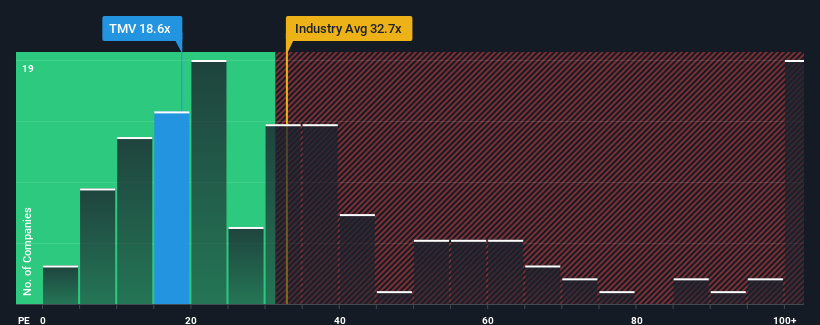

With a median price-to-earnings (or "P/E") ratio of close to 17x in Germany, you could be forgiven for feeling indifferent about TeamViewer SE's (ETR:TMV) P/E ratio of 18.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

TeamViewer certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for TeamViewer

Does Growth Match The P/E?

In order to justify its P/E ratio, TeamViewer would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 81%. Pleasingly, EPS has also lifted 37% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 18% per year over the next three years. With the market only predicted to deliver 14% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that TeamViewer's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On TeamViewer's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of TeamViewer's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for TeamViewer that you should be aware of.

Of course, you might also be able to find a better stock than TeamViewer. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether TeamViewer is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:TMV

TeamViewer

TeamViewer SE, together with its subsidiaries, develops and distributes remote connectivity solutions worldwide.

Very undervalued with solid track record.