Stock Analysis

- South Korea

- /

- Chemicals

- /

- KOSE:A126560

Why We're Not Concerned About Hyundai Futurenet Co., Ltd.'s (KRX:126560) Share Price

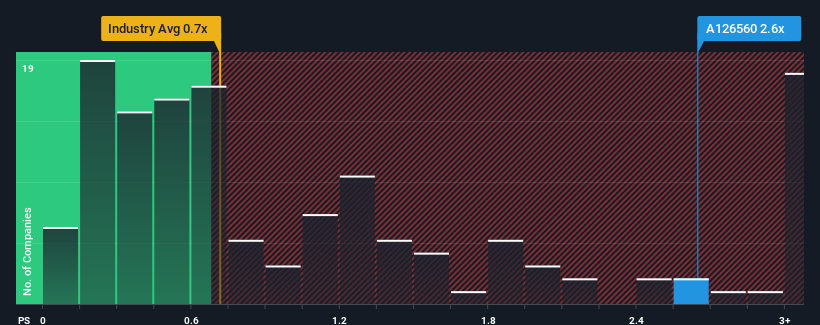

When close to half the companies in the Chemicals industry in Korea have price-to-sales ratios (or "P/S") below 0.7x, you may consider Hyundai Futurenet Co., Ltd. (KRX:126560) as a stock to potentially avoid with its 2.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Hyundai Futurenet

What Does Hyundai Futurenet's Recent Performance Look Like?

The revenue growth achieved at Hyundai Futurenet over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hyundai Futurenet will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

Hyundai Futurenet's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.3%. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 21%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Hyundai Futurenet's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does Hyundai Futurenet's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Hyundai Futurenet can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hyundai Futurenet, and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Hyundai Futurenet is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A126560

Hyundai Futurenet

Hyundai Futurenet Co., Ltd engages in the digital signage, immersive content, and corporate messaging businesses in South Korea.

Excellent balance sheet and overvalued.