Stock Analysis

- Brazil

- /

- General Merchandise and Department Stores

- /

- BOVESPA:MGLU3

Some Magazine Luiza S.A. (BVMF:MGLU3) Shareholders Look For Exit As Shares Take 28% Pounding

The Magazine Luiza S.A. (BVMF:MGLU3) share price has fared very poorly over the last month, falling by a substantial 28%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

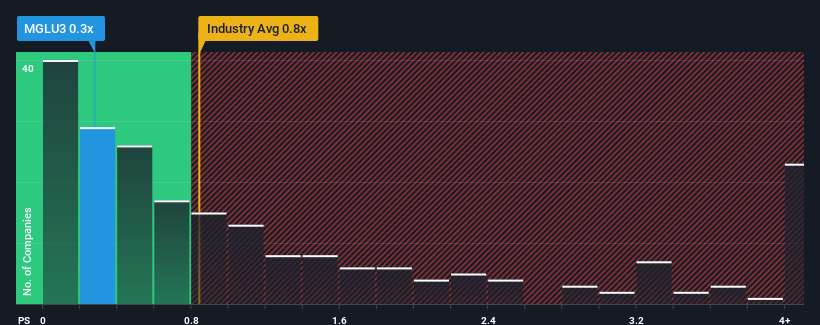

Although its price has dipped substantially, it's still not a stretch to say that Magazine Luiza's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Multiline Retail industry in Brazil, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Magazine Luiza

What Does Magazine Luiza's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Magazine Luiza's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Magazine Luiza's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Magazine Luiza's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.4% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 26% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.8% per year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 12% each year, which is noticeably more attractive.

With this information, we find it interesting that Magazine Luiza is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Magazine Luiza's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of Magazine Luiza's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Magazine Luiza that you should be aware of.

If you're unsure about the strength of Magazine Luiza's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Magazine Luiza is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MGLU3

Magazine Luiza

Magazine Luiza S.A. engages in the retail sale of consumer goods.

Reasonable growth potential with mediocre balance sheet.