Stock Analysis

- Germany

- /

- Specialty Stores

- /

- XTRA:CEC

Investors in Ceconomy (ETR:CEC) from five years ago are still down 61%, even after 6.6% gain this past week

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example the Ceconomy AG (ETR:CEC) share price dropped 63% over five years. That's not a lot of fun for true believers. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days.

While the last five years has been tough for Ceconomy shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Ceconomy

Ceconomy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Ceconomy saw its revenue increase by 0.9% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 10% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Ceconomy. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

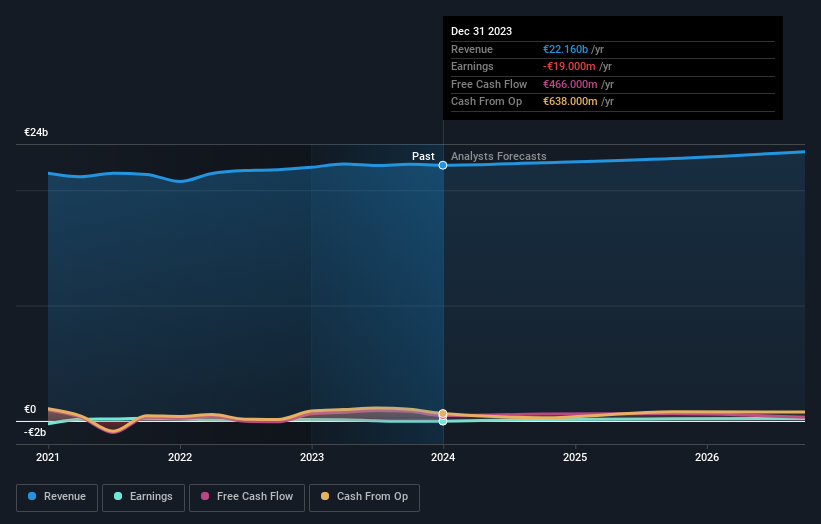

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Ceconomy's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Ceconomy had a tough year, with a total loss of 8.8%, against a market gain of about 6.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Ceconomy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:CEC

Ceconomy

Ceconomy AG, together with its subsidiaries, engages in the consumer electronics retail business.

Undervalued with reasonable growth potential.