As global markets experience a surge propelled by favorable trade deals, Asian markets are also showing signs of optimism with key indices advancing on hopes for continued economic stability. In this environment, dividend stocks in Asia offer an appealing investment opportunity for those seeking steady income streams amid the evolving trade landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.24% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.13% | ★★★★★★ |

| NCD (TSE:4783) | 4.13% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.22% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.25% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.06% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.93% | ★★★★★★ |

Click here to see the full list of 1161 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Stella International Holdings (SEHK:1836)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Stella International Holdings Limited is an investment holding company involved in the development, manufacture, and sale of footwear products and leather goods across North America, China, Europe, Asia, and other international markets with a market cap of HK$13.26 billion.

Operations: Stella International Holdings Limited generates its revenue primarily from two segments: Manufacturing, which contributes $1.54 billion, and Retailing and Wholesaling, which adds $2.60 million.

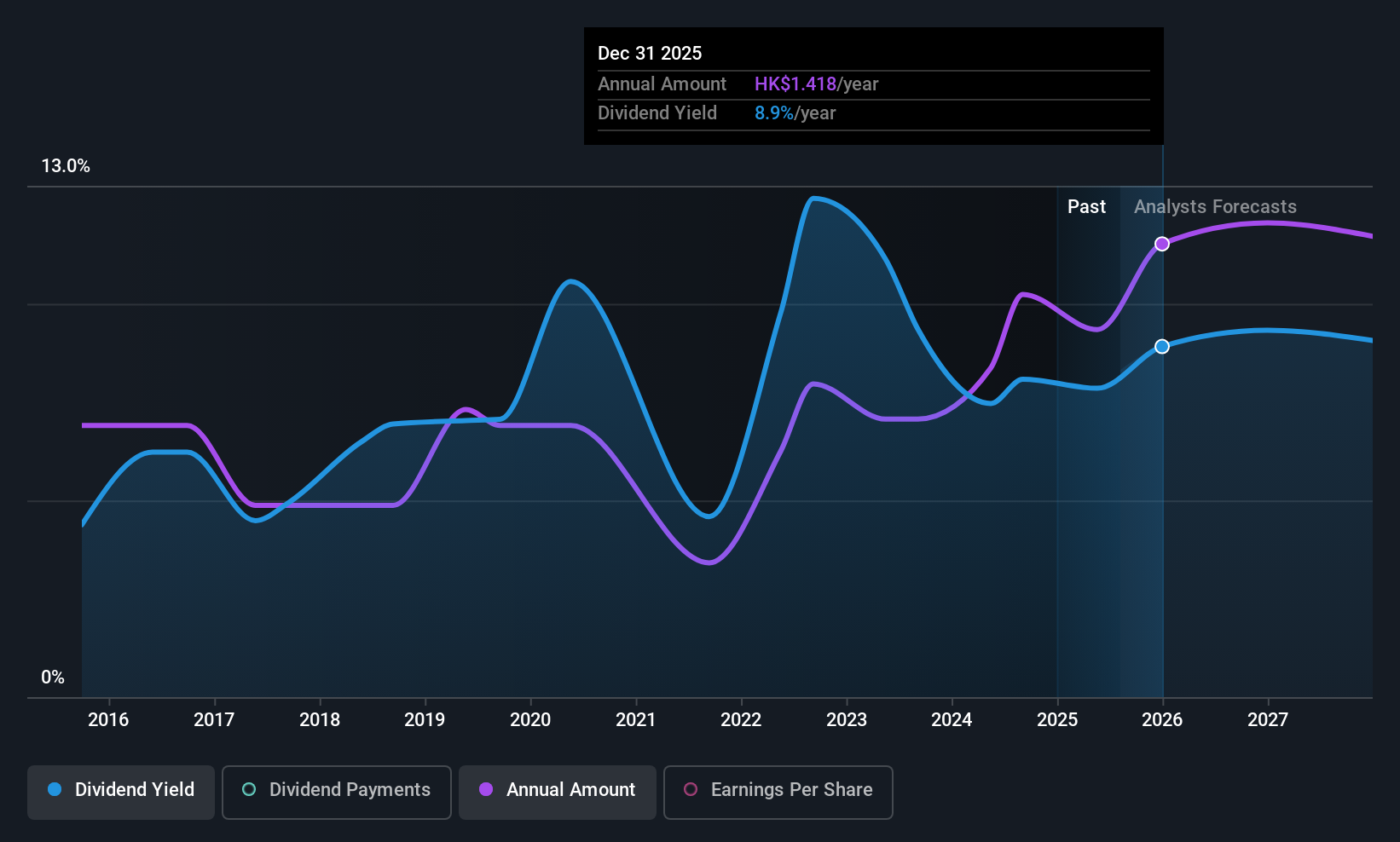

Dividend Yield: 7.2%

Stella International Holdings offers a compelling dividend yield of 7.24%, positioning it in the top 25% of Hong Kong market payers. Despite its reasonable payout and cash payout ratios, indicating dividends are covered by earnings and cash flow, the company's dividend history is marked by volatility and unreliability over the past decade. Recent earnings growth of 21.2% could support future payouts, but investors should remain cautious due to historical instability in dividend payments.

- Get an in-depth perspective on Stella International Holdings' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Stella International Holdings is priced higher than what may be justified by its financials.

Sumitomo Forestry (TSE:1911)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Forestry Co., Ltd. operates in timber building materials, housing, construction, real estate, and resources and environment sectors across Japan, the United States, Australia, China, Indonesia, New Zealand and internationally with a market cap of ¥960.72 billion.

Operations: Sumitomo Forestry Co., Ltd.'s revenue segments include Housing at ¥557.58 billion, Timber Building Materials Business at ¥253.14 billion, Global Construction and Real Estate at ¥1.28 trillion, and Environment and Resource at ¥26.46 billion.

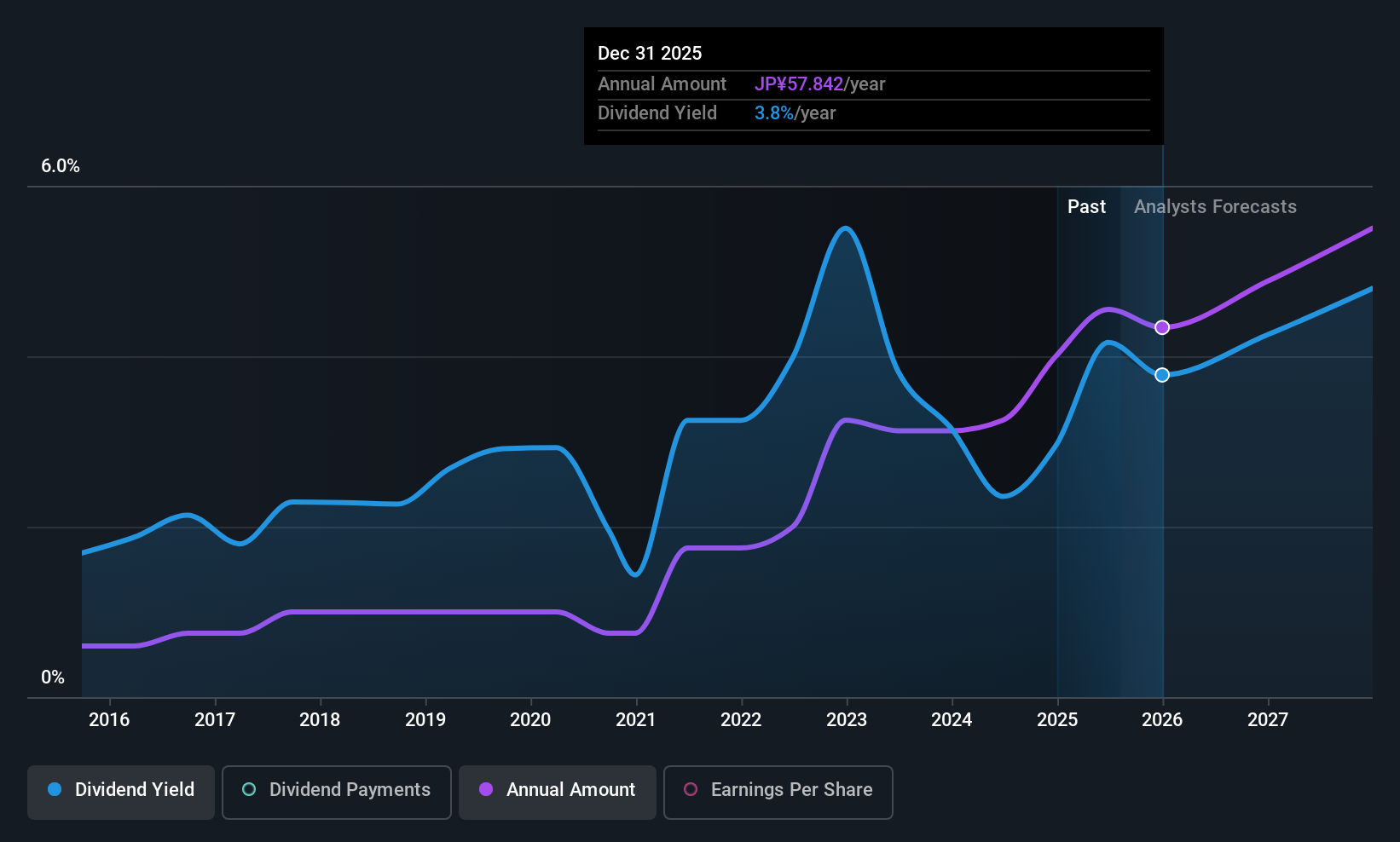

Dividend Yield: 3.9%

Sumitomo Forestry's recent board meeting led to a stock split and revision of its dividend policy, aiming to enhance liquidity and investor base. The company revised its full-year dividend forecast slightly upward to JPY 91.50 per share. Despite being in the top 25% of JP market payers with a 3.88% yield, dividends are not well covered by free cash flows and have been historically volatile, though the payout ratio remains low at 25.7%.

- Click to explore a detailed breakdown of our findings in Sumitomo Forestry's dividend report.

- Upon reviewing our latest valuation report, Sumitomo Forestry's share price might be too pessimistic.

T.RAD (TSE:7236)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: T.RAD Co., Ltd. specializes in the research, development, manufacture, and sale of heat exchangers for various applications including automobiles and industrial machines, with a market cap of ¥30.19 billion.

Operations: T.RAD Co., Ltd.'s revenue is primarily derived from its operations in Japan (¥80.20 billion), the United States (¥44.59 billion), Asia (¥24.12 billion), China (¥17.06 billion), and Europe (¥4.90 billion).

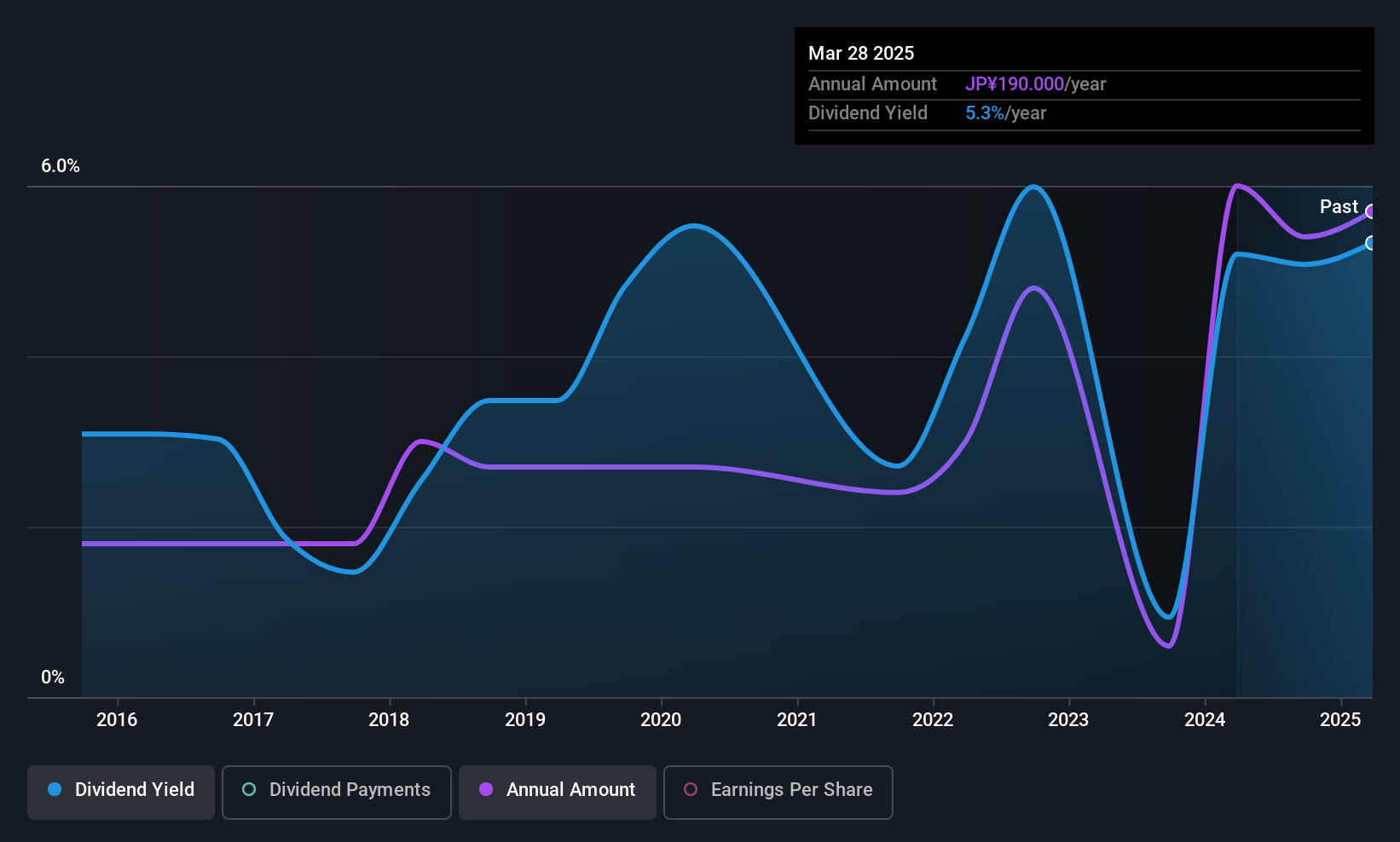

Dividend Yield: 4.9%

T.RAD's dividend yield of 4.85% places it among the top 25% of payers in Japan, with a payout ratio of 36.7%, indicating dividends are well covered by earnings. However, its dividend history is volatile, lacking consistent growth over the past decade. Recent share buybacks totaling ¥763.37 million aim to enhance shareholder value and capital efficiency. Despite a recent dividend reduction from ¥150 to ¥120 per share for fiscal 2026, earnings have grown significantly by 241.4%.

- Unlock comprehensive insights into our analysis of T.RAD stock in this dividend report.

- According our valuation report, there's an indication that T.RAD's share price might be on the expensive side.

Make It Happen

- Click this link to deep-dive into the 1161 companies within our Top Asian Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1836

Stella International Holdings

An investment holding company, engages in development, manufacture, and sale of footwear products and leather goods in North America, the People’s Republic of China, Europe, Asia, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives