Stock Analysis

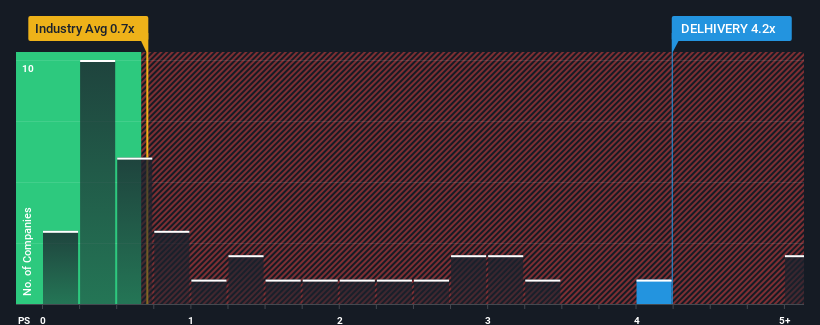

Delhivery Limited's (NSE:DELHIVERY) price-to-sales (or "P/S") ratio of 4.2x may look like a poor investment opportunity when you consider close to half the companies in the Logistics industry in India have P/S ratios below 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Delhivery

How Delhivery Has Been Performing

With revenue growth that's superior to most other companies of late, Delhivery has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Delhivery.Is There Enough Revenue Growth Forecasted For Delhivery?

Delhivery's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.6% last year. Pleasingly, revenue has also lifted 117% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the analysts watching the company. With the industry only predicted to deliver 15% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Delhivery's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Delhivery's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Delhivery maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Logistics industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Delhivery with six simple checks.

If these risks are making you reconsider your opinion on Delhivery, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Delhivery is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:DELHIVERY

Delhivery

Delhivery Limited provides supply chain solutions to e-commerce marketplaces, direct-to-consumer e-tailers, enterprises, FMCG, consumer durables, consumer electronics, lifestyle, retail, automotive and manufacturing industries in India.

Reasonable growth potential with adequate balance sheet.