Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSXV:AGX

Silver X Mining Corp.'s (CVE:AGX) Shares Leap 29% Yet They're Still Not Telling The Full Story

Silver X Mining Corp. (CVE:AGX) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

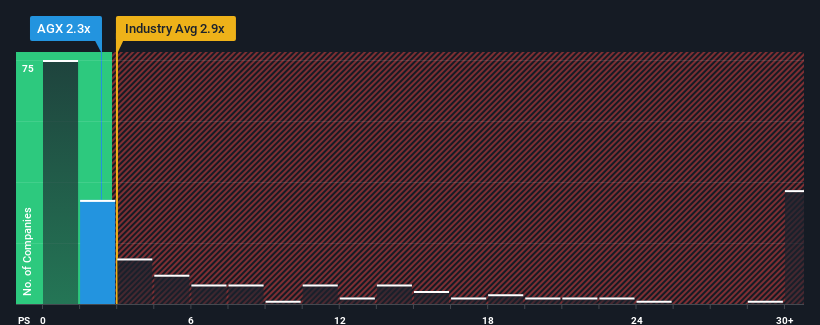

Even after such a large jump in price, Silver X Mining may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.3x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 2.9x and even P/S higher than 16x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Silver X Mining

What Does Silver X Mining's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Silver X Mining has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Silver X Mining will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Silver X Mining's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 64% over the next year. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

In light of this, it's peculiar that Silver X Mining's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Silver X Mining's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Silver X Mining's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Silver X Mining's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you take the next step, you should know about the 2 warning signs for Silver X Mining that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Silver X Mining is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:AGX

Silver X Mining

Silver X Mining Corp. engages in the exploration, acquisition, and development of mineral properties in the Americas.

High growth potential with mediocre balance sheet.