Stock Analysis

- Germany

- /

- Semiconductors

- /

- XTRA:ELG

Should You Be Adding Elmos Semiconductor (ETR:ELG) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Elmos Semiconductor (ETR:ELG), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Elmos Semiconductor

How Fast Is Elmos Semiconductor Growing Its Earnings Per Share?

Over the last three years, Elmos Semiconductor has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Elmos Semiconductor's EPS shot up from €4.17 to €5.79; a result that's bound to keep shareholders happy. That's a fantastic gain of 39%.

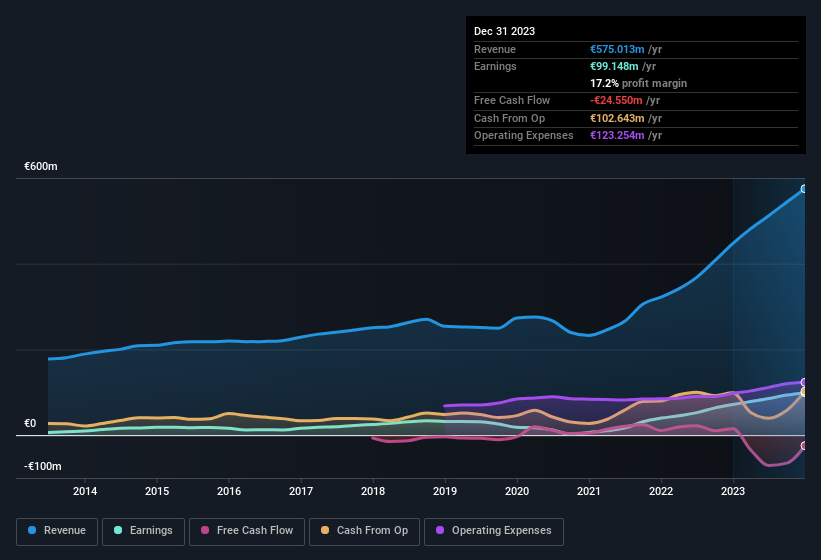

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Elmos Semiconductor achieved similar EBIT margins to last year, revenue grew by a solid 29% to €575m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Elmos Semiconductor's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Elmos Semiconductor Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Elmos Semiconductor shares worth a considerable sum. We note that their impressive stake in the company is worth €326m. That equates to 24% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Is Elmos Semiconductor Worth Keeping An Eye On?

You can't deny that Elmos Semiconductor has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. We should say that we've discovered 1 warning sign for Elmos Semiconductor that you should be aware of before investing here.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of German companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Elmos Semiconductor is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:ELG

Elmos Semiconductor

Elmos Semiconductor SE, together with its subsidiaries, develops, manufactures, and distributes microelectronic components and system parts, and technological devices for automotive industry in Germany, other European Union countries, the Americas, Asia/Pacific, and internationally.

Solid track record with excellent balance sheet.