Stock Analysis

- United States

- /

- Transportation

- /

- NasdaqGS:LSTR

Pinning Down Landstar System, Inc.'s (NASDAQ:LSTR) P/E Is Difficult Right Now

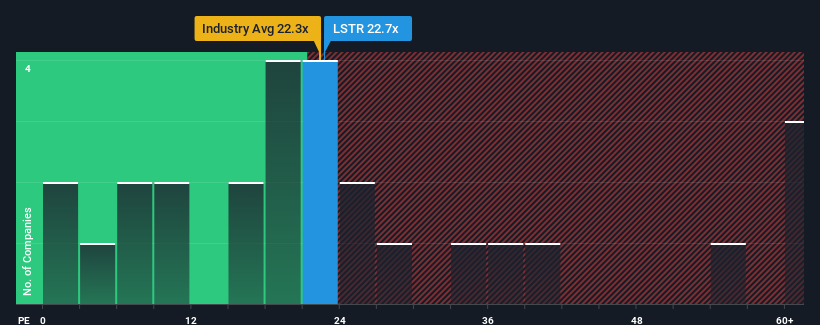

Landstar System, Inc.'s (NASDAQ:LSTR) price-to-earnings (or "P/E") ratio of 22.7x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings that are retreating more than the market's of late, Landstar System has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Landstar System

How Is Landstar System's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Landstar System's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 37%. Even so, admirably EPS has lifted 49% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 6.2% per year as estimated by the ten analysts watching the company. With the market predicted to deliver 10% growth per annum, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Landstar System is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Landstar System's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Landstar System's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Landstar System you should know about.

If you're unsure about the strength of Landstar System's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Landstar System is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LSTR

Landstar System

Landstar System, Inc. provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with acceptable track record.