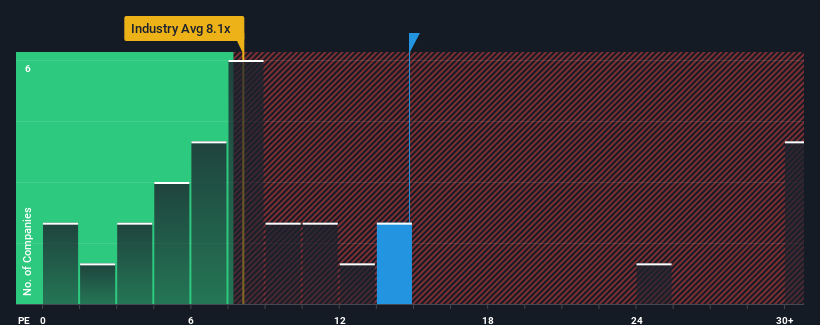

Weichai Power Co., Ltd.'s (HKG:2338) price-to-earnings (or "P/E") ratio of 14.8x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Weichai Power as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Weichai Power

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Weichai Power's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 85%. However, this wasn't enough as the latest three year period has seen a very unpleasant 10% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 19% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 15% per year, which is noticeably less attractive.

With this information, we can see why Weichai Power is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Weichai Power maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Weichai Power that we have uncovered.

If these risks are making you reconsider your opinion on Weichai Power, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Weichai Power is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About SEHK:2338

Weichai Power

Weichai Power Co., Ltd. engages in the manufacture and sale of diesel engines, automobiles, and other automobile components in China and internationally.

Flawless balance sheet with proven track record and pays a dividend.