Stock Analysis

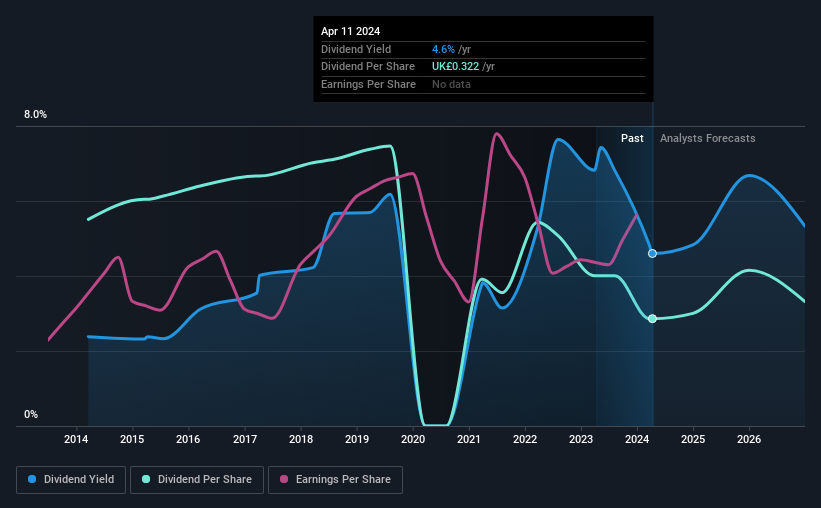

Secure Trust Bank PLC (LON:STB) has announced that it will pay a dividend of £0.162 per share on the 23rd of May. Based on this payment, the dividend yield will be 4.6%, which is lower than the average for the industry.

Check out our latest analysis for Secure Trust Bank

Secure Trust Bank's Dividend Forecasted To Be Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible.

Having distributed dividends for at least 10 years, Secure Trust Bank has a long history of paying out a part of its earnings to shareholders. While past data isn't a guarantee for the future, Secure Trust Bank's latest earnings report puts its payout ratio at 23%, showing that the company can pay out its dividends comfortably.

Over the next 3 years, EPS is forecast to expand by 109.5%. Analysts estimate the future payout ratio will be 13% over the same time period, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the dividend has gone from £0.62 total annually to £0.322. This works out to be a decline of approximately 6.3% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Although it's important to note that Secure Trust Bank's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

Our Thoughts On Secure Trust Bank's Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments Secure Trust Bank has been making. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Secure Trust Bank that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're helping make it simple.

Find out whether Secure Trust Bank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:STB

Secure Trust Bank

Secure Trust Bank PLC provides banking and financial products and services in the United Kingdom.

Very undervalued with reasonable growth potential.