Stock Analysis

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Aalberts N.V. (AMS:AALB) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Aalberts

What Is Aalberts's Debt?

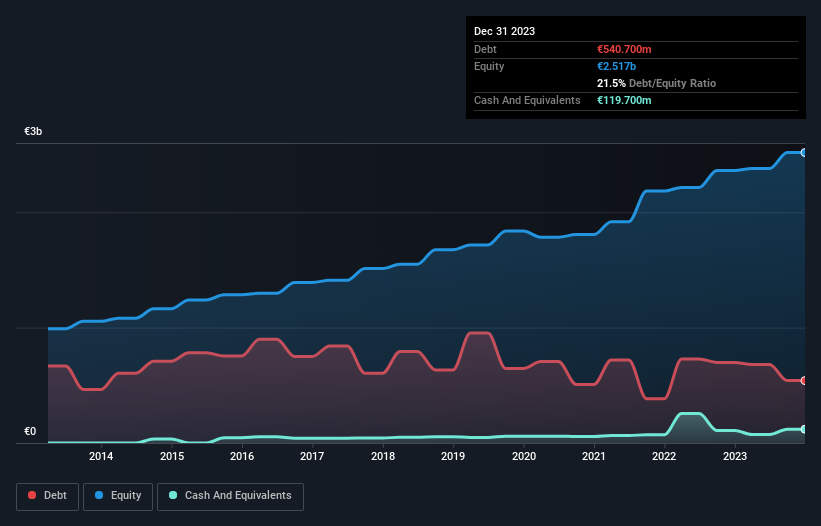

You can click the graphic below for the historical numbers, but it shows that Aalberts had €540.7m of debt in December 2023, down from €698.6m, one year before. However, because it has a cash reserve of €119.7m, its net debt is less, at about €421.0m.

How Healthy Is Aalberts' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Aalberts had liabilities of €895.3m due within 12 months and liabilities of €725.7m due beyond that. Offsetting this, it had €119.7m in cash and €406.6m in receivables that were due within 12 months. So it has liabilities totalling €1.09b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Aalberts is worth €4.99b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Aalberts has a low net debt to EBITDA ratio of only 0.67. And its EBIT covers its interest expense a whopping 11.8 times over. So we're pretty relaxed about its super-conservative use of debt. Also good is that Aalberts grew its EBIT at 13% over the last year, further increasing its ability to manage debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Aalberts's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Aalberts's free cash flow amounted to 36% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Happily, Aalberts's impressive interest cover implies it has the upper hand on its debt. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. All these things considered, it appears that Aalberts can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Aalberts you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're helping make it simple.

Find out whether Aalberts is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:AALB

Aalberts

Aalberts N.V. offers mission-critical technologies for aerospace, automotive, building, and maritime sectors.

Flawless balance sheet average dividend payer.