Stock Analysis

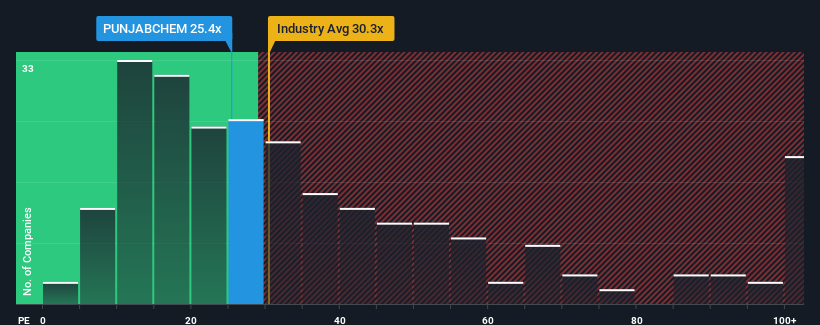

Punjab Chemicals and Crop Protection Limited's (NSE:PUNJABCHEM) price-to-earnings (or "P/E") ratio of 25.4x might make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 32x and even P/E's above 58x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

As an illustration, earnings have deteriorated at Punjab Chemicals and Crop Protection over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Punjab Chemicals and Crop Protection

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Punjab Chemicals and Crop Protection's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Punjab Chemicals and Crop Protection's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Punjab Chemicals and Crop Protection's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Punjab Chemicals and Crop Protection maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Punjab Chemicals and Crop Protection with six simple checks.

You might be able to find a better investment than Punjab Chemicals and Crop Protection. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Punjab Chemicals and Crop Protection is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:PUNJABCHEM

Punjab Chemicals and Crop Protection

Punjab Chemicals and Crop Protection Limited manufactures and sells agrochemicals, specialty chemicals, bulk drugs, and related intermediates in India, Europe, Japan, Israel, the United States, Latin America, and internationally.

Flawless balance sheet and slightly overvalued.