Stock Analysis

While shareholders of Union Bank of India (NSE:UNIONBANK) are in the black over 3 years, those who bought a week ago aren't so fortunate

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Not every pick can be a winner, but when you pick the right stock, you can win big. One such superstar is Union Bank of India (NSE:UNIONBANK), which saw its share price soar 344% in three years. On top of that, the share price is up 10% in about a quarter. But this could be related to the strong market, which is up 6.1% in the last three months.

Since the long term performance has been good but there's been a recent pullback of 4.1%, let's check if the fundamentals match the share price.

View our latest analysis for Union Bank of India

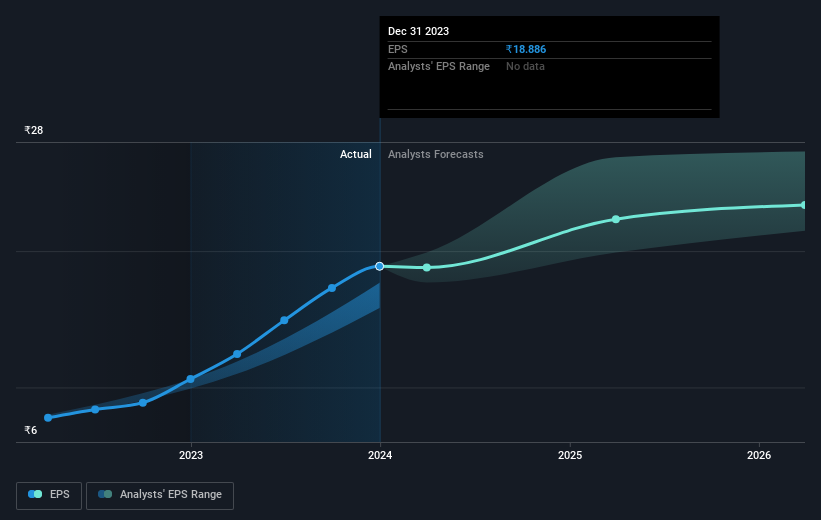

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Union Bank of India became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Union Bank of India, it has a TSR of 384% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Union Bank of India shareholders have received a total shareholder return of 104% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 12% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Union Bank of India has 2 warning signs we think you should be aware of.

Of course Union Bank of India may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Union Bank of India is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UNIONBANK

Union Bank of India

Union Bank of India provides various banking products and services.

Solid track record, good value and pays a dividend.