Stock Analysis

- India

- /

- Consumer Finance

- /

- NSEI:SHRIRAMFIN

Shriram Finance Limited's (NSE:SHRIRAMFIN) Price Is Right But Growth Is Lacking

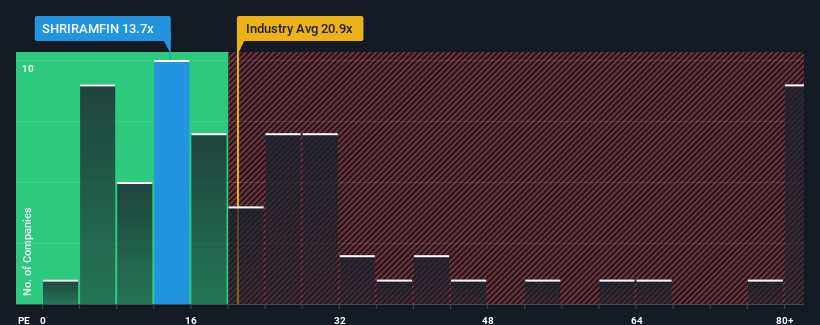

With a price-to-earnings (or "P/E") ratio of 13.7x Shriram Finance Limited (NSE:SHRIRAMFIN) may be sending very bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 31x and even P/E's higher than 57x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Shriram Finance could be doing better as it's been growing earnings less than most other companies lately. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

See our latest analysis for Shriram Finance

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Shriram Finance's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 5.7%. The latest three year period has also seen an excellent 117% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 13% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 20% each year, which is noticeably more attractive.

With this information, we can see why Shriram Finance is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Shriram Finance's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Shriram Finance (including 1 which is significant).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Shriram Finance is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:SHRIRAMFIN

Shriram Finance

Shriram Finance Limited, a non-banking financial company, primarily provides commercial vehicle financing services in India.

Average dividend payer and fair value.