Stock Analysis

- United States

- /

- Professional Services

- /

- NasdaqGS:KFRC

We Discuss Why Kforce Inc.'s (NASDAQ:KFRC) CEO May Deserve A Higher Pay Packet

Key Insights

- Kforce's Annual General Meeting to take place on 24th of April

- CEO Joe Liberatore's total compensation includes salary of US$875.0k

- The overall pay is 33% below the industry average

- Over the past three years, Kforce's EPS grew by 6.9% and over the past three years, the total shareholder return was 22%

Shareholders will probably not be disappointed by the robust results at Kforce Inc. (NASDAQ:KFRC) recently and they will be keeping this in mind as they go into the AGM on 24th of April. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

View our latest analysis for Kforce

How Does Total Compensation For Joe Liberatore Compare With Other Companies In The Industry?

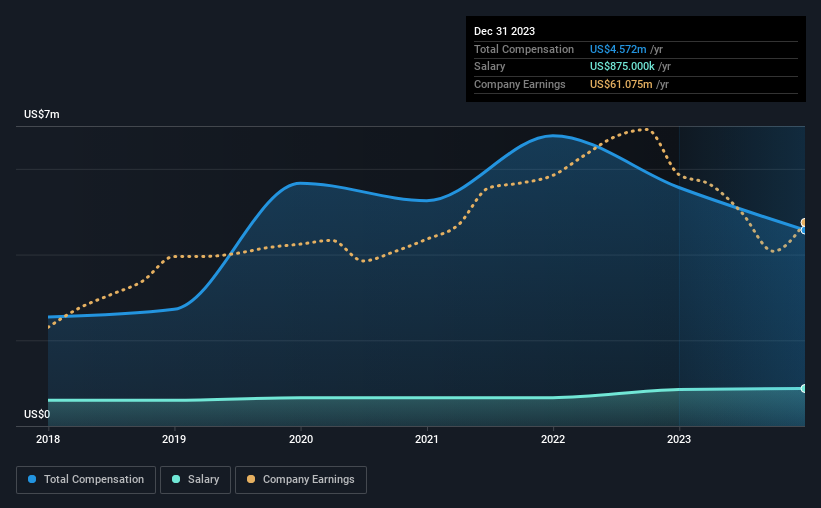

Our data indicates that Kforce Inc. has a market capitalization of US$1.2b, and total annual CEO compensation was reported as US$4.6m for the year to December 2023. That's a notable decrease of 18% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$875k.

In comparison with other companies in the American Professional Services industry with market capitalizations ranging from US$1.0b to US$3.2b, the reported median CEO total compensation was US$6.9m. That is to say, Joe Liberatore is paid under the industry median. Moreover, Joe Liberatore also holds US$15m worth of Kforce stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$875k | US$850k | 19% |

| Other | US$3.7m | US$4.7m | 81% |

| Total Compensation | US$4.6m | US$5.6m | 100% |

On an industry level, roughly 14% of total compensation represents salary and 86% is other remuneration. It's interesting to note that Kforce pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Kforce Inc.'s Growth

Kforce Inc.'s earnings per share (EPS) grew 6.9% per year over the last three years. It saw its revenue drop 10% over the last year.

We would prefer it if there was revenue growth, but the modest improvement in EPS is good. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Kforce Inc. Been A Good Investment?

With a total shareholder return of 22% over three years, Kforce Inc. shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

The company's overall performance, while not bad, could be better. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

Shareholders may want to check for free if Kforce insiders are buying or selling shares.

Switching gears from Kforce, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're helping make it simple.

Find out whether Kforce is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KFRC

Kforce

Kforce Inc. provides professional staffing services and solutions in the United States.

Flawless balance sheet, undervalued and pays a dividend.