Stock Analysis

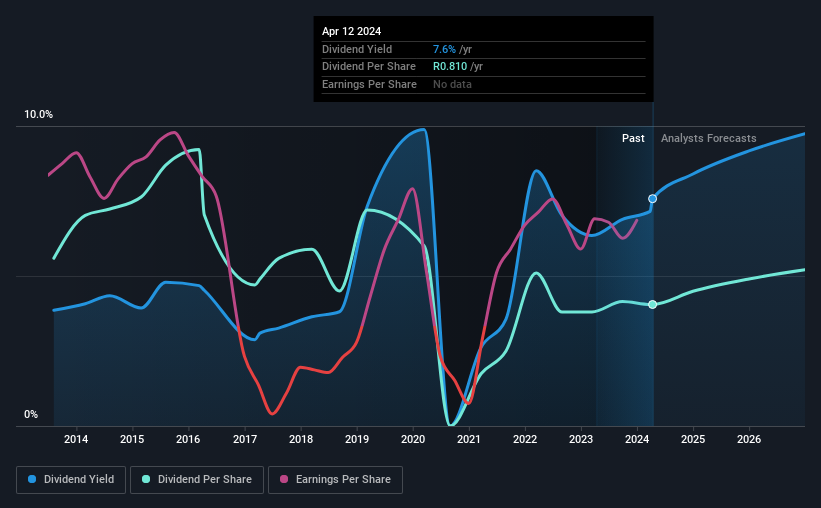

Old Mutual Limited's (JSE:OMU) investors are due to receive a payment of ZAR0.49 per share on 22nd of April. However, the dividend yield of 7.6% is still a decent boost to shareholder returns.

See our latest analysis for Old Mutual

Old Mutual's Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. The last dividend was quite comfortably covered by Old Mutual's earnings, but it was a bit tighter on the cash flow front. The business is earning enough to make the dividend feasible, but the cash payout ratio of 91% indicates it is more focused on returning cash to shareholders than growing the business.

Looking forward, earnings per share is forecast to rise by 20.0% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 38% by next year, which is in a pretty sustainable range.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was ZAR1.12 in 2014, and the most recent fiscal year payment was ZAR0.81. The dividend has shrunk at around 3.2% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. We are encouraged to see that Old Mutual has grown earnings per share at 23% per year over the past five years. Old Mutual is clearly able to grow rapidly while still returning cash to shareholders, positioning it to become a strong dividend payer in the future.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company hasn't been paying a very consistent dividend over time, despite only paying out a small portion of earnings. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Old Mutual has 2 warning signs (and 1 which is concerning) we think you should know about. Is Old Mutual not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Old Mutual is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:OMU

Old Mutual

Old Mutual Limited, together with its subsidiaries, provides financial services primarily in South Africa and rest of Africa.

Proven track record and fair value.