Stock Analysis

- Sweden

- /

- Interactive Media and Services

- /

- OM:BETCO

Why We Think Better Collective A/S' (STO:BETCO) CEO Compensation Is Not Excessive At All

Key Insights

- Better Collective will host its Annual General Meeting on 22nd of April

- Salary of €516.0k is part of CEO Jesper Sogaard's total remuneration

- The overall pay is comparable to the industry average

- Over the past three years, Better Collective's EPS grew by 10% and over the past three years, the total shareholder return was 24%

CEO Jesper Sogaard has done a decent job of delivering relatively good performance at Better Collective A/S (STO:BETCO) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 22nd of April. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Better Collective

Comparing Better Collective A/S' CEO Compensation With The Industry

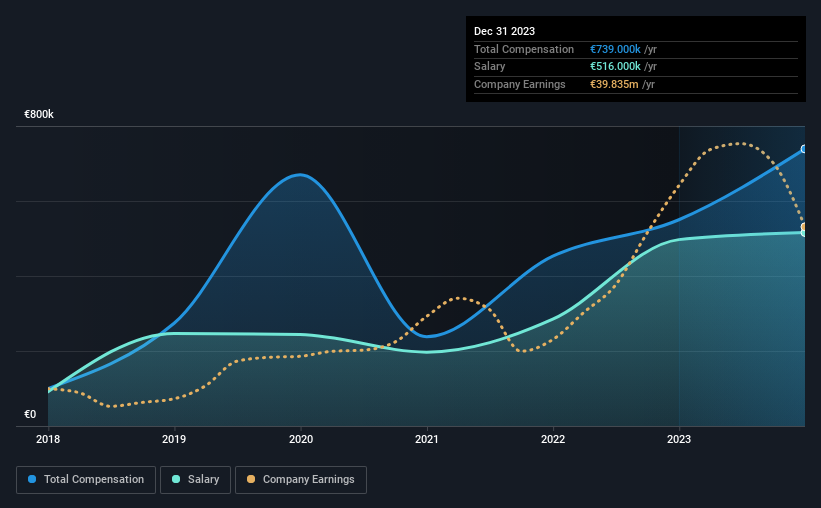

Our data indicates that Better Collective A/S has a market capitalization of kr18b, and total annual CEO compensation was reported as €739k for the year to December 2023. We note that's an increase of 34% above last year. We note that the salary portion, which stands at €516.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Swedish Interactive Media and Services industry with market capitalizations ranging between kr11b and kr35b had a median total CEO compensation of €844k. So it looks like Better Collective compensates Jesper Sogaard in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €516k | €497k | 70% |

| Other | €223k | €53k | 30% |

| Total Compensation | €739k | €550k | 100% |

On an industry level, roughly 61% of total compensation represents salary and 39% is other remuneration. Better Collective is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Better Collective A/S' Growth Numbers

Better Collective A/S has seen its earnings per share (EPS) increase by 10% a year over the past three years. It achieved revenue growth of 21% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Better Collective A/S Been A Good Investment?

With a total shareholder return of 24% over three years, Better Collective A/S shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for Better Collective that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're helping make it simple.

Find out whether Better Collective is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About OM:BETCO

Better Collective

Better Collective A/S, together with its subsidiaries, operates as a digital sports media company in Europe, North America, and internationally.

Good value with reasonable growth potential.