Stock Analysis

- Germany

- /

- Electrical

- /

- XTRA:F3C

Shareholders In SFC Energy (ETR:F3C) Should Look Beyond Earnings For The Full Story

Strong earnings weren't enough to please SFC Energy AG's (ETR:F3C) shareholders over the last week. We did some analysis and believe that they might be concerned about some weak underlying factors.

View our latest analysis for SFC Energy

Examining Cashflow Against SFC Energy's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

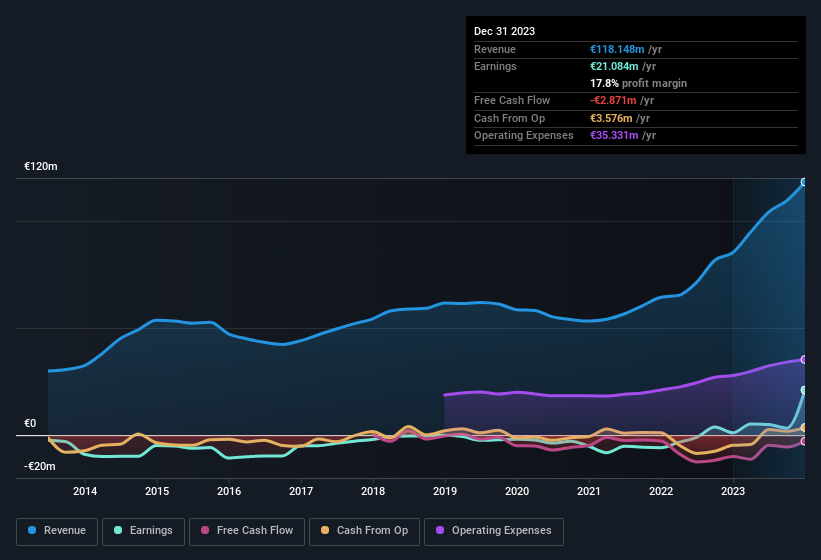

SFC Energy has an accrual ratio of 0.42 for the year to December 2023. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of €21.1m, a look at free cash flow indicates it actually burnt through €2.9m in the last year. We also note that SFC Energy's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of €2.9m. Importantly, we note an unusual tax situation, which we discuss below, has impacted the accruals ratio. This would certainly have contributed to the weak cash conversion.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that SFC Energy received a tax benefit of €12m. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On SFC Energy's Profit Performance

SFC Energy's accrual ratio indicates weak cashflow relative to earnings, which perhaps arises in part from the tax benefit it received this year. If the tax benefit is not repeated, then profit would drop next year, all else being equal. On reflection, the above-mentioned factors give us the strong impression that SFC Energy'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of SFC Energy.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're helping make it simple.

Find out whether SFC Energy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:F3C

SFC Energy

SFC Energy AG, together with its subsidiaries, develops, produces, and distributes systems and solutions for stationary and mobile off-grid power supply based on hydrogen and direct methanol fuel cells worldwide.

Flawless balance sheet with proven track record.