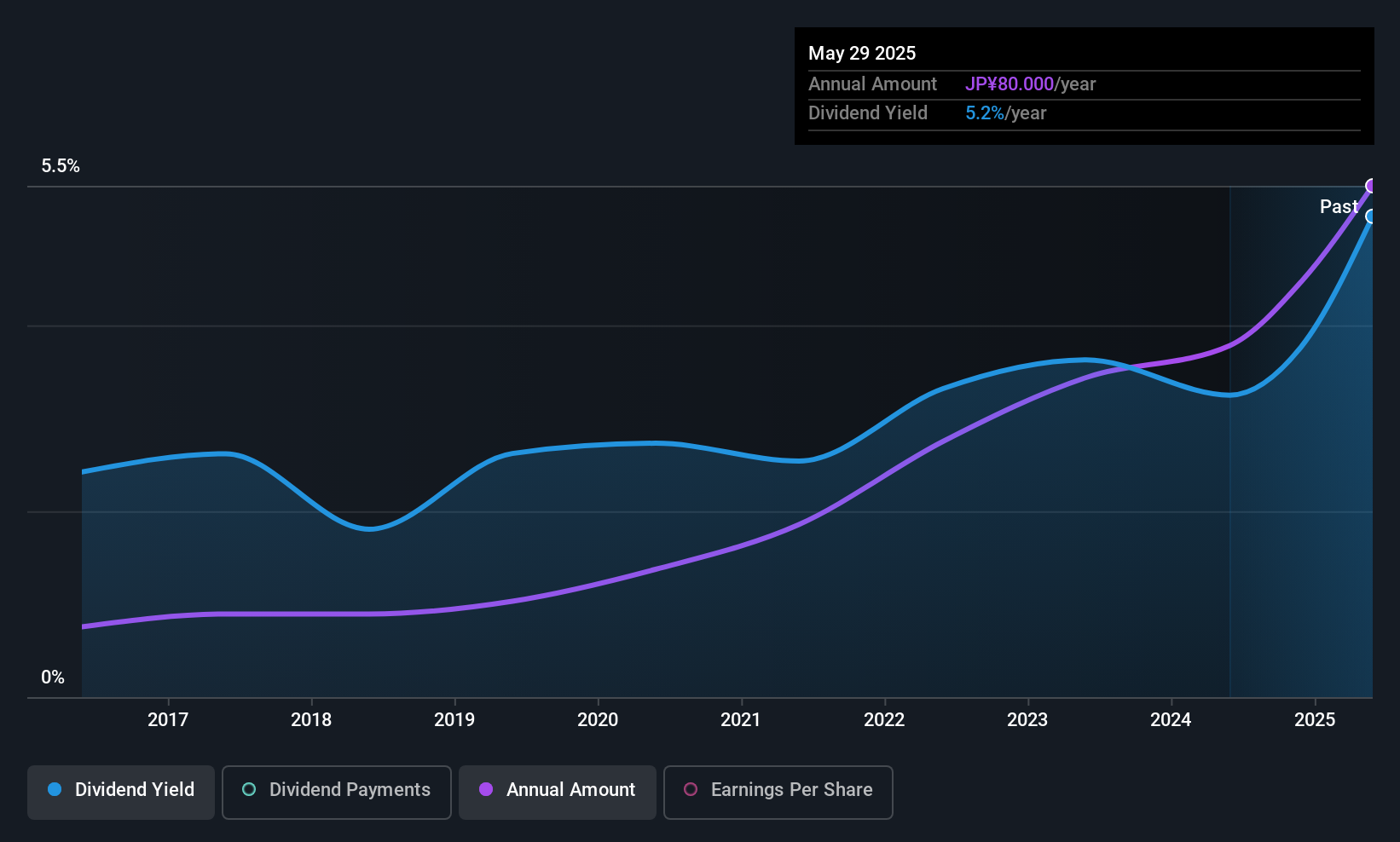

E J Holdings offers a compelling dividend profile, with a stable and growing yield of 4.86%, placing it in the top 25% of Japan's market. Its dividends are well-covered by both earnings and cash flow, maintaining payout ratios of 44.9% and 53.5%, respectively. Despite recent equity offerings totaling ¥2.878 billion, the company's dividend sustainability remains intact due to its robust financial management and strategic organizational restructuring aimed at enhancing governance and compliance systems.

- Click here and access our complete dividend analysis report to understand the dynamics of E J Holdings.

- The valuation report we've compiled suggests that E J Holdings' current price could be quite moderate.

Foster Electric Company (TSE:6794)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Foster Electric Company, Limited produces and sells loudspeakers, audio equipment, and electronic equipment both in Japan and internationally, with a market cap of ¥38.00 billion.

Operations: Foster Electric Company, Limited's revenue segments include the production and sale of loudspeakers, audio equipment, and electronic equipment.

Dividend Yield: 4.1%

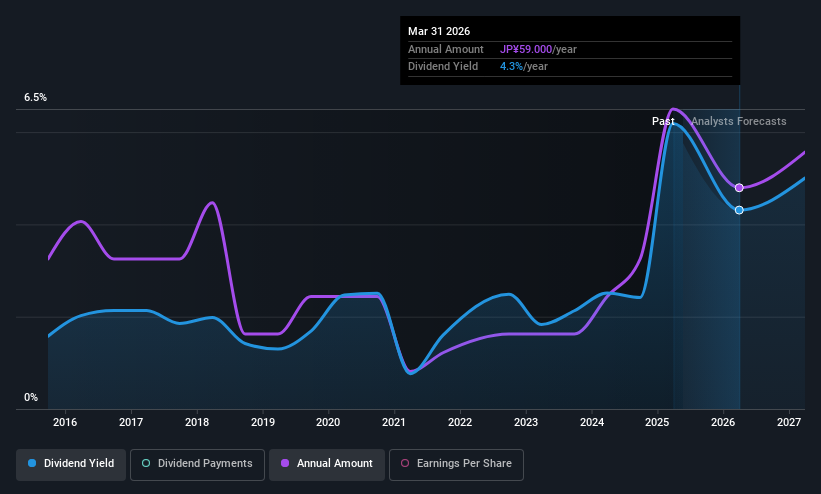

Foster Electric Company, while offering a dividend yield of 4.11% that ranks in the top 25% of Japan's market, has experienced volatility in its dividend payments over the past decade. Despite this instability, dividends are well-covered by earnings and cash flows with payout ratios of 41.5% and 14.2%, respectively. Recent guidance indicates a decrease in dividends to ¥35 per share for the fiscal year ending March 2026 from ¥40 previously, reflecting ongoing adjustments to their financial strategy.

- Get an in-depth perspective on Foster Electric Company's performance by reading our dividend report here.

- Our valuation report unveils the possibility Foster Electric Company's shares may be trading at a discount.

NANYO (TSE:7417)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NANYO Corporation operates as a general machinery trading company both in Japan and internationally, with a market cap of ¥17.29 billion.

Operations: NANYO Corporation's revenue segments include its operations as a general machinery trading company in both domestic and international markets.

Dividend Yield: 3.8%

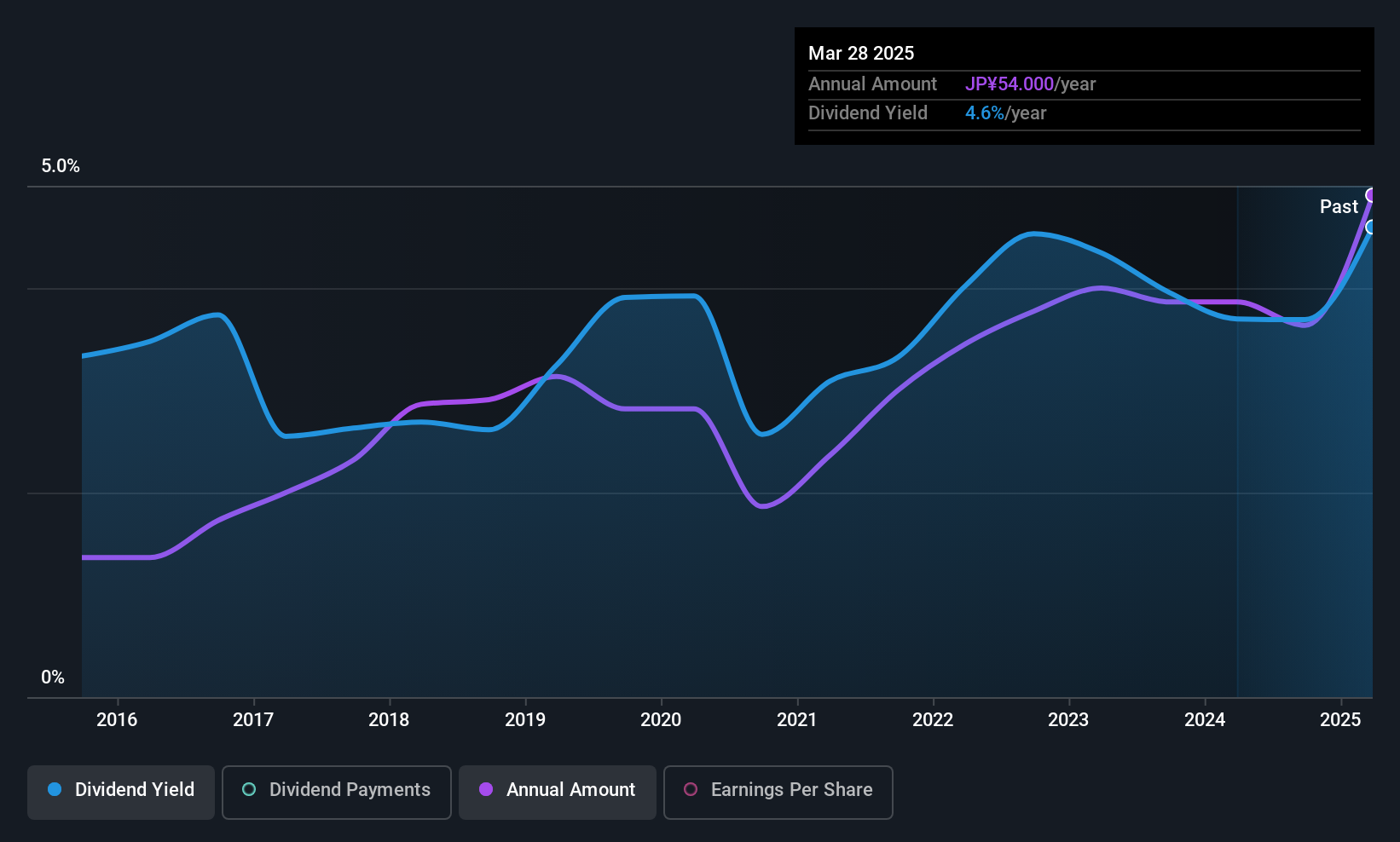

NANYO's dividend yield of 3.76% is below the top 25% in Japan, but dividends are well-covered by earnings (payout ratio: 56.5%) and cash flows (cash payout ratio: 23.3%). Despite a history of volatility in dividend payments, recent earnings growth of 10.2% annually over five years supports potential stability. The company recently completed a share buyback for ¥76.38 million to enhance capital efficiency, indicating strategic financial management amidst evolving business conditions.

- Click here to discover the nuances of NANYO with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of NANYO shares in the market.

Where To Now?

- Unlock our comprehensive list of 1203 Top Asian Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E J Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2153

E J Holdings

Through its subsidiaries, engages in the civil engineering consultant business in Japan and internationally.

6 star dividend payer with excellent balance sheet.

Market Insights

Community Narratives