Stock Analysis

- Saudi Arabia

- /

- Chemicals

- /

- SASE:2290

Yanbu National Petrochemical Company's (TADAWUL:2290) Popularity With Investors Is Clear

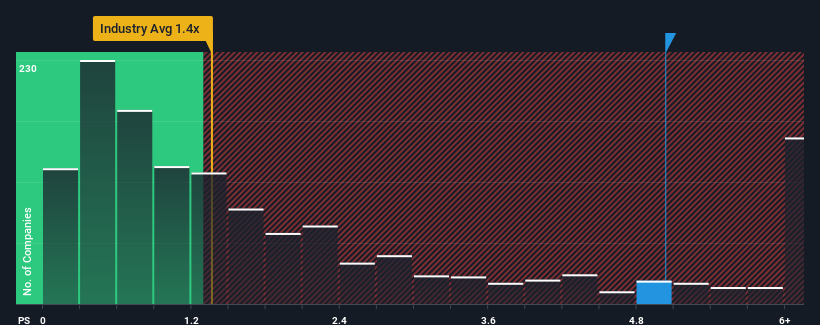

When you see that almost half of the companies in the Chemicals industry in Saudi Arabia have price-to-sales ratios (or "P/S") below 2.2x, Yanbu National Petrochemical Company (TADAWUL:2290) looks to be giving off strong sell signals with its 5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Yanbu National Petrochemical

How Yanbu National Petrochemical Has Been Performing

Recent times haven't been great for Yanbu National Petrochemical as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Yanbu National Petrochemical will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Yanbu National Petrochemical would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 35%. This means it has also seen a slide in revenue over the longer-term as revenue is down 10.0% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 17% per annum over the next three years. That's shaping up to be materially higher than the 6.2% per year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Yanbu National Petrochemical's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Yanbu National Petrochemical maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Yanbu National Petrochemical you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Yanbu National Petrochemical is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2290

Yanbu National Petrochemical

Yanbu National Petrochemical Company engages in the manufacture and sale of petrochemical products in Saudi Arabia, the Americas, Africa, the Middle East, Europe, and Asia.

Flawless balance sheet with reasonable growth potential.