Stock Analysis

- United Kingdom

- /

- Food

- /

- AIM:MPE

Unlocking 3 UK Dividend Stocks With Yields From 5.1% To 6.5%

Reviewed by Kshitija Bhandaru

Amidst a backdrop of cautious optimism in the London financial markets, with the FTSE 100 navigating through weak global cues and all eyes on pivotal economic decisions, investors are keenly watching for stable opportunities. In such a climate, dividend stocks emerge as attractive options, offering potential yields ranging from 5.1% to 6.5%, which could provide a semblance of predictability and income in uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 8.79% | ★★★★★★ |

| Keller Group (LSE:KLR) | 4.18% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.14% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.95% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.45% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.52% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.60% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 3.25% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.47% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.50% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc is a UK-based company that manufactures and sells building products across the United Kingdom, Europe, and internationally, with a market capitalization of approximately £120.62 million.

Operations: Epwin Group Plc's business operations span the manufacture and sale of building products, serving markets in the UK, Europe, and beyond.

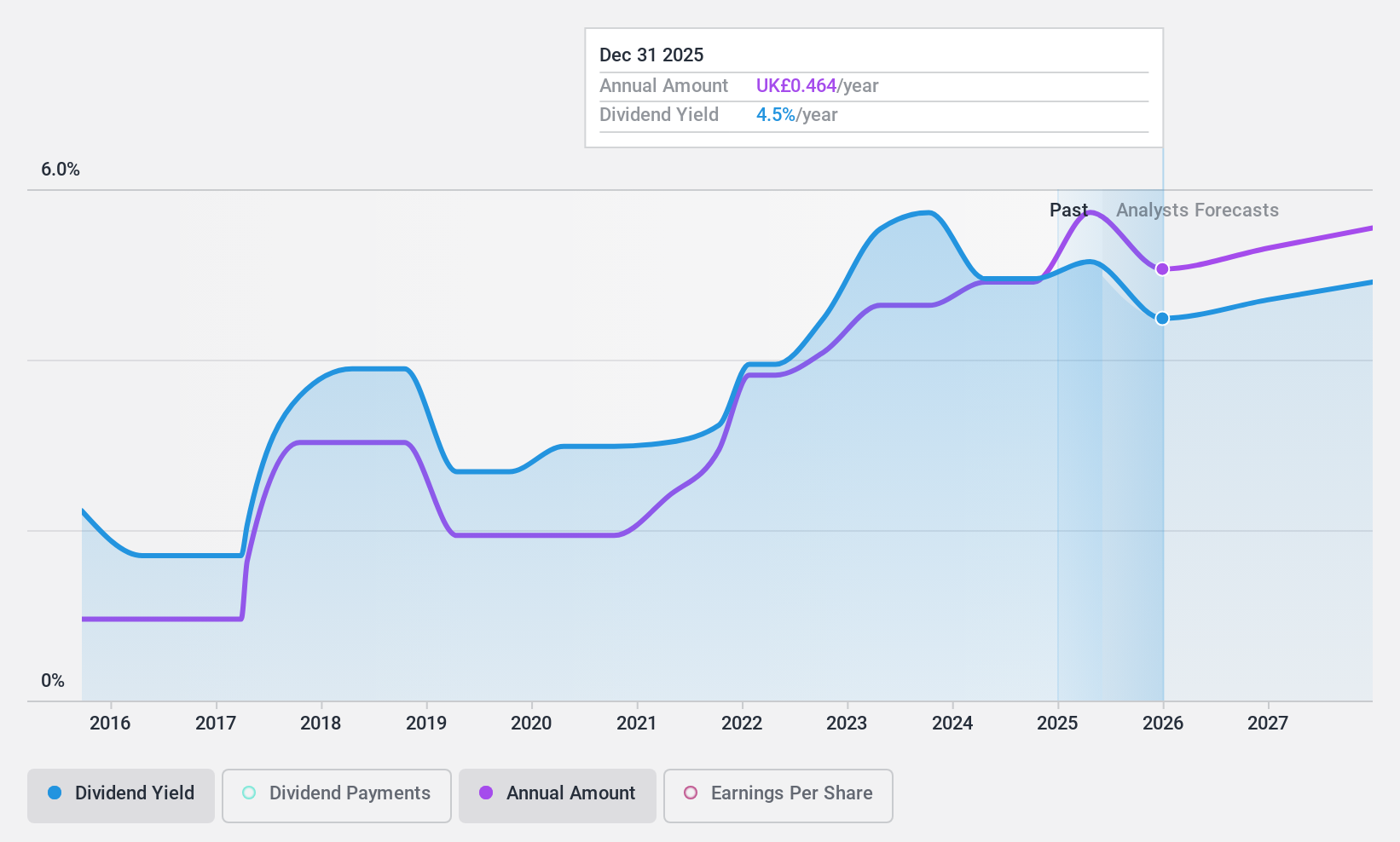

Dividend Yield: 5.4%

Epwin Group Plc, amid executive transitions with Andrew Eastgate retiring and Stephen Harrison stepping in as Chairman, reported a slight decrease in sales to GBP 345.4 million from GBP 355.8 million year-over-year but saw net income rise to GBP 9.3 million. The company has demonstrated a commitment to shareholder returns with an 8% increase in its full-year dividend to 4.80 pence per share, supported by a payout ratio of 54.3% and a cash payout ratio of just 22.4%, indicating dividends are well-covered by earnings and cash flows despite past volatility in dividend payments and an unstable dividend track record over the last decade.

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC is a company that focuses on owning and developing oil palm plantations in Indonesia and Malaysia, with a market capitalization of approximately £458.40 million.

Operations: M.P. Evans Group PLC generates its revenue primarily from its plantation operations in Indonesia, amounting to $307.32 million.

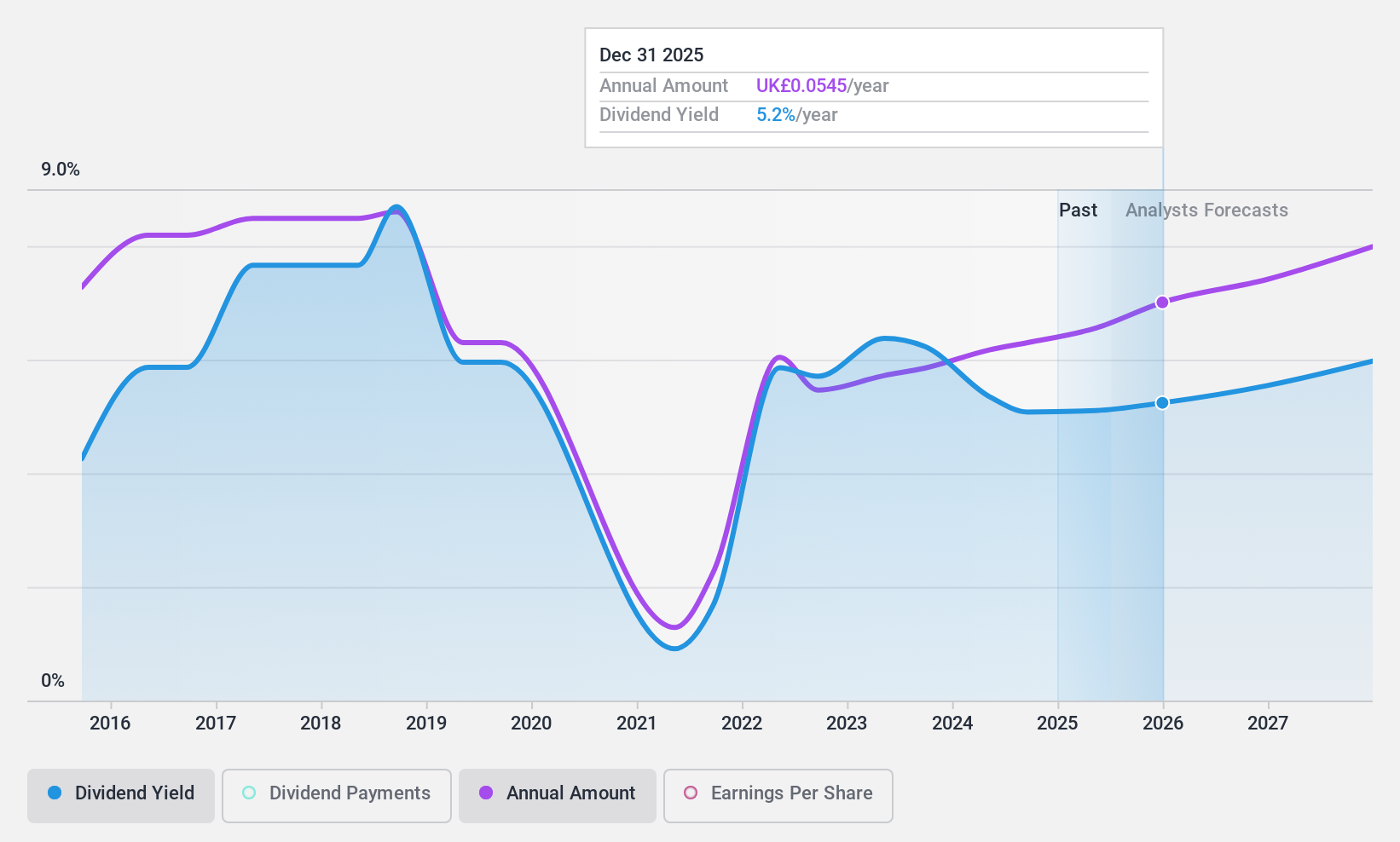

Dividend Yield: 5.2%

M.P. Evans Group PLC's recent financial performance shows a dip in sales to USD 307.37 million and net income to USD 52.49 million for the year ended December 31, 2023, from higher figures the previous year. Despite this downturn, the company increased its final dividend to 32.5 pence per share, funded by earnings with a payout ratio of 58.7% and cash flows with a cash payout ratio of 65.7%. However, its history of volatile dividends over the past decade might concern investors seeking stable returns, despite an uptick in crude palm oil production suggesting operational growth potential.

PageGroup (LSE:PAGE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PageGroup plc operates as a recruitment consultancy offering services across the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas, with a market cap of approximately £1.55 billion.

Operations: PageGroup generates its revenue primarily through recruitment services, amounting to £2.01 billion.

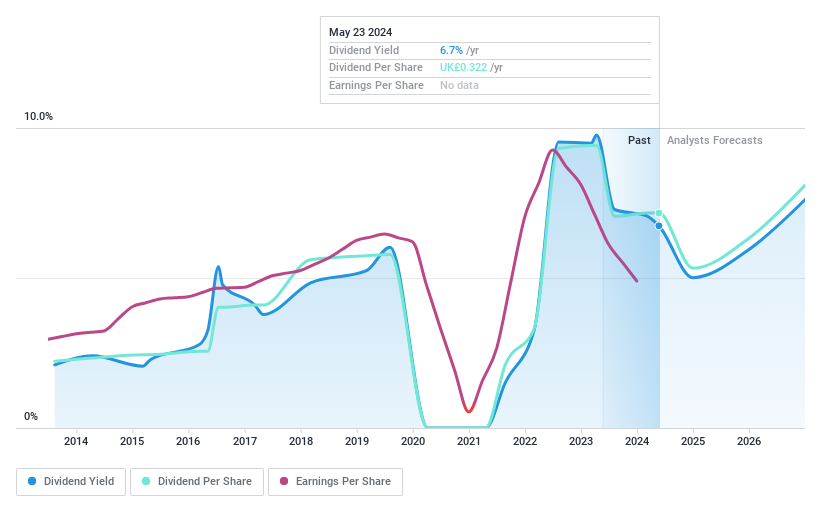

Dividend Yield: 6.6%

PageGroup's recent financial results for the year ended December 31, 2023, showed a decrease in net income to GBP 77.07 million from GBP 139.01 million the previous year, affecting basic earnings per share. Despite this downturn, the company proposed a final dividend of 11.24 pence per share, marking a 4.5% increase from the previous year's dividend. This decision reflects PageGroup's commitment to maintaining shareholder returns even in challenging times but raises concerns about sustainability given its volatile dividend history and reduced profit margins (3.8% down from last year's 7%).

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 60 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion.

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether M.P. Evans Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MPE

M.P. Evans Group

M.P. Evans Group PLC, through its subsidiaries, engages in the ownership and development of oil palm plantations in Indonesia and Malaysia.

Excellent balance sheet, good value and pays a dividend.